Adobe (ADBE) experienced a sharp decline of 19.8% in its stock value following the announcement of its fourth-quarter fiscal 2024 results on November 11. Although the company’s earnings and revenues surpassed expectations and showed improvement compared to the prior year, a disappointing forecast for fiscal 2025 led to the sell-off.

Adobe’s challenges for 2025 stem from escalating competition in the Generative AI (GenAI) sector, particularly from Microsoft (MSFT)-backed OpenAI, along with issues related to monetizing its AI solutions.

For fiscal 2025, Adobe projects total revenues to be between $23.30 billion and $23.55 billion, up from $21.51 billion in fiscal 2024. However, foreign exchange impacts and the ongoing shift from perpetual to subscription-based offerings are expected to reduce revenues by about $200 million.

The company anticipates non-GAAP earnings for fiscal 2025 to fall between $20.20 and $20.50, compared to $18.42 per share in fiscal 2024.

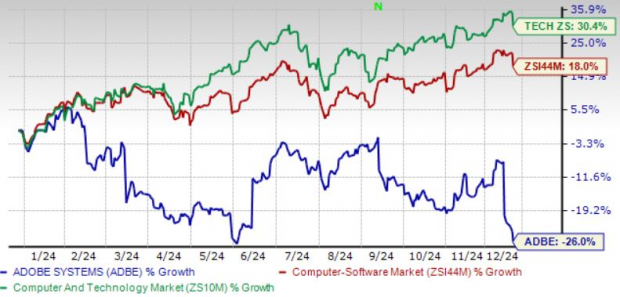

So far this year, Adobe’s stock has dropped 26%, significantly lagging behind the broader Zacks Computer and Technology sector which has returned 30.4%, as well as the Zacks Computer Software industry, which has seen an 18% rise.

Adobe’s Stock Lags Behind Peers in 2023

Image Source: Zacks Investment Research

Fiscal 2025 Earnings Estimates Fall

Current projections for fiscal 2025 from the Zacks Consensus indicate expected earnings of $20.38 per share, representing a decline of 0.8% over the past month. This figure suggests growth of 10.64% compared to fiscal 2024 earnings.

Notably, Adobe has exceeded earnings expectations reported by the Zacks Consensus in the last four quarters, with an average surprise of 2.55%.

Price and Consensus for Adobe Inc.

Adobe Inc. price-consensus-chart | Adobe Inc. Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

The Zacks Consensus Estimate for fiscal 2025 revenue stands at $23.45 billion, signaling a projected growth of 9.04% from fiscal 2024 revenues.

Adobe Stock Valuation Concerns

Currently, Adobe’s stock does not appear to be priced favorably, as indicated by its Value Score of D, which suggests a stretched valuation.

With a forward 12-month price-to-sales ratio of 8.20X, Adobe’s valuation is higher than the sector average of 6.35X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

Potential for Recovery with New Innovations

Despite its current challenges, Adobe’s strong lineup of creative products may support its recovery. Offerings like Creative Cloud, Document Cloud, and Adobe Experience Cloud have been key drivers of revenue growth.

Adobe has made significant enhancements in GenAI, launching Firefly Image Model 3 and other improvements, which boost its tools like Lightroom and Photoshop. The cumulative number of Firefly generations has now exceeded 16 billion.

Moreover, Adobe Express has seen substantial adoption, with an 84% year-over-year increase in student users. New integrations with popular apps such as ChatGPT, Google, Slack, and others have expanded its customer base.

Adobe’s Document Cloud AI Assistant has launched across multiple platforms, further enhancing its service offerings. The company is also seeing strong adoption of its platform tailored for content supply chains through Adobe GenStudio.

Partnerships with key players like Amazon (AMZN) and collaboration with tech giants like Google and Meta Platforms are pivotal for Adobe’s growth trajectory.

Expanding Client Base Fuels Growth

Adobe continues to expand its clientele in both Creative Cloud and Document Cloud sectors. Major new clients include Alphabet, American Express, Coca-Cola, and many more from diverse industries.

Investing Considerations for ADBE After Q4

For long-term investors, Adobe’s focus on GenAI and its ongoing innovation present an intriguing opportunity. However, rising competition, particularly from OpenAI, remains a concern, especially with OpenAI’s offerings reaching users sooner.

The stock’s current valuation also raises red flags. Presently, ADBE holds a Zacks Rank of #3 (Hold), suggesting that potential investors might want to wait for a more favorable entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Identifies Top 10 Stocks for 2025

Looking for some investment ideas? Zacks predicts significant opportunities with 10 top stock picks for 2025.

Historically, these recommendations have shown strong potential, gaining +2,112.6% from 2012 to November 2024, significantly outperforming the S&P 500’s +475.6%. Keep an eye out for Zacks’ selections when they are released on January 2.

Want to stay updated with Zacks Investment Research’s latest recommendations? Today, you can download 5 Stocks Set to Double, a free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Adobe Inc. (ADBE): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.