AECOM ACM has won a design and engineering services deal from the Regional Municipality of Peel (Peel Region).

ACM will be responsible for the design and implementation of the expansion of the Clarkson Water Resource Recovery Facility (WRRF) in Ontario’s Peel Region to accommodate the growing population within the Greater Toronto Area.

AECOM has already served as the original designer of the Clarkson WRRF Phase I and II expansions. This will be the third major expansion and the next stage to bring its capacity to 500 MLD by 2029.

Phase III will also include a new standby power energy center, which will protect the critical infrastructure of the plant and help maintain treatment during power outages. Moreover, its innovative solutions will support state-of-the-art treatment, including enhanced biological phosphorus removal to reduce chemical use and measures to reduce greenhouse gas emissions and improve energy efficiency. These initiatives will support Peel Region to achieve net-zero greenhouse gas emissions at their WRRFs by 2050.

Currently, AECOM is working on the Clarkson Cogeneration Expansion and multiple projects supporting drinking water treatment at the Arthur P. Kennedy and Lorne Park water treatment plants in the Peel Region. The Clarkson Cogeneration Expansion project utilizes waste methane produced in the treatment process to create green electricity.

Backlog Growth Signals Positive Outlook

AECOM has been witnessing robust prospects in each of its segments. Currently, it has a good visibility of a strong backlog and pipelines for the upcoming quarters. Owing to the improving global scenario, which is fostering infrastructural demand around the globe, there has been an increase in demand for ACM’s services. This improving trend is reflected in the company’s backlog levels.

As of the fiscal second-quarter end, the total backlog was $23.74 billion compared with $22.98 billion reported in the prior-year period. The current backlog level includes 54.8% contracted backlog growth. The design business backlog grew 6.3% to $22.29 billion. The metric was driven by a near-record win rate and continued strong end-market trends.

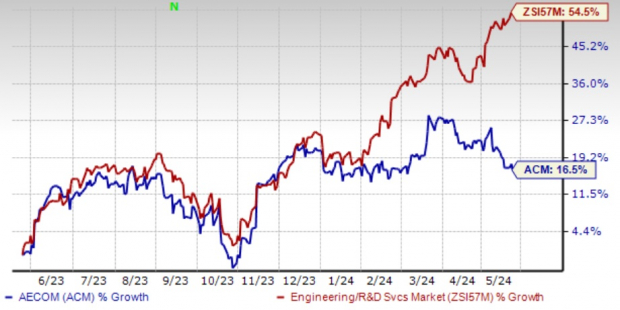

Image Source: Zacks Investment Research

Shares of this Zacks Rank #3 (Hold) company gained 16.5% in the past year compared with the Zacks Engineering – R and D Services industry’s 54.5% growth. Although shares of the company have underperformed its industry, the ongoing contract wins are likely to boost its prospects in the forthcoming quarters.

Key Picks

Some better-ranked stocks in the same space are:

Howmet Aerospace Inc. HWM presently carries a Zacks Rank #2 (Buy). HWM has a trailing four-quarter earnings surprise of 8.5%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for HWM’s 2024 sales and earnings per share (EPS) indicates a rise of 10.6% and 29.9%, respectively, from the prior-year levels.

Sterling Infrastructure, Inc. STRL presently carries a Zacks Rank #2. Sterling Infrastructure has a trailing four-quarter earnings surprise of 22.3%, on average.

The Zacks Consensus Estimate for STRL’s 2024 sales and EPS indicates a rise of 11.7% and 14.8%, respectively, from the prior-year levels.

Gates Industrial Corporation plc GTES presently carries a Zacks Rank #2. GTES has a trailing four-quarter earnings surprise of 14.9%, on average.

The Zacks Consensus Estimate for GTES’ 2024 sales indicates a 0.2% decline but EPS growth of 2.9% from the prior-year levels.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

AECOM (ACM) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Gates Industrial Corporation PLC (GTES) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.