Concentrating minds on the copper market

A decade low in spot treatment charges and refining costs has jolted the copper market into a frenzy, with evidence of heightened competition between Chinese and Indian refiners for raw materials. The remarkable plunge from 2023’s high treatment and refining charges to current levels has sent shockwaves throughout the industry, signaling a pivotal shift in dynamics that could reshape the global copper landscape.

As China and India vie for dominance in the copper sector, the unveiling of Adani’s monumental Kutch Copper smelter adds yet another layer of complexity to the unfolding narrative. The looming specter of an impending Indonesian copper ore export ban casts a shadow of uncertainty over the market, potentially marking a crucial turning point in the Copper Smelters Purchasing Team’s strategies.

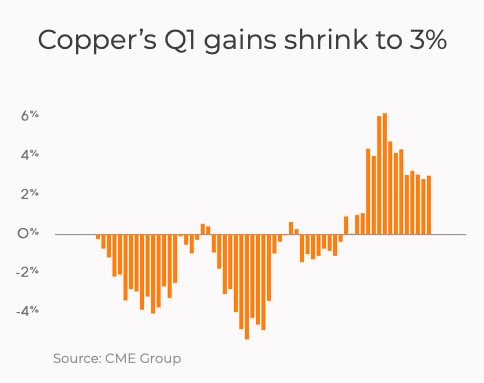

Despite China’s ambitious production plans and the recent rise in inventories, indicators such as open interest on exchanges and investor positions suggest a growing bullish sentiment in the market. The intricate dance between supply and demand paints a picture of a market teetering on the edge of transformation.

Fears over undersupply and disruptions

The copper market grapples with persistent challenges stemming from supply constraints and operational disruptions, exacerbating concerns about future growth prospects. The closure of First Quantum’s Cobre Panama mine, a significant player in the global copper arena, underscores the fragility of the industry and its susceptibility to unforeseen events.

Unplanned disruptions continue to plague copper production, with forecasted growth rates dwindling amidst mounting operational hurdles. Major players like Anglo American and Escondida face production cuts and rising costs, heralding a period of uncertainty and adjustment in the copper mining sector.

The escalating total cash costs of copper production, coupled with inflationary pressures, pose significant challenges to miners as they navigate a landscape fraught with volatility and complexity. The specter of supply disruptions looms large, casting a shadow over the market’s equilibrium and raising questions about the future trajectory of copper prices.

Heading towards five-digit copper prices

The Copper Study Group’s about-face in market surplus predictions highlights the fickle nature of copper markets, where sharp reversals and unforeseen deficits can upend prior expectations. Forecasts of refined deficits and looming supply shortages have propelled copper prices to soaring heights, with analysts predicting a bullish trajectory in the short to medium term.

Projections of copper breaching the $9,000 mark and potentially surging past $10,000 reflect a growing consensus among industry experts regarding the metal’s bullish prospects. Institutions like BMO Capital Markets, Goldman Sachs, and Capital Economics echo sentiments of optimism, envisioning a future where copper cements its status as a lucrative investment avenue.

As the demand for copper continues to surge, underpinned by a narrative of supply constraints and shifting market dynamics, the prospect of five-digit copper prices looms large on the horizon, painting a picture of a market poised for significant upheaval and transformation.