A-Mark Precious Metals Faces Challenges Amid Analyst Concerns

https://www.youtube.com/watch?v=kOf5Xocn8YE[/embed>

A-Mark Precious Metals (AMRK) operates as a full-service precious metals trading company that provides a wide range of products and services. Currently, analysts have adopted a bearish perspective on the company, resulting in a Zacks Rank #5 (Strong Sell) for its stock.

Image Source: Zacks Investment Research

Current Industry Status and Company Performance

A-Mark currently operates within the Zacks Precious Metals and Jewels industry, which unfortunately holds a position in the bottom 1% of all Zacks industries. Let’s delve deeper into the company’s performance metrics.

AMRK Falls Short of Expectations

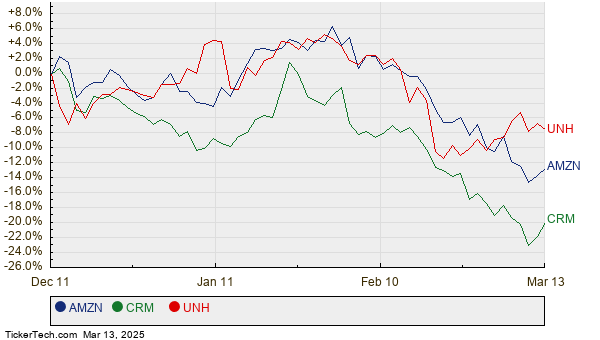

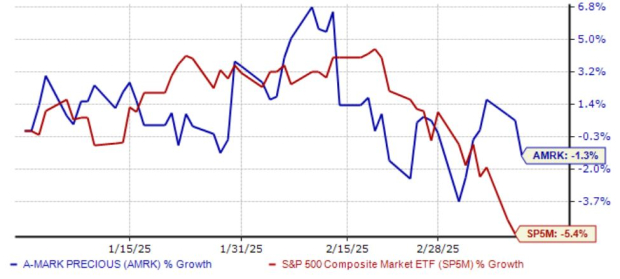

In 2025, AMRK shares have shown minimal movement, declining by about 1%, while still slightly outperforming the S&P 500. The company has consistently struggled to meet bottom-line expectations, missing consensus EPS estimates by an average of 42% over its last four earnings reports.

Image Source: Zacks Investment Research

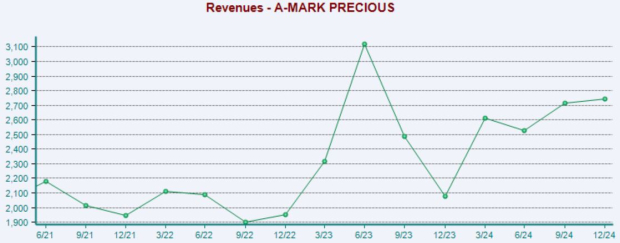

Market challenges and high precious metal prices have affected the company’s financial results. Notably, AMRK reported sales of $2.7 billion in its latest period, reflecting a robust 30% year-over-year growth.

Below is a chart demonstrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

AMRK boasts a notable annual yield of 2.9%, surpassing the S&P 500’s yield of 1.3%. The company maintains a consistent quarterly cash dividend of $0.20 per share. However, income-focused investors might be wiser to wait for improved earnings signals before diving in.

Bottom Line

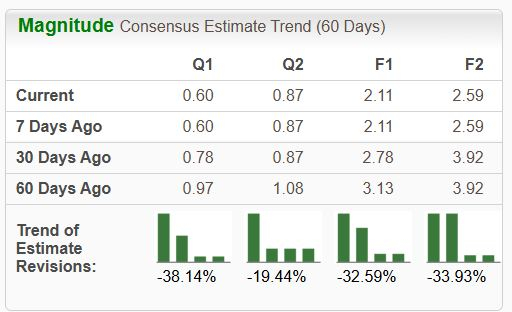

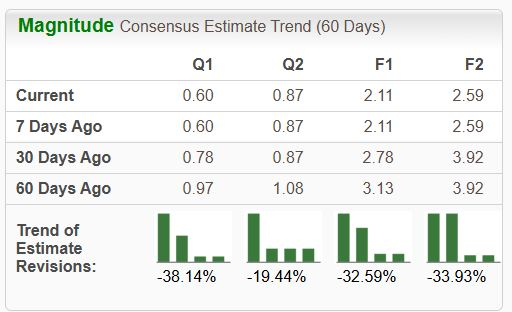

Negative revisions to analysts’ earnings estimates present a difficult outlook for A-Mark Precious Metals shares in the short term. The company holds a Zacks Rank #5 (Strong Sell), which suggests a consensus bearish sentiment regarding its earnings potential.

Investors seeking stronger opportunities should consider stocks with a Zacks Rank #1 (Strong Buy) or #2 (Buy). These options typically offer a markedly stronger earnings outlook and potential for significant gains in the near future.

Explore Promising Investment Options

Industry experts have recently identified 7 premier stocks from a list of 220 Zacks Rank #1 Strong Buys, highlighting these as “Most Likely for Early Price Pops.”

Historically, since 1988, the complete list has outperformed the market by more than double, achieving an average annual gain of +24.3%. Make sure to check out these carefully selected stocks for immediate investment consideration.

See them now >>

For the latest stock recommendations, download the report on the 7 Best Stocks for the Next 30 Days. Click for your free copy of the report.

A-Mark Precious Metals, Inc. (AMRK): Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.