It has been a whirlwind week for the biotech sector, with earnings reports taking center stage. Biogen BIIB reported disappointing results for the fourth quarter. Meanwhile, the spotlight continues to shine on mergers and acquisitions as pharma and biotech majors seek to fortify their product portfolio/pipeline.

Key Stories of the Week

Biogen’s Q4 Results: Biogen reported lower-than-expected results for the fourth quarter as both earnings and sales fell short of their respective estimates. Consequently, shares took a hit. Adjusted earnings per share (EPS) of $2.95 missed the Zacks Consensus Estimate of $3.16, marking a 27% year-over-year decline. This was due to closeout costs for Biogen’s controversial Alzheimer’s drug, Aduhelm, and lower revenues. Total revenues came in at $2.39 billion, down 6% on a reported basis (5% on a constant-currency basis). The company also announced the EC’s authorization of Skyclarys for the treatment of Friedreich’s ataxia in adults and adolescents aged 16 years and above.

Biogen expects revenues to decline by a low to mid-single-digit percentage in 2024 compared to 2023, with adjusted earnings projected to be in the range of $15.00-$16.00, implying approximately 5% growth at the midpoint of the guided range.

Gilead to Acquire CBAY: Gilead Sciences, Inc. GILD revealed its plan to acquire clinical-stage biopharmaceutical company, CymaBay Therapeutics, Inc. CBAY, for $4.3 billion. The acquisition, approved by both companies’ boards of directors, is expected to be finalized in the ongoing quarter. It will introduce CymaBay’s investigational lead product candidate, seladelpar, to Gilead’s pipeline. Seladelpar, aimed at the treatment of primary biliary cholangitis, is currently under review in the United States. Gilead has been seeking to fortify its portfolio/pipeline following a slowdown in its legacy HIV business and a few pipeline setbacks.

VRTX, CRSP Win EC Nod for Casgevy: Vertex Pharmaceuticals and CRISPR Therapeutics announced that the European Commission has granted conditional marketing approval to their one-shot gene therapy, Casgevy, for treating two debilitating blood disorders — sickle cell disease and transfusion-dependent beta thalassemia.

Performance

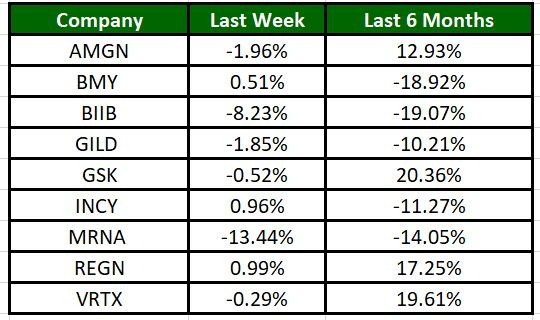

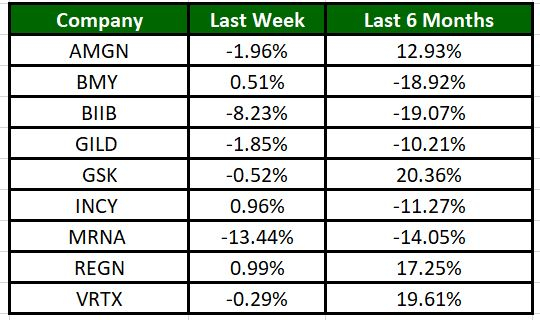

The Nasdaq Biotechnology Index has gained 0.24% in the past five trading sessions. Among the biotech giants, Moderna has lost 13.44% during the period, while shares of Vertex have surged 19.61% over the past six months.

Image Source: Zacks Investment Research

What’s Next in Biotech?

Stay tuned for more earnings and pipeline updates.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts have chosen their favorites. It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients.

It could rival or surpass other recent Stocks Set to Double like Boston Beer Company and NVIDIA.

Free: See Our Top Stock And 4 Runners Up

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.