General Dynamics Corp., known for its prowess in defense technology, has hit the jackpot. Its business unit, General Dynamics Information Technology (“GDIT”), recently clinched a colossal $922 million deal to revamp the IT infrastructure at the U.S. Central Command (“CENTCOM”) in February 2024. The General Services Administration is the benevolent giver of this lucrative contract.

The Road to Modernization

The deal mandates GDIT to wield the powers of artificial intelligence and machine learning in managing CENTCOM’s enterprise data. The aim is to enhance decision-making processes, transition CENTCOM to a revamped cloud environment, and boost the operational efficiencies of its networks. GDIT intends to leverage its zero-trust capabilities to fortify CENTCOM’s cyber defenses and shield it from potential cyber threats.

Prospects on the Horizon

Given the escalating geopolitical tensions worldwide, cyber security threats loom large as a significant risk to national security. Nations are intensifying their investments in defense products, underscoring the urgent need for a secure, reliable, and efficient IT network to connect operational bases with ground forces.

The Defense IT Spending market is poised for growth, fueled by the rising demand for autonomous defense systems, increased adoption of artificial intelligence and machine learning to bolster situational awareness, and an uptick in demand for war simulations. According to Technavio, the Defense IT Spending market is forecasted to witness a robust CAGR of 4.5% from 2023 to 2028.

GDIT stands out by delivering cutting-edge cybersecurity services that proactively combat evolving threats in the digital landscape. By supporting intricate programs within Special Operations Forces, GDIT designs and implements robust IT systems tailored for the high-pressure cyber battlefield.

GDIT’s capabilities shine a light on its pivotal role in the defense IT spending arena, positioning it to reap the benefits of the market’s growth surge through a robust influx of orders. The recent triumph in securing the CENTCOM contract further cements its position in the industry.

Surveying the Competition

Apart from General Dynamics, fellow defense contractors are poised to capitalize on the booming defense IT spending market:

Northrop Grumman (NOC): NOC’s Defense Systems arm offers innovative solutions in aircraft sustainment, mission-critical training, integrated battle command systems, and modernized weapons, alongside software development and IT modernization.

Lockheed Martin (LMT): A prominent provider of defense technology, LMT specializes in comprehensive cyber systems for the defense and global security sectors. LMT’s MR2 platform is at the forefront of digitally transforming the U.S. military with real-time insights into employee training and readiness.

BAE Systems (BAESY): A key player in the UK’s Cyber and Electromagnetic Activities domain, BAESY offers top-notch cyber and specialist wireless solutions. Its Cyber Portfolio spans various services, including risk advisory, incident response, and the management of enterprise network security.

Market Movements

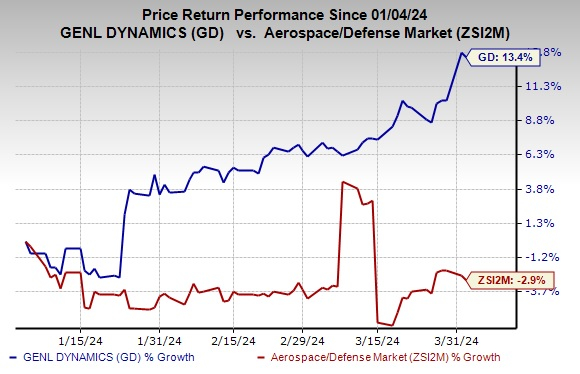

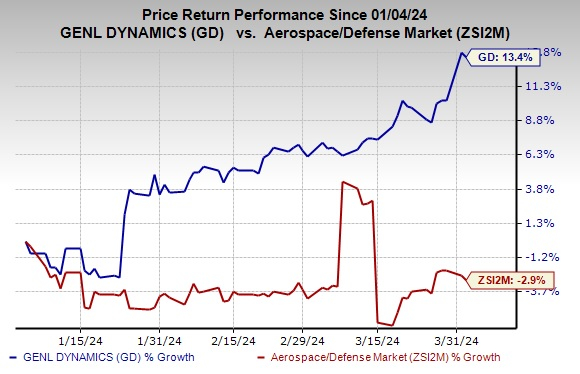

General Dynamics’ shares have surged 13.4% in the past three months, outperforming the aerospace and defense industry’s 2.9% decline.

Image Source: Zacks Investment Research

In Conclusion

In the realm of defense IT spending, General Dynamics stands tall with its recent landmark contract win. The company’s strategic approach to cybersecurity, coupled with its innovative solutions, positions it as a frontrunner in the ever-evolving digital defense landscape. As nations worldwide gear up to safeguard their interests in cyberspace, companies like General Dynamics are at the forefront of fortifying critical infrastructure against emerging threats.

The future seems promising as General Dynamics embarks on this transformative journey to bolster CENTCOM’s cyber defenses, laying the groundwork for enhanced operational efficiencies and secured networks in the digital battlefield.