In the bustling tech realm, where competition reigns supreme, three prominent players vie for the spotlight in the intricate domain of data analytics: Snowflake (NYSE: SNOW), Palantir (NYSE: PLTR), and the relatively new entrant, BigBear.ai (NYSE: BBAI). While Snowflake and Palantir have entrenched themselves in the industry, BigBear.ai is a fresh face striving to establish its foothold in this colossal market. So, does this up-and-coming data analytics expert merit a place in investors’ diverse stock portfolios?

Unraveling BigBear.ai’s Numerical Tapestry

To understand the realm of valuations in this arena, let’s delve into the numbers.

Snowflake boasts a lofty price-to-sales (P/S) ratio of 18.6, riding high on a wave of investor enthusiasm. Palantir, with an even richer P/S ratio of 24.1, raises concerns of being overvalued, even in comparison to Snowflake. In contrast, BigBear.ai sports a more modest P/S ratio of 2.0.

However, the landscape changes drastically when shifting from sales-centric metrics to profit-based indicators. Snowflake and Palantir trade at triple-digit multiples concerning forward earnings estimates. Their price-to-free cash flow ratios hover between 60 and 80—an eye-watering proposition that might deter value investors.

Yet, profitability remains a distant mirage for BigBear.ai. While the company recently achieved positive adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) and operational cash flows on a quarterly basis by a slim margin, its trailing four-quarter results linger in the negative territory. Consequently, conventional valuation metrics fail to paint a coherent picture for this unprofitable entity.

However, valuations rooted in profitability are merely one facet of the puzzle. The potential for sustained business expansion plays a pivotal role in identifying future victors, particularly in the growth-centric tech space. Snowflake flaunts remarkable historical and anticipated earnings per share (EPS) growth, partially validating its premium valuation. On the flip side, Palantir, although showcasing decent growth, has yet to fully convince skeptics of its ability to sustain momentum. For a nascent entity like BigBear.ai, the onus remains on proving its long-term growth trajectory.

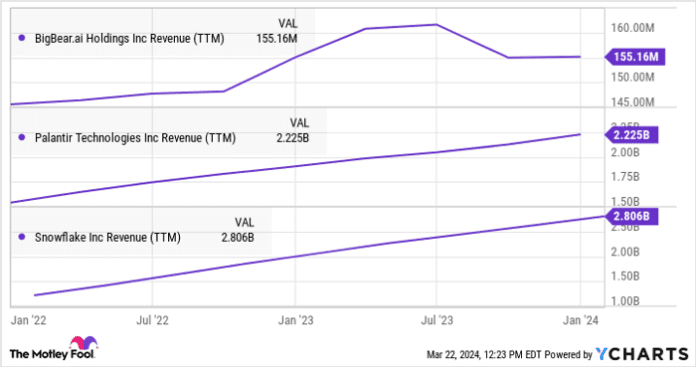

Presently, BigBear.ai is yet to rev up its engines. While Snowflake and Palantir reveled in robust revenue surges amidst the artificial intelligence (AI) frenzy of 2023, BigBear’s revenue growth, in stark contrast, decelerated:

BBAI Revenue (TTM) data by YCharts

A Glimpse into the Trio

Let’s deep dive into BigBear.ai and its heavyweight counterparts:

- Snowflake: Renowned for its cloud-based platform and scalability, Snowflake exudes popularity. Yet, its lofty valuation, restricted profits, and reliance on a handful of major clients spark concerns among certain quarters of investors.

- Palantir: With a focus on artificial intelligence and collaborations with government agencies, Palantir holds a distinct position in the data analytics sphere. However, its enigmatic business model and heavy dependency on government contracts thrust its long-term prospects into question.

- BigBear.ai: This emerging player places emphasis on artificial intelligence and machine learning solutions catering to both government and corporate clienteles. With a lower valuation and promising technology on its side, BigBear.ai tugs the interest strings of investors. Nevertheless, its brief operational timeline and scarcity in profitability hoist significant red flags. Moreover, akin to Palantir, BigBear.ai leans heavily on government contracts for sustenance.

Deciphering the Investment Conundrum

So, is BigBear.ai stock a more alluring bet compared to Snowflake or Palantir presently?

The answer resides in a labyrinth of complexities. While its lower valuation might beckon, bear in mind that this fledgling enterprise is yet to validate its mettle–echoed by the slackening revenue growth depicted in the chart above.

For risk-averse investors seeking proven growth stories, Snowflake might emerge as the preferred choice despite its premium tag. Meanwhile, Palantir, with its intriguing technology repertoire and governmental affiliations, could serve as a viable high-growth alternative for those seeking to traverse the risk spectrum.

Presenting unproven potential for robust growth, BigBear.ai might entice speculative investors amenable to heightened uncertainty levels. Remember, growth aficionados will maintain a stoic gaze until the company shifts gears in its operational machinery, whereas value investors scarcely cast a glance toward BigBear.ai at this juncture.

Ultimately, the decision to funnel investments into BigBear.ai hinges on individual risk tolerance and investment objectives. Deliberate meticulously on the potential payoffs versus the associated risks prior to reaching a verdict. Personally, I’d opt for a re-visitation of Snowflake or Palantir before diving into the tumultuous waters of BigBear.ai stock.

Should you invest $1,000 in BigBear.ai right now?

Before embarking on a BigBear.ai investment journey, ponder this:

The Motley Fool Stock Advisor analysts have pinpointed what they deem the 10 best stocks for investors to seize at this juncture… and to everyone’s surprise, BigBear.ai didn’t make the cut. The 10 chosen stocks boast the potential for colossal returns in the forthcoming years.

Stock Advisor furnishes investors with a roadmap to success, proffering insights on portfolio construction, routine updates from analysts, and two fresh stock recommendations each month. Since 2002, the Stock Advisor service has tripled the returns of the S&P 500 index*.

Discover the 10 stocks

*Stock Advisor returns as of March 21, 2024

Anders Bylund holds no positions in any of the aforementioned stocks. The Motley Fool maintains positions in and recommends Palantir Technologies and Snowflake. The Motley Fool upholds a disclosure policy.

The opinions and viewpoints articulated in this narrative are the author’s and do not necessarily mirror those of Nasdaq, Inc.