If you own a stake in Amazon (NASDAQ: AMZN), the odds are good that its fast-growing cloud computing arm is the key reason you do. While Amazon Web Services (AWS) may only account for 15% of the company’s top-line revenue, Amazon’s cloud business accounts for two-thirds of the company’s operating profits. Better still, AWS’ sales improved by 13% last year, driving this unit’s operating income up by more than 15%. Not bad. Not bad at all.

However, if you think Amazon’s cloud computing business is bulletproof, think again. Microsoft (NASDAQ: MSFT) is coming on strong, closing the gap between the two companies’ cloud computing market share. Amazon can’t afford to let this rival continue going unchecked. Or, maybe AWS isn’t in a position to prevent it.

The Cloud Computing Playing Field

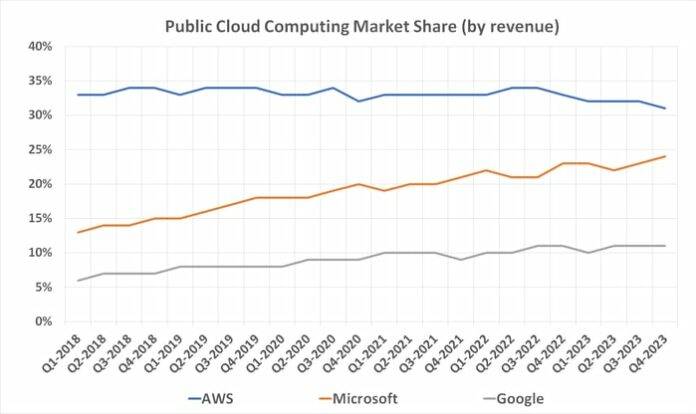

The cloud computing race is heating up. There’s still plenty of business to go around, with worldwide cloud infrastructure spending growing 20% year over year last quarter. Despite Amazon’s market leadership, Microsoft’s share of the market is growing faster, as shown in the graphic below.

Data source: Synergy Research Group. Chart by author. Quarters, in this case, represent calendar-year quarters.

That’s not catastrophic for Amazon — at least not yet. AWS experienced solid revenue and earnings growth in 2023. It’s just that Microsoft is now faring so much better on this front. Its cloud revenue was up 20% year over year for the three-month stretch ending in December, mirroring the arm’s forward fiscal progress during the quarter previous to that one. With several years’ worth of this growth disparity on the table, the threat to Amazon’s cloud business is getting much bigger in the rearview mirror.

Microsoft’s Edge Over AWS

What gives? How is Microsoft able to outpace Amazon in a business that Amazon largely pioneered? Much of the credit goes to Microsoft’s cloud-computing technology, and its Azure platform in particular. Azure is a platform that allows Microsoft’s cloud computing customers to access dozens of cloud management tools in one interface, making it more user-friendly and affordable for enterprise-level clients. Then there’s the fact that organizations looking to build artificial intelligence tools seem to prefer Microsoft over Amazon — a significant competitive edge for Microsoft.

Data source: Amazon. Chart by author. Revenue and operating income figures are in billions.

Again, AWS just doesn’t have the same AI edge, and that presents a profit problem for the e-commerce behemoth. As AWS’ profits and margins are being pinched, the threat to its cloud revenue growth is becoming more evident.

Assessing the Investments

As any market becomes more competitive, one of the first and easiest moves to make is cutting prices. And AWS has done exactly that in recent years. At the same time, AWS’ long-term customers are increasingly finding ways to lower their cloud computing costs as well. These strategies, while keeping customers on board, might lead to reduced operating profit margin rates, hinting at potential future headwinds for AWS.

Microsoft’s cloud business is likely running into the same headwind, to be fair. But Microsoft’s got far more ways to monetize its business customers. It’s also not nearly as dependent on its cloud computing arm for operating income as Amazon is, with only about half of Microsoft’s bottom line coming from a much wider array of cloud computing profit centers.

It’s not that Amazon is un-ownable here. It would be naive, however, to ignore the threat that its breadwinning business is now facing. If you’re looking for a cloud computing pick but only have room for one in your portfolio right now, Microsoft is arguably the better choice until AWS proves it can fend off the industry’s second-biggest player.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Microsoft made the list — but there are 9 other stocks you may be overlooking.

See the 10 stocks

*Stock Advisor returns as of February 12, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.