Are you investing in bitcoin (BTC-USD) or companies related to the Bitcoin network? It’s crucial to have a set of metrics for evaluating the progress of your investment. This is not just about the price on a chart; it encompasses an open-source network with millions of users, thousands of developers, and several ecosystems. Understanding these metrics is essential for fundamental research.

Have you ever used a bitcoin wallet, taken self-custody of the asset, or engaged with it in various ecosystems? These actions can provide invaluable insight for comprehensive research.

Bitcoin serves different purposes globally, enabling portable savings, censorship-resistant payments, and immutable data storage. It has significance for a wide array of individuals, and understanding its diverse use cases is vital for thorough analysis.

As we evaluate the health of the network, it’s essential to consider the various methods employed. How we perceive Bitcoin’s performance can significantly impact our conclusions.

If you’ve delved into studying monetary history and the technical details of the protocol, you likely have a specific set of key metrics for assessing the health of the Bitcoin network. Let’s walk through these metrics and explore the network’s status in each area.

1) Market Capitalization and Liquidity

There are some who claim price doesn’t matter, arguing that “1 BTC = 1 BTC”. They assert that volatility stems from the world revolving around bitcoin, rather than inherent volatility within bitcoin itself. While this sentiment holds some truth, price serves as a crucial signal over the long term.

Bitcoin’s price fluctuates in the global marketplace of money, competing against various fiat currencies, precious metals, and other cryptocurrencies. As a store of value, it vies with non-monetary assets like stocks and real estate. Thus, its price movements indicate levels of adoption and its standing as a global asset.

While the dollar may fluctuate in price around bitcoin, it is, in fact, the younger, more volatile, and less liquid network in comparison. Consequently, it is subject to more pronounced fluctuations in price. These fluctuations directly impact the purchasing power of bitcoin holders and offer insight into the asset’s appeal and utility.

Fortunately, Bitcoin’s price has consistently trended upwards, solidifying its position as one of the best-performing assets in history. Amidst aggressive tightening of central bank balance sheets and a sharp rise in positive real rates, it has demonstrated resilience and continued long-term adoption and growth. Yet, vigilance is imperative.

Liquidity, indicated by daily trading volume on exchanges and on-chain transaction value, is another crucial aspect. Bitcoin has exhibited robust liquidity, with daily trading volumes reaching billions of dollars, comparable to the liquidity of Apple (AAPL) stock. Liquidity tends to perpetuate itself, fostering further market activity.

With the advancement of both price and liquidity, Bitcoin continues to garner strength as a global asset, drawing attention from an increasing swath of investors and stakeholders.

The Complex Dynamics Influencing Bitcoin’s Value and Future

In the world of cryptocurrency, the rise and fall of Bitcoin often resembles a game of financial chess. As the digital currency garners billions of trading volume, it continues to face the challenge of attracting larger capital investments due to its perceived limitations of liquidity and size. Despite its meteoric growth, significant pools of capital find it difficult to make substantial investments, resulting in an ongoing struggle for Bitcoin to gain a foothold among major investors. It’s a battle akin to climbing rungs on the ladder of financial relevance.

The Influence of Price and Global Liquidity

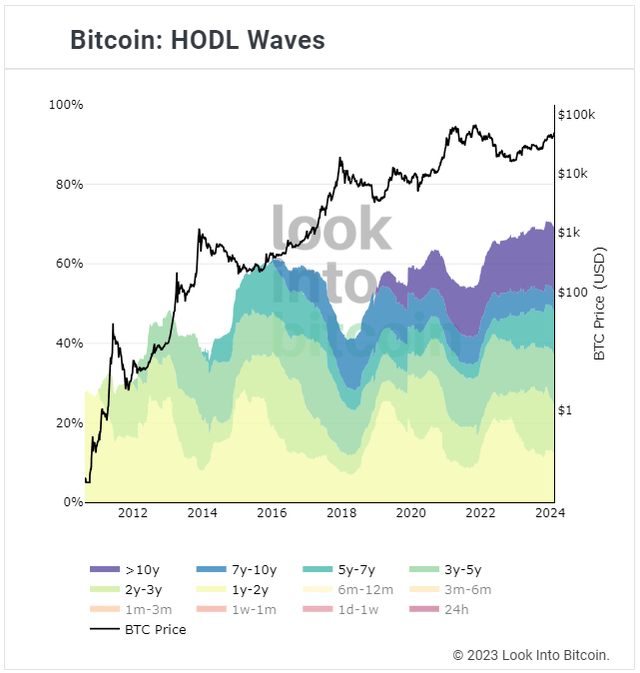

The value of Bitcoin, like any other asset, is fundamentally influenced by the principles of supply and demand. The fixed supply of the cryptocurrency means that shifts in demand can significantly impact its price. Moreover, the circulation of Bitcoin within the market is dependent on whether it is held by short-term, casual investors, or long-term, steadfast holders. This onstage performance can be visualized in the form of a supply-demand Chart reflecting the proportion of stagnant Bitcoin and its consequent price fluctuations:

The limited movement of Bitcoin’s supply in the market makes it susceptible to even marginal shifts in demand. This fragility implies that even a small surge in new demand or capital influx could significantly propel its price upwards, owing to the limited supply response from existing holders. But where does this demand originate?

A major factor correlating with Bitcoin’s demand is global broad money supply, denominated in dollars. The growth of global credit and/or central bank money creation significantly impacts this demand. Additionally, the strength of the dollar relative to other global currencies plays a pivotal role in shaping Bitcoin’s demand trends. In essence, Bitcoin’s value is a complex interplay between its intrinsic fundamentals and the dynamics of the broader financial markets, particularly the dollar’s stability and global liquidity trends.

Understanding Bitcoin’s Market Cap and Liquidity

Assessing Bitcoin’s market capitalization and liquidity in this context necessitates a long-term perspective. While the cryptocurrency is no stranger to dramatic price fluctuations, its journey involves a gradual process of evolution and adaptation. The intrinsic value of Bitcoin continues to grow, attracting more liquidity and adoption. Nevertheless, this journey is not without its share of challenges, including volatility and the need for widespread understanding and user-friendly interfaces.

Bitcoin’s notorious volatility and its dependence on leverage and perception ensure that the cryptocurrency’s path is riddled with cycles of frenzy and despair. Consequently, Bitcoin’s inherent volatility is unlikely to recede significantly until it becomes more liquid and widely embraced. The long road to mainstream adoption demands patience, resilience, and fortitude, with the asset’s stability relying on increasing adoption, liquidity, and user experience across various platforms.

The Narrative Transitions of Bitcoin

Bitcoin’s 15-year history has witnessed several narrative transitions, each shaping the cryptocurrency’s role within the financial ecosystem. From debates surrounding its utility as a payment method to its function as a savings mechanism, Bitcoin’s narrative has oscillated over time. However, the essence of Bitcoin’s purpose encompasses both these roles, serving as the underlying asset regardless of the transient shifts in emphasis. This resembles the parable of the blind men and the elephant, with each era highlighting a different facet of the same underlying asset.

The Multifaceted Nature of Bitcoin: A Lofty Beacon in a Sea of Monotonous Monies

Bitcoin has long been hailed as a safeguard against central bank monetary debasement due to its fixed supply, which in turn makes it a formidable option for savings. The versatile nature of money plays a vital role, as it serves as a medium for both payments and savings.

Bitcoin’s Role as a Settlement Network

Bitcoin, designed as a low-throughput network with a focus on decentralization, primarily functions as a settlement network. While it facilitates global transactions, day-to-day microtransactions are better suited to higher layers of the network.

Bitcoin’s Utility for Censorship-Resistant Payments

Bitcoin’s capability to enable censorship-resistant payments has been exemplified by its use in circumventing restrictions faced by entities such as Wikileaks. The decentralized nature of Bitcoin allows individuals to bypass unjust capital controls and make permissionless transfers, highlighting its inherent utility.

Bitcoin’s Appeal as a Long-Term Store of Value

Bitcoin’s finite supply and decentralized immutability make it an attractive long-term asset. Unlike traditional currencies subject to continuous debasement, Bitcoin’s fixed supply and global portability provide holders with a credible store of value.

Optionality: The Key to Bitcoin’s Versatility

The duality of Bitcoin’s role in both payment and savings underscores the importance of optionality. Holding Bitcoin grants the flexibility to execute censorship-resistant transactions and carry wealth across borders with ease, a feature imperceptible to many in the developed world but of immense significance to others worldwide.

Bitcoin’s Comparative Salability and Convertibility

Bitcoin’s high degree of salability and convertibility echoes the unique optionality that it offers, akin to the liquidity and convertibility of gold but with greater global portability.

The Salability of Fiat Currencies vs. Bitcoin

While fiat currencies retain high salability within their domestic borders, their salability and convertibility diminish significantly outside their enforced monopolies, akin to arcade tokens or casino chips with limited utility beyond specific confines.

Quantifying Salability: A Comparative View

The assessment of salability for the physical U.S. dollar illustrates its varying degrees of acceptance in different countries, highlighting the limitations of traditional currencies compared to the global reach and flexibility of Bitcoin.

The Rise of Bitcoin: A Salability Challenge and Technical Vigilance

The Salability of Bitcoin

Bitcoin, often exalted as the king of cryptocurrencies, faces a perpetual challenge of salability. Extending the metaphor of currency’s liquidity and ease of use, Bitcoin falls somewhere between the high salability of the dollar and the limited usability of physical currencies beyond their borders. In urban centers, Bitcoin’s salability is comparable to gold, yet in rural areas, it plummets, much like fiat currencies outside their realms. However, the cryptocurrency’s remarkable journey of 15 years has seen a consistent upward trajectory, making it increasingly adaptable in various locales across the globe.

The Rise of Bitcoin Hubs

One of the most promising trends is the proliferation of small Bitcoin communities worldwide. From El Zonte in El Salvador to Bitcoin Jungle in Costa Rica, these pockets of Bitcoin adoption have sprouted with remarkable velocity. Notably, El Zonte’s embrace of Bitcoin catalyzed the country’s president to confer upon it the status of legal tender. The phenomenon has resonated in locations such as Bitcoin Lake in Guatemala, Bitcoin Ekasi in South Africa, and F.R.E.E. Madeira, with dense areas of Bitcoin usage and acceptance becoming increasingly prevalent. These grassroots movements are akin to sprouting seeds, undermining the traditional financial order.

Moreover, the Africa Bitcoin Conference in Ghana, spearheaded by the exiled Togolese democracy advocate Farida Nabourema, and the recurring conferences in Indonesia, are emblematic of Bitcoin’s global reach. Furthermore, small organizations like Bitcoin Commons in Austin Texas, Bitcoin Park in Nashville, Pubkey in New York, and Real Bedford in the United Kingdom have become local Bitcoin hubs, fostering a sense of community and shared purpose.

Technical Security and Decentralization

My colleague, Jeff Booth, often underscores the criticality of Bitcoin’s security and decentralization in shaping its future and macroeconomic implications. Indeed, the ifs and elses are contingent on Bitcoin maintaining its robust decentralized network protocol, ensuring its continue relevance and value as a viable asset.

Bitcoin’s potency is contingent on its real-world operational integrity, guarded by a resilient network protocol. For Bitcoin to preserve its value, it must resiliently withstand adversities and attacks while remaining the premier mode of transactional liquidity. Thus, Bitcoin’s enduring worth is contingent on its tangible functionality rather than its theoretical appeal.

By prioritizing security and decentralization, Bitcoin distinguishes itself from other cryptocurrencies, willingly sacrificing speed, throughput, and programmability to optimize simplicity, security, and decentralization attributes. It is this conscious trade-off that sets Bitcoin apart from its counterparts, infusing the network with distinctive robustness and resilience.

Security Analysis

Despite its robustness, Bitcoin has not been immune to technical glitches. Its track record, while generally commendable, has not been devoid of hiccups. The Bitcoin node client confronted an inflation bug in 2010, swiftly rectified with a soft fork by Satoshi. In 2013, an update inadvertently resulted in a chain split. Nevertheless, the network’s uptime has been strikingly exemplary, exceeding even the record of Fedwire. This track record exemplifies the network’s resilience and ability to override past troubles, strengthening confidence in its long-term viability.

The Bright and Bumpy Road of Bitcoin

Bitcoin, the flagship cryptocurrency, has faced its share of technical challenges over the years, from glitches and bugs to potential vulnerabilities. The digital gold has experienced inflation bugs, unintended usage of upgrades, and a looming 2038 problem. However, these obstacles have not hindered the resilience of Bitcoin, showcasing its ability to overcome and adapt in the face of adversity. Let’s dive deeper into the trials and triumphs of this decentralized digital currency.

Overcoming Technical Hurdles

Since its inception, Bitcoin has navigated through technical obstacles that have tested its stability. From dealing with discrete inflation bugs to unintended usage of upgrades, the cryptocurrency has shown its agility in addressing potential vulnerabilities. Although the “year 2038 problem” may pose a future challenge, it is evident that the Bitcoin community is proactive in seeking solutions well in advance.

Resilience Amidst Hardening

Despite these challenges, the Bitcoin codebase has shown resilience over time, benefitting from the Lindy effect. The network has exhibited a notable decrease in major bugs, and its remarkable 100% uptime since 2013 speaks volumes about its robustness.

Analyze Decentralization

Decentralization serves as a crucial measure for understanding the strength of a cryptocurrency. Bitcoin boasts a widely-distributed node network, making rule changes and transaction censorship arduous tasks. The decentralized nature of Bitcoin mining, with a multitude of public and private miners, further solidifies its standing as a robust and resilient digital asset.

Quality of User Experience

While navigating through technical complexities, Bitcoin has upheld the quality of user experience, ensuring accessibility to a broad spectrum of users beyond programmers and engineers. The refined user experience has played a pivotal role in bolstering Bitcoin’s wide-ranging appeal and accessibility.

In conclusion, despite encountering various technical trials, Bitcoin’s enduring spirit and decentralized nature have positioned it as a frontrunner in the realm of digital currencies. Its ability to adapt and evolve in the face of challenges underscores its strength and resilience.

The Evolution of Bitcoin Accessibility and Legitimacy

When the concept of cryptocurrency was still in its infancy, the idea of owning Bitcoin seemed esoteric and perplexing. Fast forward to today, and the process of acquiring and managing Bitcoin has become increasingly user-friendly, thanks to the streamlined interfaces of reputable cryptocurrency exchanges and brokers. Long gone are the days of managing private keys on individual computers; the evolution of dedicated hardware wallets has made it infinitely more secure and accessible.

The Rise of User-Friendly Wallet Combinations

The integration of the Nunchuk+Tapsigner combo represents a remarkable step in the direction of simplicity and affordability in Bitcoin wallet solutions. The Tapsigner, a cost-effective $30 NFC card wallet, offers the convenience of offline private key storage, while the Nunchuk, a free mobile or desktop wallet, supports a variety of hardware wallets, including Tapsigners, for small Bitcoin holdings.

The Emergence of Bitcoin into Everyday Life

As the current generation grows up in a world with cryptocurrency wallets as commonplace as traditional bank accounts, the management of public/private key pairs is becoming an integrated part of everyday life. The notion of handling cryptocurrency, whether for financial transactions or verifying the authenticity of digital content, is on the path to becoming as routine as using a checkbook was in previous decades.

The Expanding Reach through ATMs and Vouchers

The proliferation of Bitcoin ATMs has witnessed a staggering increase, as reported by Statista, growing more than a hundredfold between 2015 and 2022. However, the recent plateauing of Bitcoin ATM numbers can be attributed to the rise of voucher purchase methods, exemplified by the game-changing solution offered by Azteco. The company’s vouchers, purchasable with cash at numerous retail and online platforms, have significantly expanded Bitcoin accessibility, particularly in developing economies, marking a pivotal shift in the prevailing norm.

Streamlined Transactions with Lightning Network

The maturation of the Lightning network, which has garnered substantial traction over the past six years, has brought forth enhanced liquidity by late 2020. This has transcended into the integration of the Lightning network into platforms such as Stacker News and communication protocols like Nostr, effectively amalgamating value transfer with information transfer. The advent of browser plug-ins like Alby has further simplified the utilization of Lightning across multiple websites, revolutionizing the traditional username/password login paradigm.

Technological Renaissance and User Experience

The recent Satoshi Roundtable event, typically known for its emphasis on altcoin content, notably shifted its focus towards avant-garde Bitcoin layer-two scaling concepts, signaling a resurgence in groundbreaking ideas and capital influx into diverse solutions within the Bitcoin network. While this surge may lead to a temporary startup valuation bubble, it promises to yield technological breakthroughs that will significantly enhance user experience.

Legal Acceptance and Global Recognition

Countering persistent apprehensions about government bans, Bitcoin has continued to garner widespread recognition and legal acceptance. The steadfast principles of game theory and the pluralistic nature of global governance have nullified the apprehension of a universal ban, as demonstrated by pioneering initiatives like El Salvador’s endorsement of Bitcoin as legal tender. Resonating historical precedents, such as the encryption algorithms of the early 1990s, underline the resilience of open-source code and the formidable challenge it poses to governmental restrictions, marking Bitcoin as an inherently resilient force in the economic landscape.

Reversals and Revelations: A Look at Cryptocurrency Bans and the Struggle for Financial Privacy

India’s Supreme Court Ruling

In 2018, India’s central bank banned banks from interacting with cryptocurrencies, lobbying the government to prohibit cryptocurrency use entirely. However, by 2020, India’s supreme court ruled against the ban, restoring the rights of the private sector to innovate using this technology.

Nigeria’s Ebb and Flow

Amid persistent inflation in their own currency, Nigeria’s central bank prohibited banks from interacting with cryptocurrencies in early 2021. Despite the ban, Nigeria had the second-highest cryptocurrency adoption in the world. After nearly three years, in late 2023, Nigeria’s central bank reversed its decision and allowed banks to interact with cryptocurrencies under regulations.

Argentina’s Policy Reversals

Argentina’s major banks faced heavy demand for cryptocurrencies to defend against triple-digit inflation in 2022. Despite government bans on offering digital assets to customers, the election of pro-bitcoin candidate Javier Milei led to a potential reversal of cryptocurrency regulations. Economist Diana Mondino expressed optimism, suggesting that “Argentina will soon be a Bitcoin haven.”

Spot Bitcoin ETFs in the U.S.

For years, the U.S. Security Exchange Commission (SEC) blocked spot bitcoin ETFs, unlike other countries that allowed them without issue. However, by early 2024, several spot bitcoin ETFs began trading, following a ruling by the D.C. Circuit Court of Appeals that the SEC’s actions were “arbitrary and capricious.”

The Conundrum of Cryptocurrency Bans

The mere holding and use of bitcoin challenges governments that attempt to ban it, especially those with a semblance of the rule of law. Governments find themselves in the awkward position of arguing against money that cannot be debased and that people can hold and send to others, or as some would say, a decentralized spreadsheet posing a threat to national security. The biggest legal challenges for the Bitcoin network are likely to center around privacy, particularly as major governments like the United States pursue regulatory measures.

While governments aim to prevent illicit activities, the push for financial transparency risks encroaching on individual privacy. The prevalence of surveillance capitalism further complicates the landscape, raising concerns over data security and the erosion of personal freedoms.

Financial privacy was once the norm, with transactions occurring via cash and coins. However, the advent of modern banking and centralized surveillance transformed the way people conduct financial transactions. The rise of cryptocurrencies challenges this established order, prompting governments to grapple with the implications of decentralized financial systems.

As governments seek to impose bank-type surveillance and reporting requirements on individuals, the tension between regulatory oversight and individual freedom becomes increasingly pronounced. The struggle for financial privacy and the acceptance of cryptocurrencies reflect a broader societal shift towards redefining the boundaries between individual rights and state intervention.

The Unstoppable Force of the Bitcoin Network: An Honest Evaluation

As we journey into the future, we are bound to witness more Zimmerman-like conflicts, with financial privacy becoming the battleground. Governments will undoubtedly tighten the screws around individuals utilizing various privacy-preserving methods, potentially going as far as criminalizing these practices. However, the defense against such overreach lies in the very nature of these methods – many are open-source, mere strings of information. The act of restricting their creation and usage is akin to criminalizing the arrangement of words and numbers. Not only is this hard to justify legally in jurisdictions that uphold free speech, but it is also challenging to enforce in practice due to the ease with which open-source code disseminates. In jurisdictions like the United States, well-funded lawsuits can be leveraged to challenge these laws as unconstitutional. The road ahead is destined to be fraught with complexities.

The Bitcoin Network’s Rating: A-

While attempting to assign a grade to the network may seem rather futile given its intangible nature, it can be summarized that most facets of the network are either improving or remaining relatively stable.

Contrary to popular belief that Bitcoin lacks fundamentals and is solely speculative, dismissing this notion calls for a deep dive into the technology ecosystem. Comprehensive research into the network and ecosystem’s fundamentals is pivotal, reminiscent of conducting an analysis of any company to gauge the likelihood of its value and price surging or plummeting.

However, there are areas that could be improved, which prevents a top-tier grade of A or A+. Miner decentralization, particularly concerning pools and ASIC production, could be enhanced. Furthermore, the overall user experience and the development of second-layer applications and ecosystems could progress further. An ideal scenario would encompass the presence of a broader array of high-quality wallets, seamless higher-layer utilization on the network, increased adoption of built-in privacy features, and more. Notwithstanding, evidence points to a significant acceleration in this regard.

In the event of Bitcoin experiencing a sustained period of elevated fees, similar to its recent trend, these moments are expected to act as catalysts, propelling the acceleration of second-layer developments. With increased fees, the base layer is less likely to be utilized, thereby providing impetus for higher-layer solutions. These phases stress-test various existing use cases, causing users and capital to gravitate toward what is functional or in demand.

Moreover, governments, at times willingly and at times reluctantly, have been gradually coerced into accepting Bitcoin to a certain extent. Nonetheless, the looming battle is likely to revolve around privacy, an arena that is far from concluding, but rather intensifying.

On the whole, the Bitcoin network remains a highly promising investment prospect, both in bitcoin directly as an asset and in the equity of companies constructing atop the network. While areas of risk persist, they also represent domains of potential enhancement and contribution. The open-source nature of the Bitcoin network ensures that anyone can scrutinize the code and recommend enhancements, construct layers that attach to it, as well as develop applications that enrich it for users.