AECOM ACM has clinched a lucrative contract from the Los Angeles County Metropolitan Transportation Authority (Metro) to deliver robust program management, design, and engineering services to bolster the region’s transition to a Zero Emission Bus (ZEB) fleet.

Steering its course through the challenging terrains of sustainable transportation, AECOM will play a pivotal role in aiding Metro’s ambitious endeavor by focusing on critical aspects such as charging infrastructure conceptualization, design, specification, and procurement. Through its expert guidance, the transition to zero-emission operations is set to navigate smoothly, offering ingenious solutions to the intricate web of transportation dilemmas.

The sustainable and adept transit vision aims at curbing greenhouse gas emissions while augmenting air quality for the denizens of Los Angeles County. A remarkable feat in itself, this initiative stands as one of the most extensive electric bus programs in the United States, bolstered by the framework of the Infrastructure Investment and Jobs Act.

Stock Performance Reflections

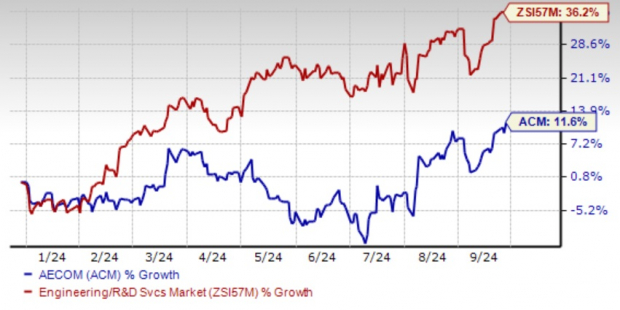

The trajectory of AECOM’s shares this year has been nothing short of commendable, with a 11.6% surge, encapsulating nearly a third of the robust 36.2% growth witnessed within the Zacks Engineering – R and D Services industry.

Image Source: Zacks Investment Research

The silver lining comes with a touch of gray, as this Zacks Rank #4 (Sell) entity has grappled with labor shortages, specifically in skilled trades. Inflationary ripples, particularly concerning raw materials and energy, might be casting shadows on margins. Furthermore, the broad economic realm, entwined with apprehensions of a looming recession or a global economic deceleration, could be casting its shadow on the construction and infrastructure landscape. The frugality of investors in the face of long-term infrastructure expenditure, especially if government funding slackens, may be a cause for prudent contemplation.

Strong Backlog & Global Demand Generate Optimism

Evading the turbulence posed by the aforementioned challenges, AECOM has been witnessing robust growth across all corridors, underpinned by a visible pipeline for the approaching quarters. The buoyant state and local financial frameworks, coupled with elevated private sector investments in water and energy transitions, have contributed to this upward mobility.

Moreover, the United Kingdom’s water sector is poised for an accelerated surge over the upcoming five years, fueled by a near twofold amplification in AMP8 funding. AECOM’s profound proficiency with major water utilities positions it advantageously to leverage this upcoming growth spurt.

The amplified global hunger for infrastructure advancement further amplifies the call for AECOM’s services. As of the closure of the fiscal third quarter, the cumulative backlog tallied at $23.36 billion, eclipsing the $23.21 billion recorded in the equivalent period the preceding year. This current backlog encapsulates a remarkable 54.8% growth in contracted backlog.

Anticipations are rife that ongoing contract victories will fuel future prospects. The landscape of global infrastructure expenditure remains resilient, unfurling opportunities for AECOM to nurture its expansion sustainably.

Spotlight on Key Picks

Among the shining stars in the realm, some notable entities are:

Sterling Infrastructure, Inc. STRL, currently adorning a Zacks Rank #1 (Strong Buy) badge. Sterling Infrastructure beams with a trailing four-quarter earnings delight of 17.4%, on average.

Projections paint a promising picture for STRL, with the Zacks Consensus Estimate pointing towards a 9.7% escalation in 2024 sales and a substantial 26.6% surge in earnings per share, from the levels witnessed in the preceding year.

Howmet Aerospace Inc. HWM, currently donning a Zacks Rank #2 (Buy) mantle. HWM revels in a trailing four-quarter earnings surprise averaging 10.9%.

Forecasts are upbeat for HWM, with estimations signaling a 12.6% elevation in 2024 sales and a towering 40.8% surge in earnings per share compared to the antecedent year levels.

M-tron Industries, Inc. MPTI, currently enshrined with a Zacks Rank #2, has tantalized investors by topping earnings estimates in three of the preceding four quarters, with a pleasant average surprise of 9.2%.

For MPTI, the Zacks Consensus Estimate portends a 16.1% uptick in 2024 sales and a remarkable 76.6% surge in earnings per share concerning the levels of the previous year.

To read this article on Zacks.com click here.

Market News and Data brought to you by Benzinga APIs