Gather around, fellow investors, as another tax season looms over us like a storm cloud on the financial horizon. But amidst the paperwork and number-crunching, there shines a beacon of hope: municipal bonds.

As the Federal Reserve’s interest-rate adjustments in recent years have pushed muni bond yields to enticing levels, these tax-exempt securities have become even more attractive to investors across the nation.

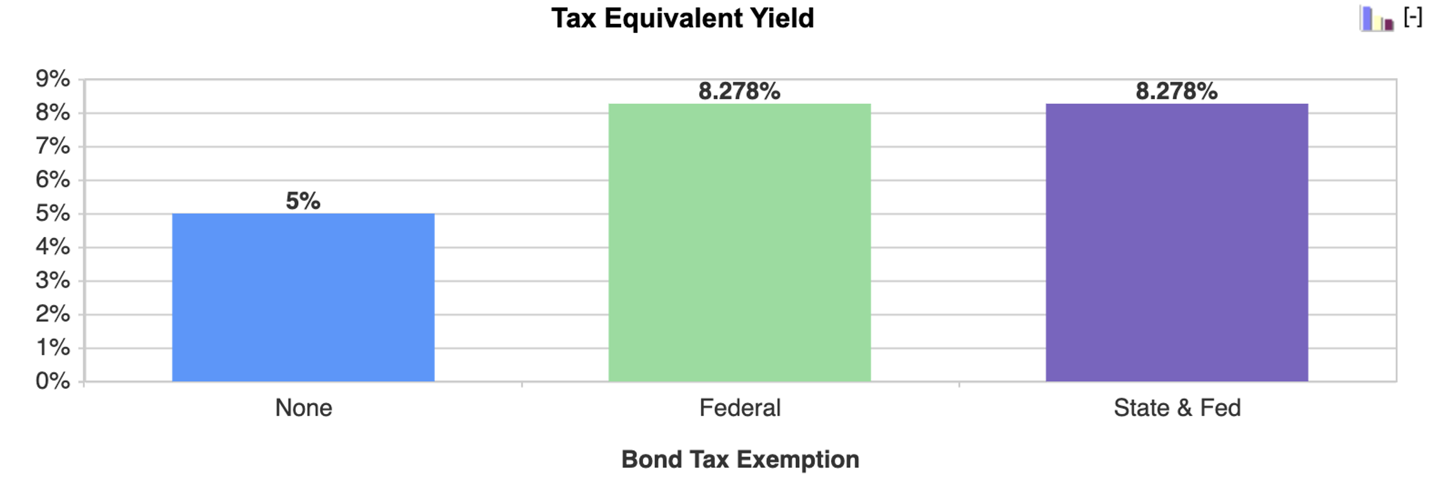

For individuals in the uppermost tax bracket, diving into 5%-yielding municipal bonds could translate to a whopping 8.3% equivalent yield from taxable instruments like stocks or corporate bonds.

However, the path to these lucrative assets isn’t without its hurdles. Securing individual municipal bonds can be a labyrinthine task, especially considering the preferential treatment that big banks and investment giants like Nuveen, Putnam, and PIMCO receive in the bond market.

Fear not, though, for individual investors can unite with these financial powerhouses through the closed-end funds (CEFs) they offer. Yet, not all muni-bond CEFs are cut from the same cloth.

Deciphering Muni-Bond CEF Quality

Join me as we embark on a quest to distinguish the gems from the rubble in the realm of municipal bond closed-end funds. Let’s set our sights on three crucial criteria and see how individual muni-bond CEFs measure up.

The Litmus Test: A Historically Sustainable Dividend

Muni-bond CEFs might weather storms better than most, but their dividend payments aren’t always steady. Take the Putnam Municipal Credit Opportunities Trust (PMO), for instance, a muni-bond CEF that has witnessed multiple payout reductions over the past decade.

These cuts certainly raise eyebrows, especially following the fund’s extraordinary spikes in payouts. Could PMO’s income be slashed again? It’s a possibility. Nevertheless, the fund’s current 4% yield boasts a newfound sustainability, courtesy of market dynamics.

Seeking Bargains: Discounts and Premiums

Unlike their mutual fund and ETF counterparts, CEFs frequently trade at discounts or premiums relative to their net asset value. Presently, the Putnam Municipal Credit Opportunities Trust (PMO) finds itself at a notable 8.3% discount—a signal that perhaps we’re in for a bargain.

But don’t cast all your chips on PMO just yet. Cast an eye on the PIMCO Municipal Income Fund III (PMX), also trading at a modest discount. PIMCO’s allure to affluent Californians seeking tax-exempt income once merited a premium—now, a discount spells a potential profit opportunity down the line.

This discount story doesn’t just end there. The discounted market price of PMX’s 5.3% yield puts it closer to 4.8% based on its NAV. This subtle shift renders payout sustainability more plausible, a theme that echoes across the muni-bond CEF landscape.

The Leadership Litmus: Management Quality

What drives some funds to command more than their intrinsic value? Enter management quality—a key factor in investor attraction. Superior fund managers not only deliver superior returns but also command premium pricing, a trend evidenced by PMO and PMX‘s historic portfolio performance.

The Underdog: Unveiling the Triumph of NMZ in Municipal Bond Funds

NMZ outshines Benchmark Fund MUB

In the world of municipal bond funds, the iShares National Muni Bond ETF (MUB) has long been considered the standard. However, recent analysis reveals a surprising turn of events – the Nuveen Municipal High Income Opportunity Fund (NMZ) has emerged as the dark horse, showing consistent and remarkable outperformance.

The Undeniable Champion: NMZ’s Decade-Long Dominance

When evaluating the total NAV return, which signifies the profits generated by the fund’s management from their portfolios, both NMZ and MUB have exceeded the benchmark municipal-bond index fund by nearly double. This exceptional outperformance has been the trend for a decade now, firmly establishing NMZ as the undeniable champion in the arena.

Long-Term Sustainability and Yield

Despite facing some challenges in 2022 and 2023, including dividend cuts due to rising interest rates, NMZ remains resilient. The 4.6% yield on NAV, coupled with the tax benefits on the fund’s 5% yield on market price, showcases the sustainability and attractiveness of NMZ’s income stream. Even with the possibility of a minor payout cut on the horizon, the fund continues to offer a substantial income stream that is hard to rival.

Looking Towards the Future

Historical data suggests that by opting for the long term with NMZ, investors stand to not only outperform the index fund significantly but also enjoy a much higher yield compared to the meager 2.7% payout offered by the benchmark fund. This strategic play promises substantial gains and a steady income flow for investors willing to engage for the long haul.

Diversification Opportunities

In the realm of high-yield dividend investing, tax-free dividends are a sought-after commodity. While NMZ offers an attractive yield, there are other Closed-End Funds (CEFs) with even more enticing dividends. These CEFs, marked by their impressive 10.2% yields, may not have the same tax benefits, but their profitability overshadows such considerations. Additionally, these funds trade at significant discounts, with projected price gains of over 20% within the next year alone.

Closing Thoughts

The success story of NMZ in the realm of municipal bond funds unveils a narrative of resilience, sustainability, and unparalleled performance. As investors navigate the complex landscape of dividends and discounts, NMZ stands out as a beacon of stability and growth. The future looks bright for those who choose to align themselves with this underdog that has proven its mettle time and time again.