Written by Nick Ackerman, co-produced by Stanford Chemist.

Ecofin Sustainable and Social Impact Term Fund (NYSE:TEAF) has witnessed a substantial widening of its discount to net asset value per share. The fund’s discount has reached the ~24% mark. This fund stands out due to its exposure to a unique blend of infrastructure assets, including MLPs, pipeline companies, education, and senior living facilities. Notably, over half of its portfolio comprises private investments, making it an intriguing but speculative infrastructure play possibly worth considering.

Following the broader equity market’s brief correction territory in October, the fund’s performance took a hit. While it began a rebound, it faltered swiftly. The widening of the fund’s discount further restrained its recovery, with the fund’s NAV outperforming its share price. The muted rebound from the October lows also contributed to this outcome.

Underlying Fundamentals of TEAF

- 1-Year Z-score: -2.81

- Discount: -24.03%

- Distribution Yield: 9.54%

- Expense Ratio: 1.85%

- Leverage: 11.30%

- Managed Assets: $231 million

- Structure: Term (anticipated liquidation date around March 27, 2031)

TEAF was launched with the goal of “attractive total return potential with emphasis on current income and uncorrelated assets.” Additionally, it provides “access to differentiated direct investments in essential assets” and “investments in intangible, long-lived assets and services.” The fund also aims to target a “positive social and economic impact.”

The fund’s modest leverage can be advantageous in a higher-rate environment. Given the volatility in the energy space, the portfolio’s significant investment in fixed-income securities helps mitigate additional volatility. However, the total expense ratio climbs to 2.66% when accounting for leverage costs, making it relatively high.

A significant portion of the portfolio comprises private investments, leading to a higher operational expense ratio. Despite the leverage costs, the fund’s advisory fee is notably higher compared to its peers.

Noteworthy Discount Widening

A substantial discount alone may not signify much, but in relative terms, TEAF’s discount is strikingly wide. With a 1-year z-score approaching -3, this level of discount is atypical outside of periods of higher volatility. Looking back over the fund’s history, it is trading well below its historical deep discount levels.

Despite the potential for further widening, historical evidence suggests that the fund can exceed even its pandemic-induced wider discount. Given its high allocations to private investments, skepticism is warranted, but the current speculative play seems to offer a compelling upside. Historically, the fund’s performance has been lackluster, adding another year of mediocre performance in 2023.

Should the fund revert to its average discount, the potential upside could be considerable, serving to cushion downside moves or fortify potential upside movements from the current levels. The term nature of the fund further adds a potential angle despite its distant maturity date. The sizable discount at this juncture translates into an annualized alpha of 3.34%, offering a guaranteed alpha compared to a non-term fund invested identically. This underscores the significant potential upside, even with the fund’s termination not imminent until 2031. However, extensions or terminations could alter the fund’s dynamics, and a guaranteed alpha does not ensure positive performance results.

Given the speculative nature of TEAF, uncertainty has been a consistent theme since the fund’s inception, as highlighted in the author’s previous coverage titled “Unique Opportunity With Unique Risks.”

Investor Appeal: Distributions Along The Journey

The monthly distributions potentially make this speculative play more bearable within one’s portfolio. However, caution should be exercised owing to the fund’s history of lackluster performance and the inherent risks associated with its significant exposure to private investments. The unique blend of infrastructure assets and the wide discount might make TEAF an appealing speculative bet but suitable only for investors comfortable with significant risk exposure.

To sum up, TEAF’s substantial discount and unique infrastructure exposure make it a compelling, albeit speculative, investment opportunity. The fund’s history of lackluster performance must be factored in, ensuring investors understand the risks associated with its sizable allocations to private investments.

Investors seeking a speculative play with an appetite for risk might find TEAF’s wide discount and unique infrastructure exposure intriguing. However, a cautious and measured approach is imperative while considering this speculative bet.

TEAF’s Unique Investment Approach: A Grounded Perspective

The art of investing is a delicate dance, a high-stakes waltz teetering between risk and reward. It cannot be denied that the beauty of this ballet is often underappreciated. Investors brave enough to step onto the floor with Tortoise Energy Infrastructure Corp (TEAF) find themselves part of this enthralling performance. By now, we’re well aware of the inherent risks that come with investment, but what sets TEAF apart from the herd is its unique investment strategy that seeks to balance verve and sensibility.

A Different Kind of Return

It’s not every day that an investment presents its earnings as if offering a slice of pie – a consistent, albeit small, slice – month after month. The temptation to reinvest may linger, but the allure of holding a piece of the pie in hand, safe from arbitrary retraction, is a comfort few investors would pass up. It’s this whisper of reassurance that murmurs to TEAF investors, assuring them that, in the worst-case scenario, a portion of their investment remains intact.

In the precarious world of investment, the timing of one’s entrance can make or break the plot. A savvy investor knows that a discount is not just a bargain; it’s potential energy, waiting to be converted into returns. With TEAF’s current rate paying an enticing 9.54%, this discount becomes the sweet cherry on top of a delectable sundae.

Unraveling the Coverage

Dabbling in the symphony of investment coverage, TEAF orchestrates a performance that strikes a harmonious chord. Delving into the net investment income, the coverage unfurls at an attractive 29.19%, a reassuring score for any equity fund. And when considering capital gains that offset any potential shortfalls, the melody only grows sweeter. Yet, the real plot twist lies in the return of capital distributions, revealing a narrative of resilience with a coverage reaching nearly 46% – a rarity for most equity CEFs.

However, before one begins forecasting, it’s crucial to discern the nature of the return of capital distributions. A closer look uncovers a tale of both non-destructive and destructive varieties, hinting at the complexity and duality of financial narratives.

TEAF’s Portfolio: A Performance Unveiled

Just as a master painter layers the canvas with different hues, TEAF’s portfolio reveals a splattering of unique hues, setting it apart from the typical investment performance. The fund’s foray into a diverse array of infrastructure and private investments paints a vivid picture, adding an unexpected twist to the typical narrative. And with an eclectic mix of equity and fixed-income investment approaches, TEAF invites investors to revel in a truly distinctive experience.

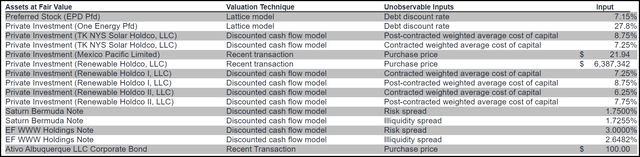

Yet, the plot thickens as we uncover the concentration of the fund’s portfolio in level 3 securities, revealing the fund’s bold stance amid the intricate web of investment instruments. Private investments stand out as the driving force behind this concentration – an audacious move that beckons both skepticism and awe.

Amidst the symphony of diversity, the fund’s concentration in top-ten holdings can’t be overlooked, adding an unexpected crescendo to the performance. It’s here that the private investments, particularly in Renewable Holdco entities, take center stage, intertwining with the narrative and lending it a distinctly intriguing flavor. These private solar investment projects exhibit a resilience that holds its valuations with admirable determination, much like a sprout pushing through the concrete.

However, amidst the applause, caution is warranted, for the winds of change have often unsettled even the most resilient of investments. While the valuations of Renewable Holdcos stand strong as of May, the storm clouds gathering on the horizon threaten a narrative shift. It is in these uncertain moments that the spotlight shines brightest, revealing the potential resilience or fragility of a performance to the audience.

The Eccentric Advisory Fund: A Speculative Bet with Tax-Exempt Bonds

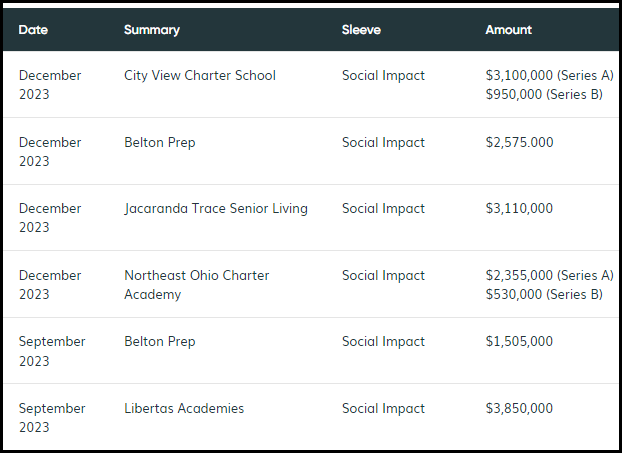

In the world of investments, valuing an asset remains an art rather than a science. The value of something is only truly determined by what someone is willing to pay, especially in the case of level 3 securities where guesswork becomes inevitable. The Eccentric Advisory Fund (TEAF) has further solidified its position as an intriguing investment opportunity by adding six private investments to its portfolio, particularly significant given the surge in the private investment sleeve, largely driven by the addition of tax-exempt bonds in charter schools such as Belton Prep, City View Charter School, Northeast Ohio Charter Academy, and Libertas Academies. This strategic move has caused the portfolio to shift further into a fixed-income exposure.

At the end of the day, though, something is only worth what someone/some entity is willing to pay. They can estimate the value until then, but level 3 securities simply take some guesswork.

Finally, since our last update, the fund has provided investments in another 6 private investments. This was substantial and could have been likely the driving factor in why the private investment sleeve of the portfolio climbed materially since our last update.

Belton Prep was 2 of these, which is a charter school that they had previously invested in April 2023. Though these latest two are materially higher investment amounts than the first. They are also tax-exempt bonds, where the first was taxable.

This wasn’t the only charter school that they have more recently invested in either. There was also the City View Charter School, Northeast Ohio Charter Academy, and Libertas Academies. Several of these investments were also tax-exempt bonds they were investing in besides the Series B issuances that were taxable in both cases. Given these were all further debt investments, the portfolio could have shifted further into fixed-income exposure.

The Undervalued Speculation

TEAF is trading at a significant discount to its NAV per share. The fund slumped along with the broader markets in October 2023. The recovery from that level in terms of its underlying portfolio didn’t necessarily come back with the same steam as public investments, but even still, the fund’s share price was even more muted, and that resulted in a substantial widening of the discount. Now, at such a deep discount on an absolute and relative basis, TEAF looks like an interesting speculative bet.