Nvidia’s Remarkable Growth: A Game-Changer in AI Stock Performance

In 2024, many AI stocks surged, with some doubling, tripling, or even quadrupling in value. However, one stock stands out for exceeding analyst expectations consistently. Nvidia could hold surprises for investors in 2025.

Nvidia: The Champion of Exceeding Expectations

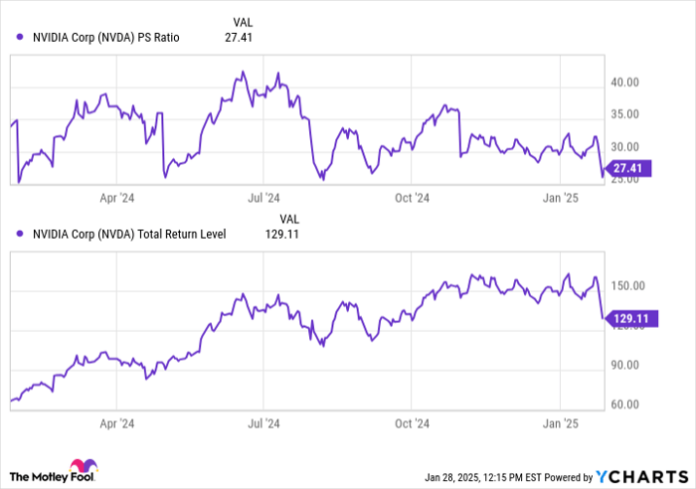

If you’re following the artificial intelligence (AI) landscape, Nvidia (NASDAQ: NVDA) is likely a familiar name. The company has consistently outperformed analyst projections. Despite its multitrillion-dollar market cap and the scrutiny of over 50 analysts, Nvidia has surpassed consensus earnings estimates in the last four quarters. Its stock price has skyrocketed by more than 100% in the past year, even as its price-to-sales ratio has remained stable. Clearly, Nvidia has mastered the art of exceeding expectations.

Where should you invest $1,000 now? Our analyst team has identified the 10 best stocks to buy at this moment. Check out the 10 stocks »

NVDA PS Ratio data by YCharts.

A significant highlight for Nvidia in 2024 was the introduction of its next-generation Blackwell chips, named after mathematician David Blackwell, known for his contributions to statistics, game theory, and advancements in machine learning.

The new chips are about 25 times faster than their predecessors, with a focus on efficiency. Nvidia claims these Blackwell chips will be water-cooled, promising “25 times less cost and energy consumption” than the earlier models. This is crucial for scalability, especially since previous chips like the H100 relied on less efficient cooling methods.

As the AI sector develops, the energy demands of applications, GPUs, and data centers are becoming increasingly significant. Surprisingly, the biggest hurdle for AI isn’t the technology but rather the infrastructure required to support it. Many leading tech firms, who are significant users of AI, are also committed to transitioning to renewable energy sources.

Nvidia is on the verge of shipping Blackwell chips shortly. However, another potential game-changer for 2025 is capturing attention.

Nvidia’s Strong Demand in Emerging Markets

Amid the rising excitement for AI, another transformative technology, self-driving cars, is approaching a critical turning point.

The slow adoption of autonomous vehicles primarily arises from the vast amounts of data and sensors they require to make quick decisions and achieve safety standards trusted by regulators and consumers. Nvidia is at the forefront of this technology with its DRIVE Platform, capable of supporting level 5 autonomous driving without human intervention.

The future of self-driving cars hinges on the computational infrastructure provided by chipmakers. Nvidia holds a commanding lead in AI GPU markets, with its market share ranging between 70% and 95%. Predictions show the autonomous driving sector could generate $300 billion to $400 billion in revenue within the next year. Nvidia is poised to be pivotal in driving this market’s expansion.

Will 2025 be the year of mainstream autonomous driving? Companies like Amazon and Tesla are competing to make this future a reality. If they succeed, Nvidia could see revenue and profits that analysts have yet to fully incorporate into their estimates. Notably, Nvidia’s growth stems from its unique end markets—inclusive of AI and self-driving vehicles—that continue to surprise with their rapid development.

The recent launch of DeepSeek, an open-source alternative to OpenAI’s ChatGPT, has gained swift global traction. This further illustrates how Nvidia’s market segments are set to exceed growth expectations. With several high-potential markets expanding together, advanced GPUs will be essential, suggesting that Nvidia will keep delivering impressive results in upcoming quarters.

Is It Worth It to Invest $1,000 in Nvidia Today?

Before purchasing Nvidia stock, consider the following:

The Motley Fool Stock Advisor analyst team recently highlighted their idea of the 10 best stocks for investors right now, and surprisingly, Nvidia was not among them. The chosen stocks may yield significant returns in the future.

Reflect on this: when Nvidia made the list on April 15, 2005… an investment of $1,000 would have grown to $725,740!*

Stock Advisor offers an easy pathway to investment success, featuring guidance for building a portfolio, frequent analyst updates, and two new stock recommendations each month. This service has achieved returns that exceed the S&P 500 by more than four times since its inception in 2002*.

Discover more »

*Stock Advisor returns as of January 27, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board. Ryan Vanzo holds no positions in any mentioned stocks. The Motley Fool has positions in and recommends Amazon, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of Nasdaq, Inc.