Recent insights reveal a surge in out-of-the-money (OTM) Tesla Inc. (TSLA) put options set to expire in 37 days. This significant activity potentially signals a market bottom for TSLA stock, offering a compelling income strategy for current investors.

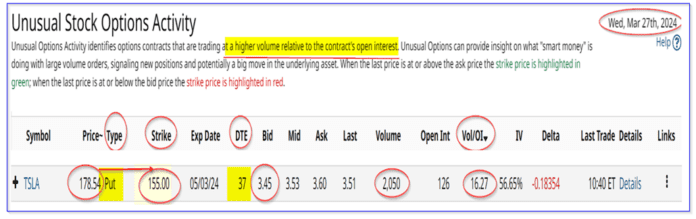

The recent Barchart Unusual Stock Options Activity Report (UOA) highlights a substantial surge in trading on Wednesday, March 27. Over 2,000 put option contracts exchanged hands at the $155 strike price, expiring on May 3. Remarkably, this surge is notable considering the previous outstanding interest (OI) stood at a mere 126 contracts, resulting in a Vol/OI ratio of over 16 times the norm.

Notably, the premium for these put options stood at a notable $3.45 per contract on the bid side, presenting an immediate yield of 2.223% for investors engaging in shorting these contracts, with only 37 days remaining until expiration.

Moreover, a hypothetical trade repetition every month could yield an expected annual return (ER) of approximately 22.23%. While monthly yields may vary, this high ER potential warrants attention.

The surge in put options presents an opportunity for existing shareholders to boost their returns on TSLA stock through shorting these OTM puts. With a breakeven point of $151.55 per share ($155-$3.45), considerably below the current price of $170.41, investors stand to generate income before losses materialize.

Furthermore, the recent low point for TSLA stock at $162.50 on March 14 indicates a potential upward trend, providing a favorable entry point for investors amid any future stock declines.

Nevertheless, some risks persist. As Tesla prepares to release its Q2 earnings in May, concerns regarding financial performance from its challenging Q1 figures arise. While Q4 saw modest growth in revenue and automotive sales, adjusted EBITDA dropped by 27% annually. However, robust free cash flow (FCF) of $2.064 billion and a solid FCF margin of 8.2% are positive indicators amidst the volatility.

Price Projections

If Tesla maintains its current trajectory, anticipated FCF for 2024 could boost to over twice the 2023 figure, notwithstanding a conservative 5% margin. Considering the projected revenue for 2024, TSLA could potentially hit a $593.5 billion market cap by utilizing a 1.0% FCF yield metric.

This assessment implies that Tesla stock may be undervalued, with a potential value of over $187 per share within the next year, offering a margin of 4.5% from its current market capitalization.

In essence, shorting OTM put options emerges as a viable income strategy for current shareholders, leveraging additional income collection and a disciplined approach for potential stock acquisition at a lower price point with promising returns.

Engaging in shorting TSLA puts for an added 2.22% income presents an attractive income opportunity, particularly beneficial for existing TSLA investors.

While this article by Mark R. Hake, CFA does not reflect any positions in the securities discussed, all content serves informational purposes. Refer to the Barchart Disclosure Policy for further insights.

The expressed views are solely those of the author and do not represent Nasdaq, Inc.’s opinions.