In the ebbs and flows of the stock market, growth stocks have once again surged to the forefront, riding the wave of a resilient bull market that has been ongoing for more than a year. This resurgence follows a period of adversities that particularly weighed down growth-focused companies, making the current rally an enticing opportunity for investors seeking outsized returns.

Amidst this backdrop, two shining stars beckon – Amazon (NASDAQ: AMZN) and Airbnb (NASDAQ: ABNB).

Amazon: A Triumph Against All Odds

In the tumultuous year of 2022, Amazon faced skepticism. Lackluster revenue growth, sluggish advertising sales, escalating expenses, and an uncommon net loss painted a dreary picture. Yet, the tech titan orchestrated a remarkable resurrection, partly fueled by improved economic circumstances. Implementing stringent cost-cutting measures, Amazon steered its bottom line back to profitability.

While Amazon’s stock has reaped significant rewards in the past year, the true takeaway lies deeper. The foundational strength of Amazon’s business stood resilient amidst challenges, reaffirming its mettle in navigating volatile market conditions and emerging stronger.

With a colossal market cap of $1.76 trillion, Amazon’s enduring potential shines through. The company stands at the helm across multiple industries, with ample room for future growth. Dominating e-commerce in the U.S. and the global cloud computing sphere, Amazon holds unrivaled market share, particularly in the promising realm of cloud services.

Airbnb: Weathering Challenges, Galvanizing Growth

While Airbnb’s stock trailed behind the broader market over the past year, the company’s financial performance remained robust.

In 2023, the vacation rental platform notched revenue of $9.9 billion, marking an 18% surge from the previous fiscal year. Airbnb’s net income more than doubled year over year to $4.8 billion, capping off 2023 with free cash flow of $3.8 billion, a slight uptick from the $3.4 billion recorded in 2022.

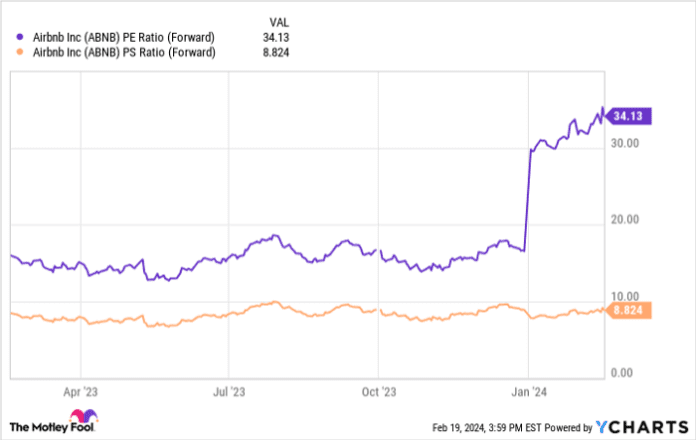

Yet, despite these commendable results, Airbnb struggled to match the market’s pace. Regulatory headwinds in key regions like New York and lofty valuation metrics have likely dimmed its stock performance.

However, these challenges hardly dent Airbnb’s long-term appeal to discerning investors. The platform’s ecosystem continues to flourish, boasting over 5 million hosts and 7.7 million listings. As the ecosystem burgeons, Airbnb’s economic moat strengthens, propelled by its platform network effect.

Embarking on forays into underpenetrated markets like Germany, Brazil, and Korea, Airbnb’s growth trajectory remains promising. Embracing new growth horizons by venturing “beyond the core,” Airbnb holds the potential to unlock substantial opportunities.

To Invest or Not to Invest in Amazon?

Before delving into Amazon’s stock, it’s wise to ponder: what’s the 10 best stocks spotlighted by the Motley Fool Stock Advisor team for soaring returns? Amazon might not make the cut, but these 10 picks promise colossal gains in the years ahead.

Stock Advisor offers a roadmap to success, furnishing expert portfolio-building guidance, analyst insights, and bi-monthly stock picks that have outstripped the S&P 500’s returns since 2002*

Explore the 10 stocks

*Stock Advisor returns as of February 20, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Amazon. The Motley Fool holds positions in and recommends Airbnb and Amazon. The Motley Fool has a disclosure policy.

The expressed opinions presented here belong solely to the author and do not necessarily align with those of Nasdaq, Inc.