Associated Banc-Corp (ASB) ventures forth with an ambitious strategic plan, geared towards fortifying its loan and deposit balances and improving fee income. Evidently, the financial institution has set its sights on achieving a favorable operating leverage, relying on the success of its phase-driven growth initiatives. Despite a climate of escalating funding costs and a challenging operational landscape, its resolve remains steadfast.

Driving Organic Growth

ASB remains resolute in its pursuit of organic growth, fortified by robust loans and deposit balances, and an unwavering commitment to augment fee income. Over the past six years, from 2017 to 2023, loans and deposits have experienced an commendable Compound Annual Growth Rate (CAGR) of 5.8% and 6.6%, respectively. Under its strategic plan, ASB seeks to bolster its lending prowess by incorporating “higher-margin” loans into its portfolio and making substantial digital investments to bolster its revenue streams.

The Financial Projection

Even though Associated Banc-Corp’s total revenues experienced a slight dip in 2021, they have showcased a consistent CAGR of 3.2% over the last six years. Looking ahead, it’s anticipated that total revenues-FTE (excluding one-time items) will observe a projected CAGR of 2.5% by 2026, propelled by the execution of strategic plans and the growth of the Net Interest Margin (NIM).

Strategic Blueprint

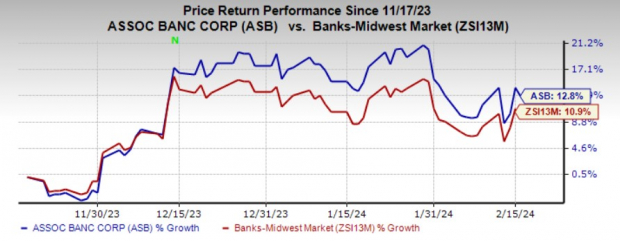

In November 2023, ASB unveiled Phase 2 of its strategic plan, building on the foundations laid by its initial phase announced in September 2021. This progressive blueprint aims to further fortify ASB’s loan and deposit-gathering capabilities by 2025, signifying its unwavering commitment.

Riding the NIM Wave

High interest rates are expected to continue bolstering Net Interest Margin (NIM) expansion, although the metric will be weighed down by elevated funding costs. Despite a NIM reduction in 2021 and 2020, primarily due to low interest rates, 2022 witnessed a rebound amid rising rates, followed by a slight decline in the subsequent year. Nevertheless, NIM is projected to stand at 2.81%, 2.91%, and 3.01% in 2024, 2025, and 2026, respectively.

Hurdles to Overcome

However, the rosy picture is marred by a consistent increase in non-interest expenses for Associated Banc-Corp, registering a CAGR of 2.3% over the past six years due to escalating personnel costs and technology expenses. Added to this are concerns about the deteriorating asset quality, with provision for credit losses expected to surge by 41.1% in the year 2024.

Opportunities Beyond ASB

Amidst the tumult, there are a couple of stocks making a splash in the banking sphere – 1st Source Corporation (SRCE) and Farmers National Banc Corp. (FMNB), each currently flaunting a Zacks Rank #1 (Strong Buy). While SRCE’s 2024 earnings have been revised upward by 7.1% over the past 30 days, FMNB’s 2024 earnings have also witnessed a 4% upward revision during the same period.