The “Magnificent Seven” stocks are some of the best and brightest growth investments you could have owned over the past year. These companies have been synonymous with growth in recent years:

- Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL)

- Amazon (NASDAQ: AMZN)

- Apple (NASDAQ: AAPL)

- Meta Platforms (NASDAQ: META)

- Microsoft (NASDAQ: MSFT)

- Nvidia (NASDAQ: NVDA)

- Tesla (NASDAQ: TSLA)

How would you have fared if you invested $1,000 into each of these seven stocks ($7,000 total) seven years ago? How would that investment look in comparison to putting $7,000 in the S&P 500 over the same timeframe?

Evolution of the Magnificent Seven

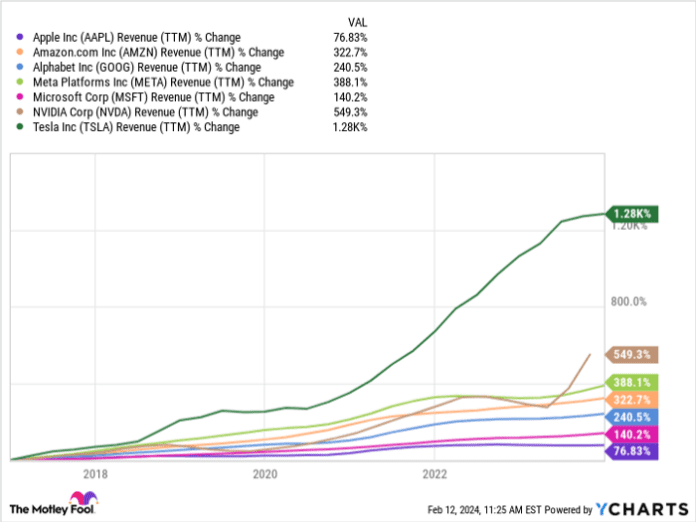

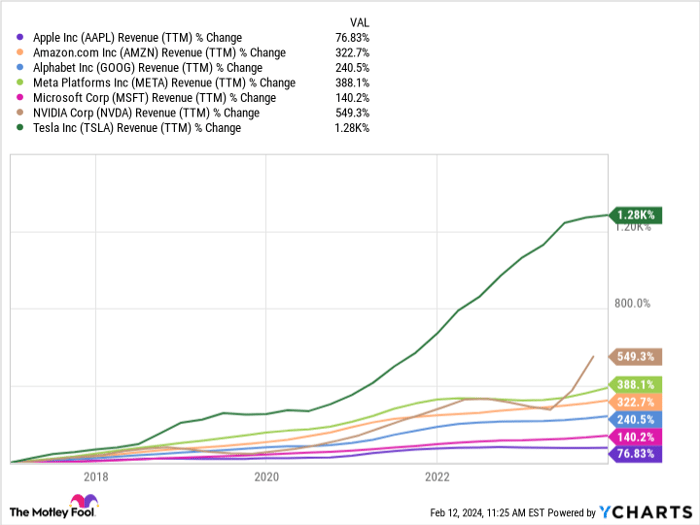

In the span of seven years, these big-name stocks have not just been popular; they’ve also generated monstrous growth, solidifying their positions as prominent market leaders.

A prime example is electric vehicle manufacturer Tesla, which transformed from an unprofitable enterprise into a consistently profitable powerhouse. Despite current concerns about its margins, Tesla’s present-day standing vastly surpasses its 2017 state when it reported a net loss of $2.2 billion.

Nvidia, in particular, has emerged as a promising growth stock due to the crucial role its chips play in driving advancements and efficiencies in artificial intelligence (AI). Amidst these trends, all the “Magnificent Seven” companies have displayed substantial growth since 2017, hinting at the potential for continued dominance in their respective markets.

AAPL Revenue (TTM) data by YCharts.

Snapshot: The Magnificent Seven Returns

Below is a summary of the returns for each stock, illustrating the gains if $1,000 was invested in each on Feb. 1, 2017, and held until market close on Feb. 1, 2024:

| Stock | Feb. 1, 2017 Price | Feb. 1, 2024 Price | Return | 7-Year Return on $1,000 Investment |

|---|---|---|---|---|

| Apple | $32.19 | $186.86 | 480.5% | $5,804 |

| Amazon | $41.62 | $159.28 | 282.7% | $3,827 |

| Alphabet | $39.68 | $142.71 | 258.8% | $3,587 |

| Meta Platforms | $133.23 | $394.78 | 196.3% | $2,963 |

| Microsoft | $63.58 | $403.78 | 535.1% | $6,351 |

| Nvidia | $28.49 | $630.27 | 2,112% | $22,123 |

| Tesla | $16.62 | $188.86 | 1,036% | $11,363 |

Data source: Yahoo Finance. Calculations by the author. Notes: Prices are adjusted for stock splits. Prices are the closing price for that day. Alphabet data is for its Class C stock. Seven-year return is for the stock only and is not the total return that includes dividends.

The total value of those investments as of Feb. 1 would be approximately $56,019. From an original $7,000 investment spread across all seven stocks, you’d have generated a return of 700%. If you had instead invested $7,000 into the S&P 500, the value of your investment today would be roughly $15,070. While you would have more than doubled your money, the returns wouldn’t be nearly as impressive.

Are these Stocks Still Diamonds in the Rough?

Investing in the world’s top growth stocks is generally a shrewd move. Holding stakes in all seven of these leading companies can help mitigate overall risk, positioning you for robust returns. Although smaller stocks and less-proven investments could yield higher returns, they often come with greater risks.

Given these companies’ relentless pursuit of growth opportunities, buying and holding any or all of these stocks is likely to result in promising long-term returns. The lesson here is that even well-known or established businesses can still be excellent investment opportunities, as evidenced by the remarkable payoff for shareholders from holding these stocks.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 12, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.