Reflections on Historical Performance

The tumultuous landscape of the financial market has put the age-old debate on the efficacy of the classic 60/40 portfolio back under the microscope. Investors and financial wizards have sparred over its relevance in a time when volatility reigns supreme and alternative investment strategies glitter on the horizon.

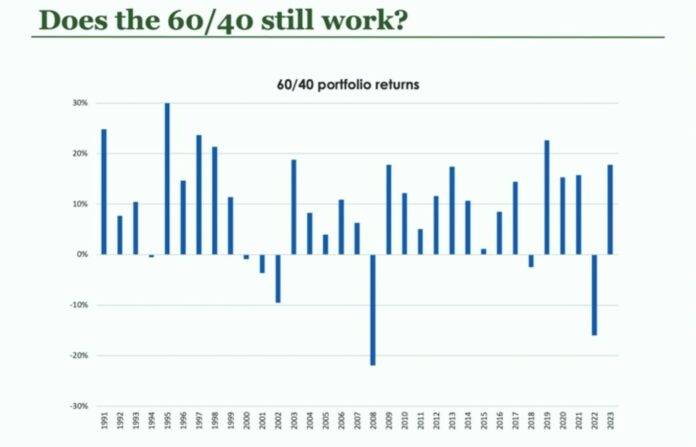

The year 2022 saw the traditional 60/40 portfolio take a hit that reverberated through the financial world, leaving advisors and investors with a bitter aftertaste. The memory of that rough patch remains etched in the collective memory of market participants.

Bill Nygren, CFA, U.S. CIO, together with Adam Abbas, the head of fixed income and PM at Harris Associates, recently trimmed the hedges of the 60/40 portfolio in a revealing video session. Nygren soberly noted that significant downturns have occurred only three times since 1991, causing people to question the relevance of the concept post-recession.

One of the portfolio’s shining features is its ability to smoothen out market waves by combining stocks and bonds into a single benchmark. The blending results in a reduction of overall volatility due to the varying correlation patterns between stocks and bonds.

Historically, a conventional 60/40 mix has proven highly effective in lowering volatility levels, especially when stocks and bonds dance to opposite market beats. Nonetheless, the years 2022 and 2023 ushered in a period of heightened correlation between the two, dulling the portfolio’s magic touch in taming volatility.

The Significance of Bonds in the 60/40 Portfolio

Bonds play a pivotal role in the dynamics of the 60/40 portfolio, offering more than just a lifeboat during stormy market weather. Abbas delved into the triad of benefits that bonds bring to the investment table.

“The allure of fixed income lies in its ability to provide a substantial real yield post-inflation,” emphasized Abbas.

The era of the Fed’s quantitative easing strategy cast a shadow over bond yields for over ten years, causing them to lose luster in investors’ eyes. However, the tides have turned, unveiling real yields ranging between 1.5% and 2%, promising positive outcomes over the next financial laps.

Bonds also serve as a vital diversification tool, stepping up like a chameleon to counterbalance the volatility of stocks. In times of interest rate hikes, stock and bond correlations usually soar, only to taper off as rates recede. With the prospect of forthcoming Fed rate cuts, the alignment between stocks and bonds is likely to loosen.

Lastly, Abbas underscored the importance of robust all-in yields from the bond side, factoring in recoveries and defaults for a holistic investment strategy.

“For much of the past 15 years, we have scarcely ticked off one of these boxes,” highlighted Abbas. “Today, we find all three boxes neatly checked.”

The horizon looks promising for the tried-and-tested 60/40 portfolio amidst the cacophony of alternative investment options. While alternative strategies have earned a spot in the sun, the 60/40 blend promises a bright future as bond yields return to the limelight.

For more news, insights, and analysis, explore the Portfolio Construction Channel at ETFTrends.com.

The opinions expressed herein solely belong to the author and may not reflect the views of Nasdaq, Inc.