MRV Engenharia e Participações (BOVESPA:MRVE3) is in the spotlight as analysts have revised the one-year price target down to 12.56/share, marking a 13.82% decrease from the prior estimate of 14.57 set on January 16, 2024.

Looking at the broader picture, the average price target represents a 63.06% increase from the latest closing price of 7.70/share. This fluctuation embodies a recalibration in market perceptions, guiding investors through the ebbs and flows of financial forecasts.

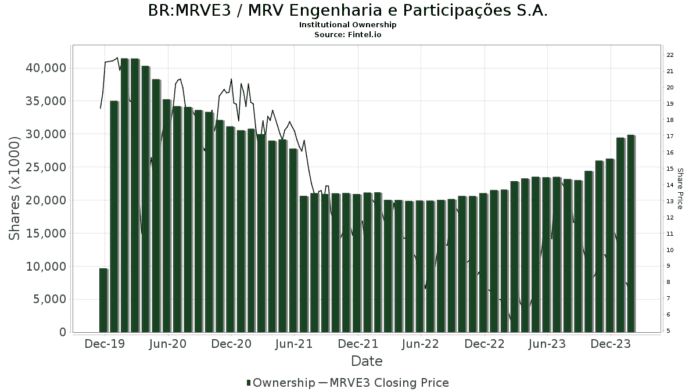

The Fund Sentiment: Analyzing Institutional Positions

With 41 funds or institutions reporting positions in MRV Engenharia e Participações, there has been a notable rise of 2.50% in owners over the last quarter. The average portfolio weight across all funds dedicated to MRVE3 stands at 0.14%, signaling a significant decrease of 32.76%. Institutions collectively hold 29,660K shares, reflecting a noteworthy 14.19% increase over the past three months.

VGTSX, represented by the Vanguard Total International Stock Index Fund Investor Shares, now holds 5,170K shares of MRVE3, amounting to 0.92% ownership of the company. This marks a 22.60% increase from the previous filing. Simultaneously, the firm has reduced its portfolio allocation by 20.15% this quarter, navigating the tides of market dynamics.

VEIEX, through the Vanguard Emerging Markets Stock Index Fund Investor Shares, owns 5,081K shares, representing 0.90% ownership. The firm has shown an 18.80% increase in ownership, albeit reducing its portfolio allocation by 22.30% in the recent quarter.

IEMG, managed by the iShares Core MSCI Emerging Markets ETF, holds 3,597K shares, equivalent to 0.64% ownership. Despite a 3.16% increase in ownership, the firm has scaled back its portfolio allocation by 12.39% during the last quarter.

DFCEX, operating the Emerging Markets Core Equity Portfolio – Institutional Class, maintains its 2,661K shares, representing 0.47% ownership, with no changes reported in the previous quarter.

EWZS, facilitated by the iShares MSCI Brazil Small-Cap ETF, now holds 1,679K shares, signifying a 0.30% ownership stake. The firm has observed a 13.62% increase in shares owned, while adjusting its portfolio allocation by 18.35% in the latest quarter.

Fintel serves as an indispensable investing research platform available to various players in the financial arena, offering insights, tools, and data vital for informed decision-making.

From fundamentals and analyst reports to ownership data and fund sentiment, Fintel propels investors towards a heightened understanding of market dynamics. Explore our exclusive stock picks driven by advanced, quantitative models designed for maximizing profits.

Curious for more? Click here to delve deeper.

This article was originally featured on Fintel.

Disclaimer: The views and opinions articulated here are those of the author and do not necessarily align with Nasdaq, Inc.