Costco and AutoZone’s Earnings Signal New Trends for Q1 2025

The kickoff to the Q1 2025 earnings season was marked by the recent releases from Costco (COST) and AutoZone (AZO). This week, four additional S&P 500 companies are preparing to report their Q1 results, with Oracle (ORCL) set to announce on Monday, March 10th, and Adobe (ADBE) on Wednesday, March 12th.

These earnings reports from Costco, AutoZone, Oracle, and Adobe pertain to their fiscal quarters ending in February, which will be included in the overall tally for Q1, as counted by us and various research organizations. By the time major banks release their quarterly results in approximately a month, nearly two dozen S&P 500 companies will have shared their Q1 results.

Corporate Profitability Trends Face Mixed Signals

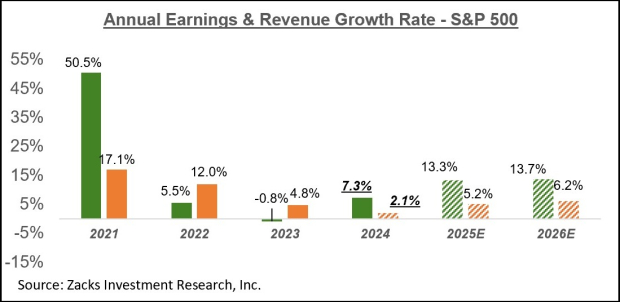

Our analysis of corporate profitability remains positive. Earnings growth has been accelerating, evidenced by the preceding quarter’s impressive +14.6% growth rate (+17.3% excluding Energy), the highest in three years.

We anticipate that these favorable growth trends will persist in the current and upcoming quarters. Moreover, the sectors contributing to this growth momentum appear to be expanding beyond the technology focus observed in recent years.

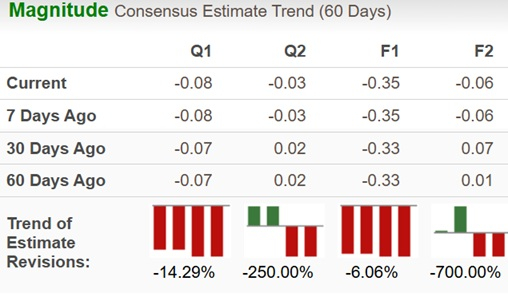

However, we are cautious about potential negative macroeconomic implications stemming from policy uncertainty. This uncertainty has recently emerged in sentiment measures, compounded by guidance downgrades from several retailers citing tariffs and other issues. Such downgrades could indicate an early warning sign of a downturn in the earnings landscape. Even prior to these developments, we had noted an elevated rate of negative revisions to earnings estimates for Q1 2025.

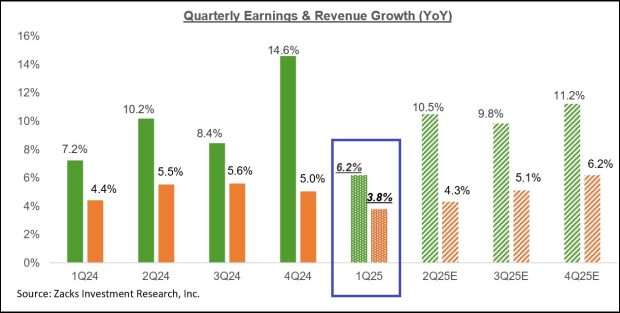

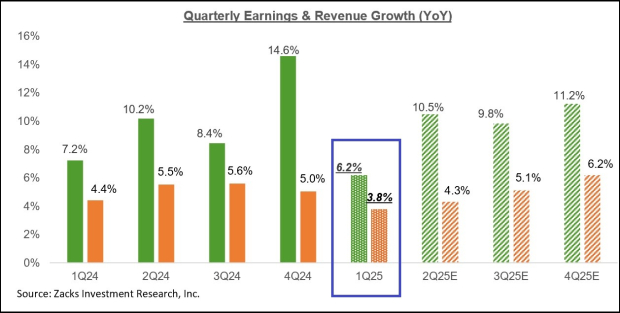

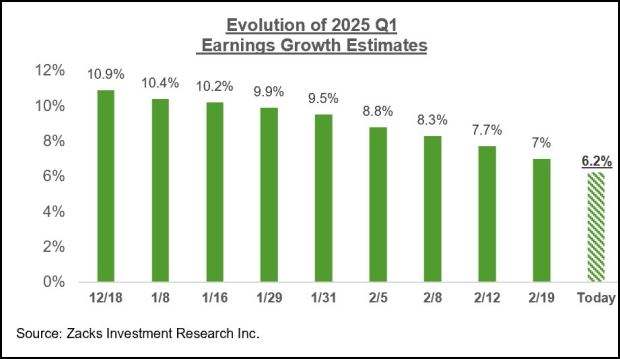

The current expectation is for Q1 earnings to increase +6.2% year-over-year, accompanied by a +3.8% rise in revenues following last quarter’s +14.6% earnings growth on +5% revenue gains.

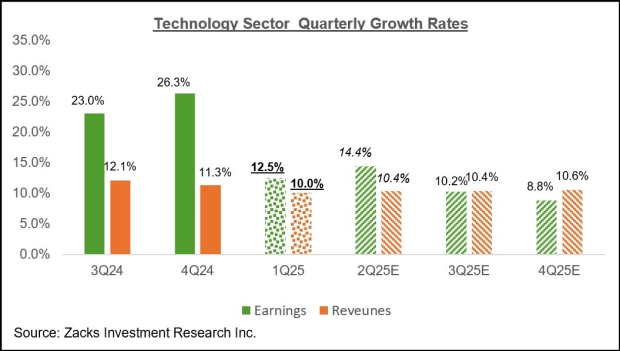

The chart below illustrates the current earnings and revenue growth expectations for Q1 2025, contextualized with growth over the previous four quarters and projections for the subsequent three quarters.

Image Source: Zacks Investment Research

The following chart reflects how Q1 earnings growth expectations have shifted since the start of the quarter.

Image Source: Zacks Investment Research

Negative Revisions and Sector Performance

As highlighted previously, there have been more downward revisions to Q1 estimates since January than in similar time frames in recent quarters. Notably, the extent of these negative revisions is more significant and widespread. Since January, estimates have decreased for 14 out of 16 Zacks sectors, with the largest reductions seen in the Conglomerates, Autos, Basic Materials, Aerospace, and Consumer Discretionary sectors.

In contrast, the Medical and Construction sectors have reported upward revisions to Q1 estimates since the quarter began.

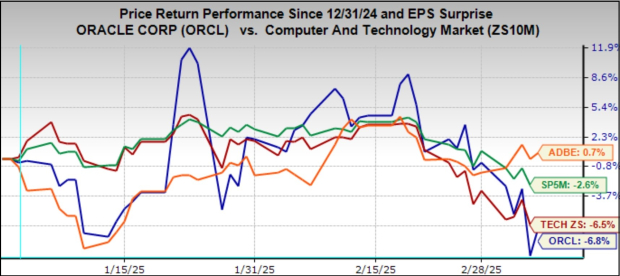

The Tech sector, which has experienced relatively stable estimates over the past year, is also facing downward adjustments to Q1 forecasts. Confidence surrounding the AI investment cycle was recently affected by China’s DeepSeek announcement. This shift in market sentiment has led to challenges for AI-focused stocks this year.

This trend is apparent in the performance of Oracle and Adobe, both of which are set to report this week. The chart below depicts the year-to-date performance of these stocks relative to the broader market (S&P 500 index) and the Zacks Tech sector.

Image Source: Zacks Investment Research

Outlook for Oracle and Adobe

Oracle is projected to report earnings of $1.48 per share on revenues of $14.36 billion, translating to a year-over-year growth of +5% in earnings and +8.1% in revenues. While estimates have remained stable over the past month, they are lower compared to two and three months ago. Oracle, having established itself as a significant player in AI, has seen some recent stock underperformance, though it remains a strong performer over a longer period.

In contrast, Adobe has fared better during the recent market downturn but has struggled overall over the past year. Adobe shares have decreased by -18.9% in comparison to Oracle’s +38.1% gain, the S&P 500’s +13.1% increase, and the Zacks Tech sector’s +11.1% rise. Following its last two quarterly releases, Adobe’s estimates have stabilized since the start of this quarter.

The technology sector’s evolving earnings expectations hold significant importance, as it has driven growth over the previous two years. Earnings for Q1 in this sector are anticipated to rise by +12.5% compared to last year, alongside a +10% increase in revenues, a shift from the sector’s substantial +26.3% growth in the previous quarter.

Image Source: Zacks Investment Research

Broader Earnings Landscape

The following chart provides an overview of the earnings outlook on a calendar-year basis, indicating expectations for double-digit earnings growth in 2025 and 2026.

Image Source: Zacks Investment Research

For a comprehensive analysis of the general earnings outlook, including future expectations, we invite you to examine our weekly Earnings Trends report.

Current Stock Insights from Zacks

Be among the first to explore our top 10 stock picks for 2025, personally curated by Zacks Director of Research Sheraz Mian. This portfolio has achieved remarkable success since its inception, gaining +2,112.6% from 2012 through November 2024, surpassing the S&P 500’s +475.6% return. Sheraz has carefully selected 10 companies from the Zacks Rank that are best suited for investment in 2025.

Discover the New Top 10 Stocks >>

Oracle Corporation (ORCL): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Adobe Inc. (ADBE): Free Stock Analysis Report

AutoZone, Inc. (AZO): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.