With the recent bullish activity in the market, numerous stocks, including industry darlings like Amazon AMZN, Arista Networks ANET, and Abercrombie & Fitch ANF, are approaching or surpassing their 52-week highs.

If you’re eager to harness this force, all three of these stocks carry a favorable Zacks Rank, denoting upward adjustments in earnings estimates among analysts. Let’s dig into each one to understand and capitalize on their strength.

Amazon: A Titan in the Market

Amazon shares have been stellar performers, boasting notable outperformance compared to the general market. Currently designated as a Zacks Rank #1 (Strong Buy), the stock is experiencing an upward trajectory in earnings expectations.

Image Source: Zacks Investment Research

Significantly, the company is anticipated to revive its high-growth pattern in its present fiscal year, with consensus estimates predicting a phenomenal 280% growth in earnings on 11% higher sales. The company’s reduced costs have been a pivotal driver of its market dominance. Remarkably, the shares are currently not overly priced, trading at a 2.5X forward price-to-sales ratio, well below its 3.1X median of the last five years and its peak of 4.8X in 2020.

Image Source: Zacks Investment Research

Arista Networks: Riding the AI Wave

Arista Networks has significantly benefitted from the artificial intelligence frenzy. The company supplies network switches to hyperscalers to facilitate faster communication between computer servers.

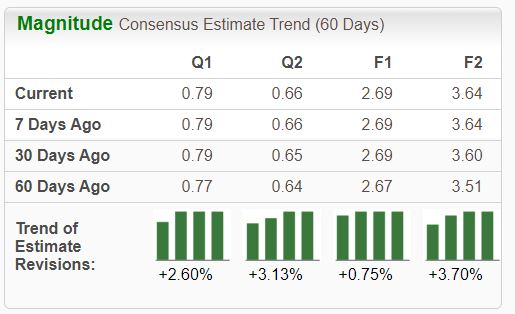

Similarly holding a Zacks Rank #2 (Buy), Arista Networks has seen a robust upward trend in earnings estimates for its current fiscal year, with estimates soaring 25% to $6.55 per share over the past year.

Image Source: Zacks Investment Research

Similar to Amazon, Arista Networks boasts an impressive growth trajectory, with consensus estimates indicating a remarkable 43% earnings growth and a 33% surge in sales for its current fiscal year. The growth momentum is expected to continue in FY24, with estimates hinting at an additional 10% surge in earnings coupled with an 11% increase in revenue.

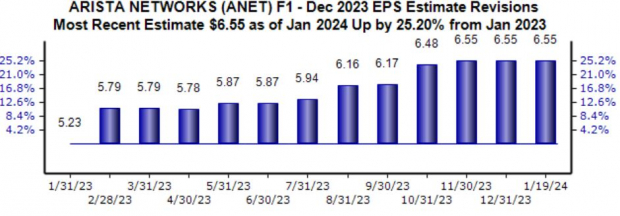

As investors eagerly await the company’s next quarterly release scheduled for February 12th, the Zacks Consensus EPS estimate of $1.70 suggests a remarkable 20% year-over-year growth and has surged 8% since last October.

The stellar quarterly results have been pivotal in driving the shares higher, as highlighted by the green arrows in the chart below.

Image Source: Zacks Investment Research

Abercrombie & Fitch: A Retail Force to Reckon With

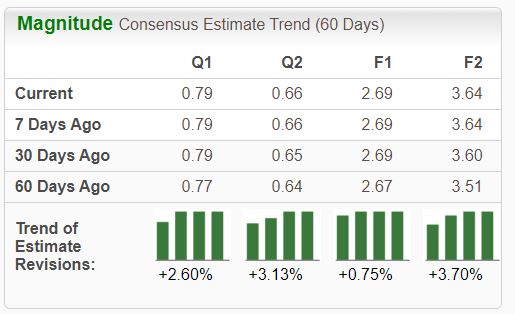

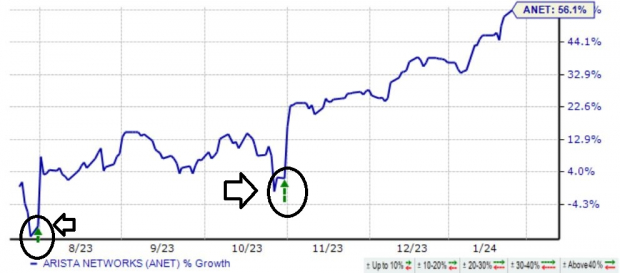

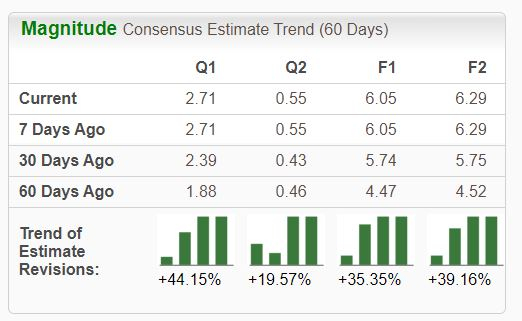

Abercrombie & Fitch, currently a Zacks Rank #1 (Strong Buy), operates as a specialty retailer offering premium, high-quality casual apparel for men, women, and children through an extensive store network. The company has witnessed a surge in earnings expectations across the board.

Image Source: Zacks Investment Research

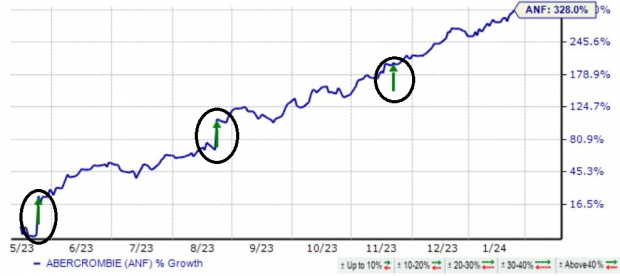

Similar to Arista Networks, Abercrombie & Fitch has seen its shares propelled by better-than-anticipated quarterly results, exemplified in the chart below. In fact, the company has surpassed the Zacks Consensus EPS Estimate by an average of 700% across its last four releases.

The shares have surged post-earnings in three consecutive releases, as depicted in the chart below.

Image Source: Zacks Investment Research

Closing Thoughts

Momentum has seamlessly carried over into 2024, with numerous stocks breaking their 52-week highs and undoubtedly pleasing investors.

If you’re eyeing these impressive trends, the three stocks mentioned above – Amazon AMZN, Arista Networks ANET, and Abercrombie & Fitch ANF – could prove to be fantastic considerations worth exploring.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.