Intuitive Surgical, listed as Intuitive Surgical (NASDAQ: ISRG), has weathered a tumultuous storm over the past five years. The pandemic and various economic challenges posed serious hurdles for the company. Despite initial setbacks, Intuitive Surgical has continued to exhibit robust performance, making it a prime candidate for long-term investment.

While the journey ahead may not be all smooth sailing, Intuitive Surgical possesses all the markers of a growth stock worth embracing for the foreseeable future. Let’s dissect the reasons behind this optimism.

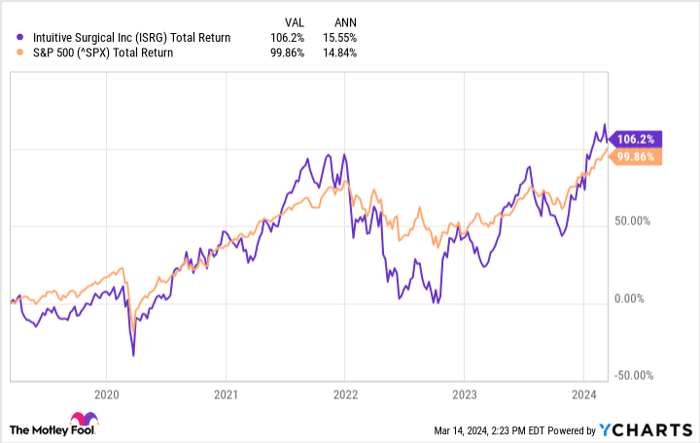

ISRG Total Return Level data by YCharts

Strength in Core Business Operations

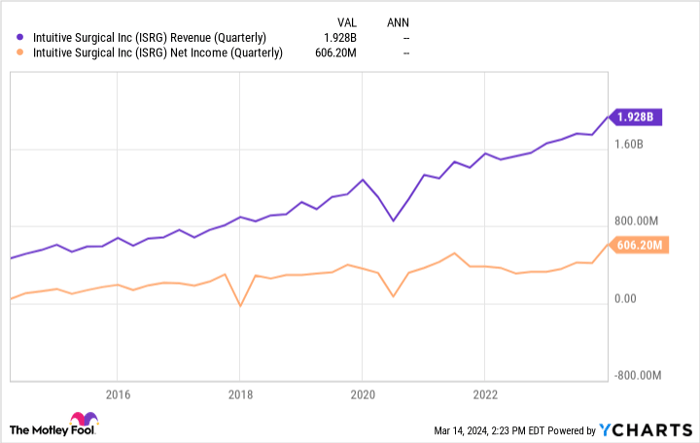

Intuitive Surgical specializes in developing robotic-assisted surgery (RAS) systems, with the da Vinci system being its flagship product. While the machines themselves are high-priced, the company garners a significant portion of its revenue from the sale of instruments and accessories. Revenue growth is directly proportional to the number of procedures conducted with its systems, driving instrument sales and, consequently, overall revenue.

As Intuitive Surgical continues to expand its installed base (which stood at 8,606 da Vinci systems by the end of 2023), revenue is expected to maintain an upward trajectory. Moreover, the aging population and the anticipated increase in surgeries utilizing the da Vinci system present a favorable industry landscape for sustained revenue growth.

The widespread applications of the da Vinci system, ranging from hernia repairs to colon resection surgeries, cater to a broad spectrum of procedures that are likely to become more prevalent with time. This trend, coupled with the company’s early entrant advantage in the RAS market, bodes well for its financial future.

ISRG Revenue (Quarterly) data by YCharts

Navigating Challenges with Foresight

Intuitive Surgical faces obstacles on its growth path, with competition being a prominent concern. While healthcare giants like Johnson & Johnson and Medtronic are vying for a share of the RAS market, they are yet to catch up with Intuitive Surgical’s market dominance. Even if these competitors enter the fray, the underpenetrated nature of the RAS industry suggests room for multiple winners.

Additionally, fluctuations in demand for specific procedures using the da Vinci system, such as bariatric surgeries affected by the popularity of weight loss medications, pose a risk. Nevertheless, given the vast growth potential in the RAS domain, these challenges are unlikely to impede Intuitive Surgical’s overall financial performance significantly.

Intuitive Surgical has demonstrated remarkable resilience in adverse conditions and has marginally outpaced the broader market. This resilience testifies to the strength of its foundational business model. Positioned favorably within the RAS industry, the company presents ample opportunities for investors patient enough to reap handsome returns over the long haul.

Do you have $1,000 to spare for Intuitive Surgical?

Prior to investing in Intuitive Surgical, ponder this question:

The Motley Fool Stock Advisor analyst team has identified the10 best stocks for investors to consider, with Intuitive Surgical not among them. The selected stocks are poised for substantial growth in the foreseeable future.

Stock Advisor offers an actionable roadmap for success, encompassing portfolio construction advice, regular updates from analysts, and two fresh stock picks each month. Since 2002*, the Stock Advisor service has tripled the returns of the S&P 500, highlighting its reliability.

Discover the 10 stocks for yourself

*Stock Advisor returns as of March 20, 2024

Prosper Junior Bakiny has holdings in Intuitive Surgical and Johnson & Johnson. The Motley Fool maintains positions in and endorses Intuitive Surgical. It also recommends Johnson & Johnson and Medtronic. The Motley Fool abides by a disclosure policy.

The opinions expressed in this article are solely those of the author and do not necessarily align with those of Nasdaq, Inc.