On February 14, 2024, Lancaster Colony announced that its board of directors has declared a regular quarterly dividend of $0.90 per share ($3.60 annualized), maintaining the same payout as the previous period. The dividend is eligible for shareholders of record as of March 7, 2024, with a payment date set for March 29, 2024. To qualify for the upcoming dividend distribution, shares must be purchased before the ex-dividend date of March 6, 2024.

At the prevailing share price of $192.89 per share, the stock boasts a dividend yield of 1.87%. Delving into historical context, over the past five years, the average dividend yield has been 1.83%, reaching a high of 2.68%, and a low of 1.52%. Impressively, the current dividend yield is 0.16 standard deviations above the historical average, suggesting a favorable return for investors.

Furthermore, the company upholds a healthy dividend payout ratio of 0.77. This ratio signifies that Lancaster Colony dispenses a significant portion of its income to shareholders, a testament to its commitment to rewarding investors while sustaining a prudent approach to financial management. Notably, the company has maintained a 3-year dividend growth rate of 0.20%, displaying consistency and growth in its dividend disbursements over time.

Fund Sentiment and Analyst Projections

The increasing institutional interest in Lancaster Colony echoes a positive fund sentiment, with 673 funds or institutions reporting positions in the company, reflecting a 2.12% rise in the last quarter. This surge is also mirrored in the average portfolio weight of all funds, which rose by 2.94% to 0.19%. Moreover, total institutional shares in Lancaster Colony expanded by 2.10% over the last three months to reach 20,169K shares, underscoring growing investment confidence in the company.

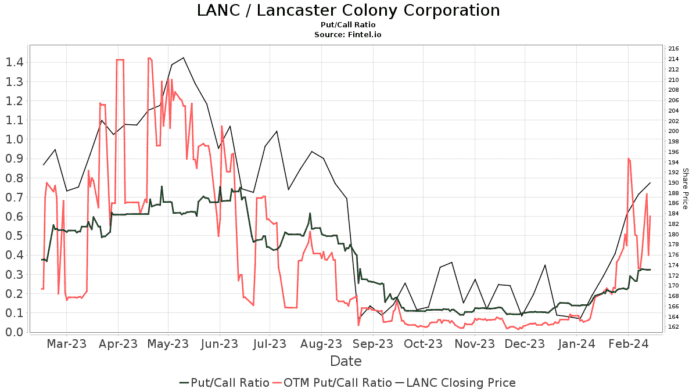

Consequently, the put/call ratio of LANC stands at 0.32, indicative of a bullish outlook, further reinforcing the positive market sentiment surrounding the company. Analyst projections amplify this optimism, with the average one-year price target for Lancaster Colony standing at 195.23, reflecting a projected increase of 1.21% from the latest reported closing price of 192.89. Notably, forecasts span from a low of 167.66 to a high of $237.30, typifying a broad spectrum of positive expectations for the company’s stock performance.

Additionally, the projected annual revenue for Lancaster Colony demonstrates a 4.17% increase to 1,945MM, further solidifying positive growth prospects. The non-GAAP EPS is estimated at 7.40, signaling a positive upward trajectory for the company in the projected period.

Institutional Activities

Examining the activities of major shareholders, William Blair Investment Management stands out, holding 1,382K shares, representing 5.02% ownership of the company. In its previous filing, the firm reported owning 1,308K shares, reflecting an impressive increase of 5.35% in ownership. Conversely, IJH – iShares Core S&P Mid-Cap ETF demonstrated an increase of 5.56% in shareholding, while Champlain Investment Partners and Vanguard Total Stock Market Index Fund Investor Shares witnessed decreases of 5.45% and 14.75% in their portfolio allocations in LANC, respectively. Notably, Diamond Hill Capital Management displayed a notable decrease, witnessing a 16.97% reduction in shareholding and a 21.72% downturn in its portfolio allocation in LANC over the last quarter.

The fluctuating activities of these shareholders underline the dynamic nature of institutional investment in Lancaster Colony. Notably, these maneuvers reflect the evolving perceptions and strategic decisions of major institutional investors within the market.

Lancaster Colony Background Information

Lancaster Colony Corporation operates as a manufacturer and marketer of specialty food products for the retail and foodservice markets. The company’s commitment to product quality, innovation, and customer satisfaction has fortified its position as a trusted name in the industry.

Ultimately, Lancaster Colony’s sturdy dividend performance, positive fund sentiment, and analyst forecasts portray a company that is poised for continued growth and value creation. These factors collectively underscore the enduring appeal that Lancaster Colony holds for investors seeking a blend of income and capital appreciation within the market.

Source: Fintel

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.