abrdn National Municipal Income Fund recently announced the declaration of a regular monthly dividend of $0.04 per share ($0.45 annualized) by its board of directors. This decision marks a consistent payout, with the company previously paying the same amount per share. The ex-div date for shareholders to qualify for the dividend is February 21, 2024, with those recorded as shareholders of the company as of February 22, 2024, set to receive the payment on February 29, 2024.

The current dividend yield stands at 4.41%, considering the current share price of $10.20 per share. Looking back over the past five years, the dividend yield has averaged 4.50%, with a low of 3.66% and a high of 6.14%. Analyzing these figures further, the standard deviation of yields is 0.70, based on a sample size of 192 dividends. Notably, the current dividend yield is 0.12 standard deviations below the historical average. Additionally, the company’s 3-year dividend growth rate stands at -0.13%.

The Fund Sentiment

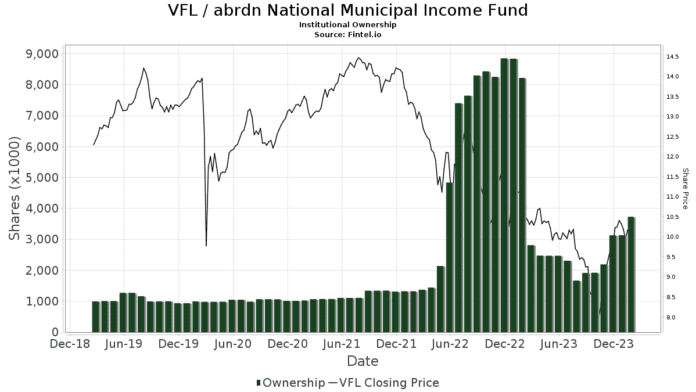

A total of 64 funds or institutions have reported positions in the abrdn National Municipal Income Fund. This marks an increase of 9 owners, reflecting a substantial 16.36% growth in the last quarter. Notably, the average portfolio weight dedicated to VFL across all funds stands at 0.14%, signifying a sharp increase of 35.66%. Furthermore, the total shares owned by institutions have surged by 36.44% in the last three months, reaching 3,729K shares.

Examining specific shareholders, Mackay Shields presently holds 402K shares, with no change reported in the last quarter. Hennion & Walsh Asset Management holds 250K shares, reflecting a notable increase compared to its prior filing, with a 37.19% rise in shareholding. The firm also boosted its portfolio allocation in VFL by an impressive 69.15% over the last quarter. Similarly, Logan Stone Capital now holds 234K shares, indicating a substantial 63.78% increase from its prior filing, with its portfolio allocation in VFL witnessing a staggering 142.02% surge over the last quarter. Saba Capital Management holds 230K shares, reporting a 26.34% increase from its prior filing and a 34.92% rise in portfolio allocation in VFL over the last quarter. Lastly, Rivernorth Capital Management retains 187K shares, with no change reported in the last quarter.

Background Information on abrdn National Municipal Income Fund

The Fund aims to provide current income exempt from regular federal income tax, while ensuring the preservation of capital.

Additional reading:

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds. The database includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, the platform’s exclusive stock picks are powered by advanced, back-tested quantitative models that aid in enhancing profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.