Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides to debate controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Karrie Gordon and Nick Peters-Golden discuss whether alternative investments, known as alts, hold merit in portfolio allocation as we navigate 2024.

Karrie Gordon, staff writer, VettaFi: Hey Nick, it’s intriguing to dive into the realm of alternative investments today. Alts are brimming with innovation, especially in the ETF arena. While I advocate for a permanent spot for alts in portfolios, the unique circumstances of this year underscore the importance of incorporating alt strategies deliberately.

Nick Peters-Golden, staff writer, VettaFi: Hi Karrie, the allure of alts is undeniable, but timing and context play a crucial role in their relevance. I believe exploring innovative approaches within the 60/40 strategy might offer the competitive edge in today’s market environment. Let’s hear what our readers have to say!

Emphasis on Diversification in 2024

Gordon: Alts garnered significant interest in recent years as the correlation between stocks and bonds soared. Why the hype, you ask? Well, high correlations spell trouble for the traditional 60/40 portfolio. When stocks and bonds march in lockstep, the protective role that bonds historically played vanishes.

Alternatives step in with their array of diversified return avenues. These strategies, ranging widely, possess fundamental characteristics distinct from stocks and bonds. Take the poster child of alts this year, bitcoin, for instance.

Crypto prices sway with macro factors and investor sentiment. Yet, they also respond to the robust fundamentals of the underlying technology, the broad adoption of crypto, regulatory shifts, and more. Furthermore, investors in spot bitcoin can earn returns by staking their coins, providing an additional layer of non-correlated returns. Just peek at bitcoin’s more than 50% year-to-date surge upon regulatory nods for spot BTC ETFs.

Similarly, gold’s trend this year, options strategies and their yield premiums, hedge fund tactics, commodities, and others exhibit diversified return potentials. With inflation ambiguity looming and uncertainty over the Fed’s rate-cut initiation, expanding beyond stocks and bonds emerges as a prudent move.

Peters-Golden: I acknowledge the rationale backing alts, no doubt. Successful investing demands a degree of diversification, but does it always necessitate an alt slice when viable diversification yielding strong returns is within reach? Investors might find robust equity exposure diversified away from the S&P 500 sans the need for alt allocation – if that’s the objective, that is.

Consider investors seeking divergence from the conventional U.S. equities market. A perusal through VettaFi’s compilation of global ex-U.S. ETFs unveils some top performers. For example, Invesco S&P International Developed Momentum ETF (IDMO) boasts a one-year return of 38%, per VettaFi data. Priced at a mere 25 bps and mirroring the S&P Momentum Developed ex U.S. & South Korea LargeMidCap Index, with over half of its assets in Japan.

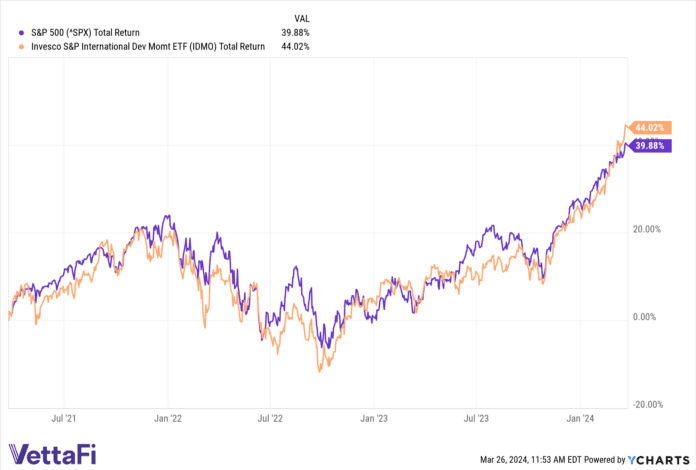

Over one-year, three-year, and year-to-date spans, IDMO has outshone the S&P 500 (SPX) without leaning on U.S. exposures. True, its charges eclipse those of SPY, but based on the chart below, investors could have reaped superior returns with IDMO – all while swaying away from the U.S. economic landscape.

Although past performance doesn’t ensure future outcomes, juxtaposing IDMO with an alt allocation enables a blend of returns and partial deviation from the U.S. market.

This all hinges on the assumption that diversification aims at safeguarding against a potential U.S. economic upheaval. But what if, contrary to expectations, the U.S. economy exhibits remarkable resilience presently?

If the pursuit of performance through alts takes precedence over diversification for defensive purposes, adhering to the U.S. economic sphere might be prudent. Contemplations abound regarding the Fed’s ability to engineer a soft landing post-rapid rate hikes, and broadly speaking, the economy seems poised for a graceful descent. This scenario arguably curbs the exigency for alternative income sources

Continued Ascendancy of Options Overlay Strategies

Gordon: Irrespective of the economic trajectory, options overlay strategies have staked a claim to popularity and potency. These strategies gained prominence in 2022 amid elevated stock-bond correlations that afflicted traditional 60/40 portfolios. In the throes of inflation and rate ambiguities in 2023, these funds flourished, drawing considerable capital inflows.

Forecasts by Nicholas Elward, Natixis Investment Managers’ Senior VP overseeing institutional product development and ETFs, indicate sustained growth for options strategy ETFs this year. Notably, options overlay ETF expansion ranks among Natixis’ top three ETF investment themes for the current year.

Many of these strategies orbit around bolstering income within core holdings. Options income ETFs leverage call premiums to supplement underlying exposures. Consequently, they furnish a compelling, diversified income source alongside prevailing fixed-income positions.

Natixis rolled out the Natixis Gateway Quality Income ETF (GQI) last December, currently yielding 7.79% by 03/25/24. Another crowd favorite, the JPMorgan Equity Premium Income Fund (JEPI), amassed nearly $1.4 billion in YTD inflows. The NEOS S&P 500 High Income ETF (SPYI) recently breached the $1 billion AUM mark, offering distribution yields of 12.14% as of 02/29/24.

Other options strategies mitigate equity risk and downturns while aiming to quell volatility. Amid the unfolding inflation and rate narratives this year, options overlay strategies present diverse advantages to income-centric portfolios, meriting inclusion.

Peters-Golden: An essential aspect of investing to bear in mind is the concept of opportunity cost. Capital allocated to one sphere precludes investment elsewhere. Neglecting this cost could spell significant repercussions, especially with anticipated rate slashes trickling down from the Fed. The fallout from missed rate-cut advantages could be severe.

What are the prospects of such a scenario unfolding? Certain sectors like renewables, tech, and even methodologies like fundamental investing stand to gain from reduced borrowing costs.

Renewables, in particular, possess robust structural merits. The clean energy segment has reaped governmental funding largesse, relying heavily on debt. The puzzle pieces are aligning, and if lower-rate debt materializes post-cut, the sector could shine.

A similar narrative permeates disruptive tech landscapes. A.I.’s transformative impact echoes through the economy, propelling tech titans like Nvidia (NVDA). Yet, a disproportionate reliance on these A.I. giants could render the economy top-heavy. Exploring nascent disruptive tech entities poised for significant growth might present a compelling alternative.