HealthEquity, Inc. HQY, a player in the medical savings and spending sector, has been leveraging its innovative investment platform, particularly its Health Savings Accounts (HSAs), propelling a robust third-quarter fiscal 2024 performance, poised to ignite further investor optimism. Despite its meteoric rise, the company is not without its challenges, notably intense market competition and potential risks associated with mergers and acquisitions.

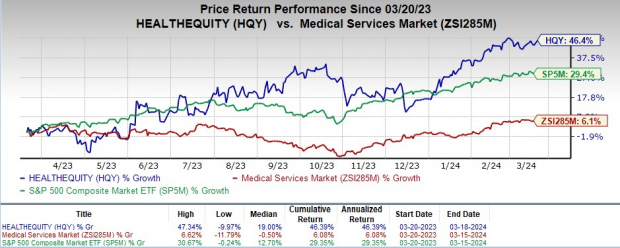

In the last year, this Zacks Rank #3 (Hold) stock has seen a commendable 46.4% growth, outshining the industry’s 6.1% ascension, while the S&P 500 has marked a commendable 29.4% surge in the same time span.

The Financial Landscape

A monetary juggernaut, HealthEquity steers with a market capitalization of $6.99 billion, projecting a promising 28.6% growth over the next five years. The company’s stellar track record includes surpassing the Zacks Consensus Estimate earnings in all the trailing four quarters, boasting an impressive average earnings surprise of 16.5%.

Image Source: Zacks Investment Research

Peeling Back the Layers

Promising Investment Platform: HealthEquity’s cloud-based services present an accessible hub where users can manage their medical expenses, make informed spending choices, prioritize their health, and build savings all in one digital space. The platform also offers access to supplementary services from external vendors vetted by HealthEquity, broadening its appeal to users.

Surge in Health Savings Accounts (HSAs): The tally of HSAs rose by 8.4% year over year, with 592,000 HSAs with investments recorded as of Oct 31, 2023, marking an 11.9% surge annually. Total accounts, encompassing HSAs and 6.9 million consumer-directed benefits, reflected a 5.4% uptick year over year as of October 2023-end. Additionally, the total assets in HSA, inclusive of investments and cash, soared by 11.7% year over year.

Resilient Q3 Performance: In the third quarter of fiscal 2024, HealthEquity shone brightly, showcasing a robust top and bottom-line surge. The revenue growth was attributable to robust contributions from various income streams, complemented by margin expansions.

The Flipside

Meeting the Giants: The medical services arena teems with fierce competition, a dynamic and fragmented landscape where HealthEquity navigates to maintain its edge. Garnering and retaining client engagement, championing the appeal of its services to existing and prospective clients, and stimulating consumer interest in utilizing HSAs and other consumer-directed benefits represent pivotal determinants of the company’s triumph.

Transitioning through Acquisitions: While HealthEquity stands to benefit from its recent acquisitions, success hinges on the smooth integration of the acquired entities with its existing operations. However, the road to synergy might be riddled with obstacles, including unforeseen time delays, higher-than-anticipated costs, potential business disruptions, and financial setbacks that could test the company’s mettle.

Estimate Progression

Anticipated earnings per share for fiscal 2024 have taken a positive trajectory for HealthEquity, with the Zacks Consensus Estimate climbing 6.9% in the past 90 days to reach $2.15. The fourth-quarter fiscal 2024 revenue estimate stands at $258.4 million, reflecting a 10.4% upsurge from the corresponding figure in the previous year.

Discovering Potential

Amidst the medical stride, other noteworthy stocks in the sector include the vivacious DaVita Inc. DVA, the stalwart Cardinal Health, Inc. CAH, and the dynamic Cencora, Inc. COR.

DaVita, boasting a Zacks Rank #1 (Strong Buy), anticipates a robust long-term growth rate of 12.1%. The company has consistently outperformed earning estimates in the past four quarters, with an average surprise of 35.6%. DaVita’s stock has surged by 58.3% against the industry’s 18.9% rise over the past year.

Cardinal Health, flaunting a current Zacks Rank of 1, projects a long-term growth rate of 14.2%. The company has continuously exceeded earning projections in the trailing four quarters, averaging a 15.6% surprise. Cardinal Health’s stock has soared by 51.9% compared with the industry’s 3.2% gain over the last year.

Cencora, sporting a Zacks Rank of 2 (Buy), forecasts a long-term growth rate of 9.8%. The company has surpassed earning expectations in the previous four quarters, with an average surprise of 6.7%. Cencora’s stock has rallied by 51.5% against the industry’s 3.6% increase in the past year.

Seizing the Potential in the Oil Markets

Global demand for oil is surging, presenting significant opportunities for oil producers. Despite recent price fluctuations, companies in the oil and gas sector are poised for substantial profits. Zacks Investment Research has released a time-sensitive report to guide investors on capitalizing on this trend. In their report “Oil Market on Fire,” they highlight four unexpected oil and gas stocks positioned for substantial gains in the upcoming weeks and months.

Want access to expert advice from Zacks Investment Research for the most recent stock recommendations? Download “7 Best Stocks for the Next 30 Days” today for valuable insights.

To delve deeper into individual stock analysis:

- DaVita Inc. (DVA) : Free Stock Analysis Report

- Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

- Cencora, Inc. (COR) : Free Stock Analysis Report

- HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Read the full article on Zacks.com here.

Disclaimer: The opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.