Verizon Communications Inc. (NYSE:VZ) has just reported their earnings for Q4 2023. The investment world has eagerly awaited this unveiling, akin to the striking of a blacksmith’s hammer on an anvil. Investors, much like traders pledging allegiance to a house position, eagerly anticipated what was to unfold, eager to reap the future gains and dividends.

Verizon Q4 Results and the Economic Context

As the critical Q4 earnings season begins, there is a cloud of concern looming over the economic landscape due to uncertainties about the 2024 guidance and the overall consumer wellbeing brought about by ongoing Federal actions. However, amidst these concerns, Verizon has managed to surpass expectations, with revenue figures striking a triumphant note that reverberates in the overarching economic ambience.

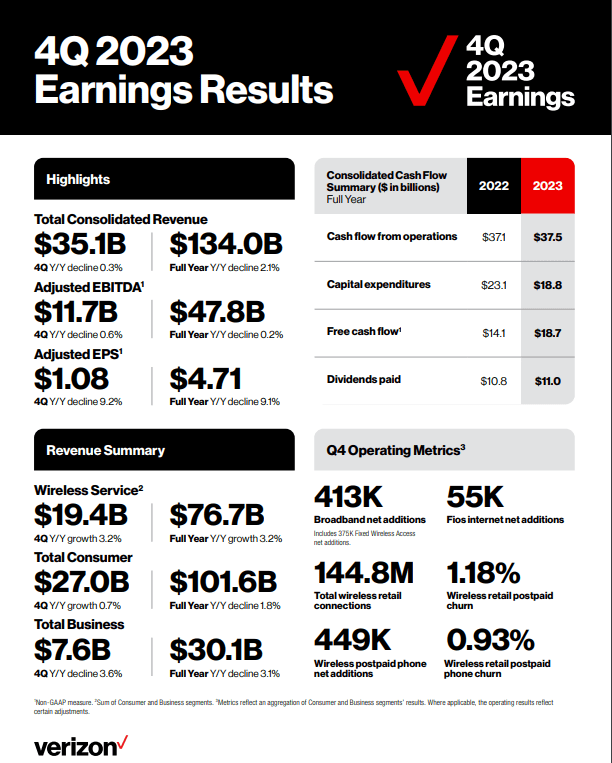

Verizon’s Q4 revenue of $35.1 billion, though showing a marginal 0.6% decrease from the previous year, has surpassed anticipated figures, standing tall at the highest end of the spectrum. Thus, painting a picture of resilience amidst an economic landscape fraught with uncertainties and trepidation.

The Driving Forces Behind Verizon’s Q4 2023 Revenue

The strength of Verizon’s performance becomes further evident upon delving into the details of the revenue drivers. The retail postpaid net additions, wireless postpaid phone gross additions, and broadband net additions have all surpassed expectations. Notably, Verizon’s wireless retail postpaid net adds of 1.4 million have triumphed over projections, signaling a robust performance that aligns with the initial storyline that Verizon has artfully crafted.

Verizon’s Q4 2023 Earnings: Exceeding Expectations

The overarching narrative of Verizon’s Q4 earnings performance is one of resilience and adherence to the guiding stars of diligence and cost management. Crucially, the operating expenses and operating income have managed to hold steady, showcasing a commendable display of financial prudence. Moreover, the earnings per share (EPS) and adjusted EBITDA figures, despite residing at the lower end of expectations, have carved out an impressive narrative of stability and financial fortitude.

The Unyielding Debt Situation

When it comes to Verizon, a perennial talking point continues to be the weighty burden of debt that the company shoulders like a resilient Atlas. Although the voyage towards debt reduction is wrought with toil and turmoil, Verizon continues to navigate these choppy waters, steadfast in its efforts to chip away at this colossal appendage. The debt-to-adjusted EBITDA ratio, though monumental, is a testament to Verizon’s unwavering determination to unravel itself from the quagmire of debt.

Closing Thoughts on Verizon’s Performance

As the curtains draw to a close on the saga of Verizon’s Q4 2023 earnings, questions loom large. The anticipated guidance foretells a tale of murkiness, with mixed prospects that are yet to be unveiled. Nevertheless, Verizon’s stock, though not quite as alluring as in past times, still radiates appeal. The company’s journey, akin to a phoenix rising from the ashes, marks a saga of revival and resurgence that beckons investors to ponder their next steps.

Join the Conversation

As the narrative of Verizon’s performance unfolds, the investment community eagerly anticipates the chorus of diverse opinions and insights. What are your thoughts? Do you envision the company soaring to new heights, or perhaps do you harbor doubts about its longevity? The stage is set, and the floor is yours to join the dialogue.