Bill.com: A Strong Comeback with Growth Potential for Investors

Bill.com (NYSE: BILL), a software company focused on enhancing the financial processes of small and mid-sized businesses (SMBs), went public in December 2019 at a price of $22 per share. In less than two years, its value skyrocketed 1,418%, reaching a peak of $334. However, following a shift in economic conditions and interest rates, Bill.com is now focusing on sustainable growth and profitability after its stock price dropped significantly.

Adapting to New Market Realities

In the past, low interest rates allowed Bill.com to invest aggressively in expanding its operations, even at the cost of incurring losses. The financial landscape has changed dramatically, prompting the company to tighten its expenditures while maintaining growth.

Following the stock’s peak in 2021, Bill.com saw a decline, currently trading at 74% below its all-time high. Nevertheless, it has rebounded from a 52-week low of $43. With the recent release of its fiscal 2025 first-quarter results, the company achieved impressive revenue growth and profitability, providing a potential buying opportunity for investors looking to allocate an extra $500.

Comprehensive Solutions for Small Businesses

Small business owners juggle various responsibilities, including marketing, product development, bookkeeping, and operations. Bill.com’s software offers tools to streamline these processes, specifically focusing on accounts payable, accounts receivable, and expense management.

The company’s main product is a cloud-based digital inbox that organizes invoices, reducing paperwork headaches. Each invoice is routed for approval and can be settled with a single click. Additionally, thanks to its integration with popular accounting platforms, every transaction is automatically logged.

Bill.com also acquired Invoice2go, enabling businesses to create and send invoices effortlessly while tracking incoming payments. The company has introduced invoice financing, providing liquidity to businesses that experience delays in customer payments. In less than a year, over 200,000 loans have been funded through this service.

By the end of Q1, Bill.com reported a record high of 476,200 SMB customers, with acquisitions occurring both directly and through a network of over 8,500 accounting firms. These firms endorse Bill’s software to improve efficiency for their clients, resulting in a mutually beneficial relationship.

Since 2018, Bill.com has processed over $1 trillion in transaction volume, solidifying its position as one of the largest B2B payment platforms worldwide. Despite this, it represents just a small fraction of the $125 trillion in global payments processed by over 70 million SMBs, indicating substantial room for continued growth.

Image source: Getty Images.

Strong Financial Performance

During Q1, Bill.com achieved record revenue of $358.5 million, an 18% increase compared to the previous year and surpassing management’s guidance of $351 million. This growth rate marked an improvement from 16% in the previous quarter.

Management raised the full-year revenue forecast for fiscal 2025 to an estimated $1.451 billion, up from $1.432 billion, highlighting the company’s solid performance.

Remarkably, Bill.com also reduced its operating expenses by 1.3% during the quarter, attributed to lower administrative and research and development costs. While cost-cutting can slow revenue growth, this quarter’s results showcased a healthy demand for the company’s services.

With lower expenses combined with faster revenue growth, Bill.com generated $8.9 million in GAAP net income— a significant turnaround from a net loss of $27.8 million the prior year. This result is a positive indicator of profitability for investors. Additionally, on a non-GAAP basis, the company posted $68.6 million in net income, reflecting a 33.2% increase year-over-year.

Evaluating Bill.com’s Stock Valuation

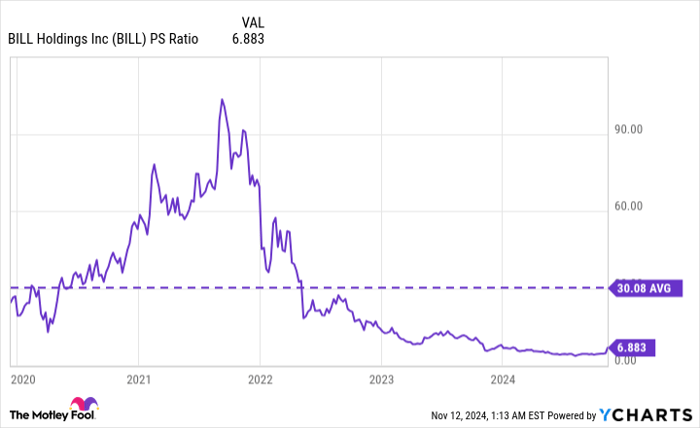

Despite its stock almost doubling from a low of $43, Bill.com may still be undervalued. The stock currently trades at a price-to-sales (P/S) ratio of 6.8, close to its lowest point since the initial public offering in 2019. This represents a significant 77% discount from its five-year average P/S ratio of 30.1.

BILL PS Ratio data by YCharts

While the average P/S ratio included a period of overvaluation in 2021, the current valuation seems reasonable given the company’s recent revenue acceleration and upward revision of its fiscal forecast. Bill.com’s vast market potential, along with the possibility of lower interest rates stimulating growth among SMBs, creates an opportune scenario for future earnings. Investors willing to hold for five to ten years may find this an attractive time to consider buying shares.

Is Bill Holdings a Smart Investment?

Before making any investment decisions regarding Bill Holdings, it’s worth noting that the Motley Fool Stock Advisor team has named other stocks as the top 10 best buys at the moment, excluding Bill Holdings. These selected stocks have considerable potential for outstanding returns in the coming years.

For example, if you had invested $1,000 in Nvidia on April 15, 2005, at the time of its recommendation, your investment would now be worth $870,068!*

Stock Advisor provides investors with actionable insights and strategies for portfolio-building, offering regular updates and two new stock picks each month. The service has outperformed the S&P 500 since 2002, delivering over four times the returns.

See the 10 stocks »

*Stock Advisor returns as of November 11, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool recommends Bill Holdings and has positions in it. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.