Adobe Shares Struggle Amid Increased Competition in AI

ADBE’s Performance Against Industry Trends

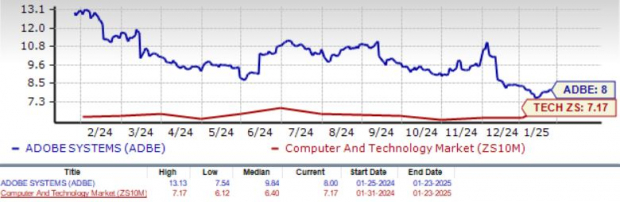

Adobe (ADBE) shares have dropped 29.8% over the past year, lagging behind the Zacks Computer and Technology sector’s gain of 28.5% and the Zacks Computer Software industry’s increase of 14.2%.

In fiscal 2025, Adobe faces challenges from heightened competition in the Generative AI (GenAI) sector, particularly from Microsoft (MSFT)-backed OpenAI. Additionally, the company struggles with effectively monetizing its AI solutions.

Looking ahead to fiscal 2025, the company anticipates that Digital Media Annual Recurring Revenue will grow approximately 11%. The revenue forecast for the Digital Media segment is estimated to be between $17.25 billion and $17.40 billion, indicating a 9% increase at the mid-point compared to fiscal 2024. However, this guidance reflects limited pricing benefits and a shift in focus toward user engagement rather than immediate monetization.

Overall, Adobe expects total revenues to fall between $23.30 billion and $23.55 billion, compared to $21.51 billion in fiscal 2024. A $200 million revenue hit is expected from unfavorable foreign exchange impacts and the ongoing transition from perpetual licenses to subscriptions.

Performance Overview of ADBE Stock

Image Source: Zacks Investment Research

For fiscal 2025, Adobe expects its non-GAAP earnings to range between $20.20 and $20.50, up from $18.42 per share in fiscal 2024.

Revised Earnings Estimates Point Downward

The Zacks Consensus Estimate for fiscal 2025 earnings has dipped 0.7% in the past 60 days, now standing at $20.39 per share. This represents a growth of 10.69% from the earnings reported in fiscal 2024.

Over the last four quarters, ADBE has exceeded the Zacks Consensus Estimate with an average surprise of 2.55%.

Adobe Inc. Price and Consensus

Adobe Inc. price-consensus-chart | Adobe Inc. Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

The Zacks Consensus Estimate for fiscal 2025 revenues has been set at $23.45 billion, suggesting a growth of 9.04% compared to fiscal 2024.

Valuation Concerns for ADBE Stock

Currently, Adobe’s stock appears to be overvalued, with a Value Score of D indicating that it is trading at a higher price/sales ratio than the sector average. ADBE is trading at 8X forward 12-month price/sales, compared to the sector’s 7.17X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

Growth Through a Robust Product Portfolio

Despite challenges, Adobe’s solid portfolio can boost its growth. The company’s Creative Cloud, Document Cloud, and Adobe Experience Cloud products contribute significantly to revenue growth.

Recent AI innovations, such as Express, Acrobat AI Assistant, Firefly Services, and GenStudio, have broadened Adobe’s offerings and are expected to enhance market share and monetization potential.

Adobe has made strides in its GenAI portfolio with the introduction of Firefly Image Model 3 and advancements in video models, which are integrated into tools like Lightroom and Photoshop, benefiting creative professionals worldwide. With over 16 billion Firefly generations recorded, the impact is substantial.

The rising adoption of Adobe Express by businesses is also noteworthy, particularly as it integrates with popular applications like ChatGPT and Google’s services, extending its market reach.

The Document Cloud AI Assistant is now available across various platforms, including desktop, web, and mobile, while Adobe GenStudio continues to gain traction among enterprises.

Furthermore, Adobe’s partnership with Amazon (AMZN) allows its Experience Platform to be accessible via Amazon Web Services, which, along with collaborations with major companies, serves as a significant growth driver.

Attracting New Enterprise Clients

Adobe has successfully acquired new clients in both its Creative Cloud and Document Cloud segments. Noteworthy clients include Alphabet, American Express, Coca-Cola, Johnson & Johnson, LVMH, Procter & Gamble, T-Mobile, and the U.S. Department of Defense for the Creative Cloud in the last fiscal quarter.

Similarly, for the Document Cloud, major additions include Abbott Laboratories, BWI GmbH, and Kaiser Permanente among others.

What’s Next for Adobe Stock?

With its increasing focus on GenAI and a robust product suite, Adobe continues to present long-term growth opportunities for investors. However, the intensifying competition from OpenAI raises concerns. While Adobe plans to roll out its video model in early 2025, OpenAI’s Sora is already available to ChatGPT subscribers, emphasizing the need for Adobe to strengthen its monetization strategies.

The stretched valuation may deter value-oriented investors, with ADBE currently holding a Zacks Rank #3 (Hold), suggesting a more favorable time may be needed before accumulating shares.

Zacks Highlights Cutting-Edge Semiconductor Stock

This new top semiconductor stock, only a fraction of NVIDIA’s size, shows tremendous potential for growth, benefitting from a booming demand in Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is forecasted to grow from $452 billion in 2021 to $803 billion by 2028.

Stay updated with the latest stock recommendations from Zacks Investment Research. Today, you can download the “7 Best Stocks for the Next 30 Days” report for free.

For further analysis, check out: Amazon.com, Inc. (AMZN), Microsoft Corporation (MSFT), Adobe Inc. (ADBE), Alphabet Inc. (GOOGL).

To see the full article, visit Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.