Plummeting Commodity Prices Hitting CRK Hard

Comstock Resources, Inc. (CRK) finds itself in the throes of plummeting commodity prices, which has led to the suspension of its dividend amidst weak natural gas prices. With a market capitalization of $2 billion, the independent natural gas producer operates within the Haynesville shale in North Louisiana and East Texas.

A String of Disappointments in Q4 2023

On February 13, 2024, the company reported its fourth-quarter 2023 results, marking the third consecutive miss. Earnings stood at $0.10, falling short of the Zacks Consensus of $0.16 by $0.06. Notably, natural gas and oil sales, coupled with realized hedging gains, amounted to $354 million, with the hedging gain tallying to $4.1 million. Additionally, the company expanded its Western Haynesville acreage by 23,000 net acres, crossing 250,000 net acres in the play. Described as achieving “solid results” in the Haynesville shale drilling program, it remains to be seen how the company weathers the challenges posed by the ongoing industry headwinds.

Dividend Takes a Hit

Given the persistently weak natural gas prices, the company took the anticipated decision of suspending its quarterly dividend until natural gas prices exhibit signs of improvement. In conjunction, there has been an announcement of reducing the number of operating drilling rigs from 7 to 5, with 2 of those 5 drilling rigs continuing operations in the Western Haynesville play.

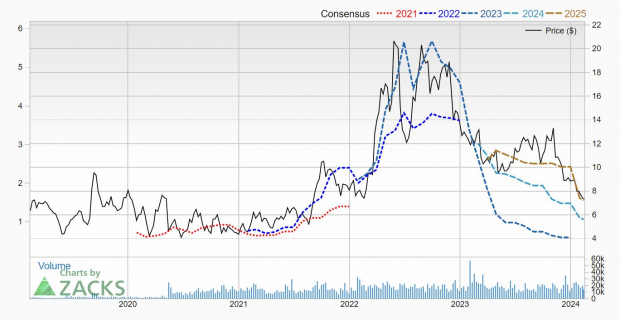

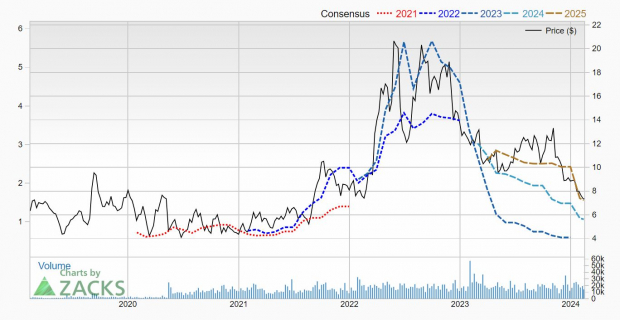

Analysts Slashing Earnings Estimates

Projections for 2024 and 2025 have already witnessed downward revisions, with the 2024 Zacks Consensus Estimate plummeting to $1.06 from $1.36 over the last 30 days. Similarly, the 2025 Zacks Consensus Estimate nosedived to $1.56 from $1.96. While both years are anticipated to yield substantial earnings growth (125.5% and 46.9% respectively), investors are left to contend with the predicament at hand.

Shaky Six-Month Performance

Not unlike other commodity stocks, Comstock Resources witnessed a decline in its shares over the last 6 months, mirroring the downward trajectory of natural gas prices. Even with a seemingly attractive forward P/E of 6.9, it remains unwise to delve into the stock until a substantive upturn in natural gas prices materializes. Additionally, the absence of a dividend payout further dampens the attractiveness of the stock to investors.

Looking to the Future

For investors eyeing natural gas plays, a watchful stance on gas prices is essential. The opportune moment to consider Comstock as an investment will only arise when natural gas prices begin to resurge.

A Glimpse of Hope Amidst Bearish Market Sentiment

Although beset by the prevailing challenges, brighter prospects may emerge for Comstock Resources as the industry tides turn. With a discerning eye and strategic monitoring of market dynamics, astute investors may capitalize on future upswings in natural gas prices and the subsequent revival of Comstock Resources.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Free: See Our Top Stock And 4 Runners Up

Comstock Resources, Inc. (CRK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.