Source: Aerospace Trek / Shutterstock.com

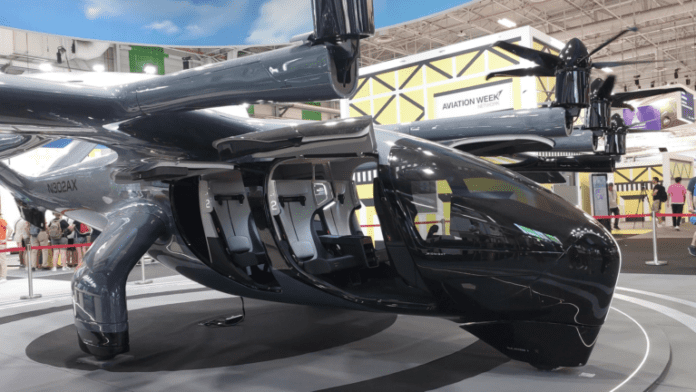

Air mobility specialist Archer Aviation (NYSE:ACHR) — a visionary in electric vertical takeoff and landing (eVTOL) aircraft — experienced a setback in share value amidst upside news. The company announced the successful completion of a battery pack drop test series, a significant achievement for investor reassurance. However, ACHR stock contends with revolving questions concerning authenticity.

The recent unveiling by Archer regarding the meticulous battery pack release examinations, held at a National Institute for Aviation Research laboratory, marks an important stride for ACHR stock. The tests are deemed formidable challenges for eVTOL aircraft.

Detailed over a week, Archer’s engineering and certification teams facilitated the extensive testing of the company’s exclusive battery packs. Tasks included dropping the battery at a height of 50 feet, simulating high-impact scenarios and testing various charge levels: 0%, 30%, and 100%.

As reported by the company, “the battery packs endured the impact without failure signs and astonishingly, remained functional.”

The crux of the drop tests lies in Federal Aviation Administration (FAA) certification. For an eVTOL to earn this label, it must meet stringent benchmarks, with battery trials at its core.

Archer’s battery lead, Alex Clarabut, emphasized, “Passing the battery pack drop tests successfully ushers in a key chapter for credit certification evaluations with the FAA.” He further expressed gratification that the batteries excelled post-test.

Nevertheless, ACHR stock faces skepticism. Recent statements about entering the final phase of type certification for its Midnight eVTOL stirred industry curiosity as the aircraft had not yet transitioned to wing-borne flight, with no piloting history.

Subsequently, clarification was given, defining the final phase of certification as the FAA’s “implementation phase” predating type certificate issuance. This development, however, left ACHR stock investors unsettled.

Well-known CNBC personality Jim Cramer’s recent comments reflect this sentiment, noting reluctance towards Archer due to its lack of earnings dominance amidst a plethora of other lucrative stocks.

Significance of Archer Aviation’s Milestone

Despite lingering uncertainties, ACHR stock retains unanimous strong buy recommendations from industry analysts. The average price target of $10.33 suggests a potential 120% increase from the current value. The upper-end prediction points to $12 per share.

Josh Enomoto, a former senior business analyst for Sony Electronics, is not involved in the securities mentioned but shares exclusive insights based on InvestorPlace.com‘s stipulations.