Nvidia Takes Center Stage in Dow Jones, Intel Faces Challenges

Merging Technology and Market Dynamics

Nvidia Corp NVDA continued its impressive momentum on Monday as it prepares to replace Intel Corp INTC in the Dow Jones Industrial Average. The embattled chipmaker Intel is witnessing a decline in its stock price.

S&P Dow Jones Indices announced on Friday that both Nvidia and Sherwin-Williams Co SHW will be added to the index next week.

After a substantial 25-year presence in the Dow, Intel will make way for Nvidia, while Sherwin-Williams will replace Dow Inc DOW.

Also Read: Intel Strengthens Ties with China, Invests $300 Million to Expand Chip Operations

This change highlights the shifting landscape in chip manufacturing and indicates ongoing difficulties for Intel.

It is noteworthy that the Dow’s 30 companies are ranked by share price, not market capitalization.

Nvidia positioned itself strategically for this inclusion by announcing a 10-for-1 stock split in May. This move reduced its share price without impacting its market cap, enabling it to join the index without disturbing its balance, as reported by CNBC.

The company’s revenue has soared, doubling over the last five quarters and tripling in three, primarily due to high demand for its next-generation Blackwell AI GPU.

Major tech firms such as Microsoft Corp MSFT, Meta Platforms Inc META, Alphabet Inc GOOG GOOGL Google, and Amazon.Com Inc AMZN are investing in Nvidia’s GPUs like the H100 to propel their AI initiatives.

Beth Kindig from I/O Fund predicts that Blackwell chips could help Nvidia achieve a $10 trillion market valuation by next year.

On the other hand, Intel is facing serious hurdles. Once a leader in PC chip production, Intel has struggled against Advanced Micro Devices Inc AMD and has lagged in the AI space.

Recently, Intel’s board approved a plan to save costs that includes cutting its workforce by 16,500 jobs and downsizing its real estate, a strategy first disclosed in August.

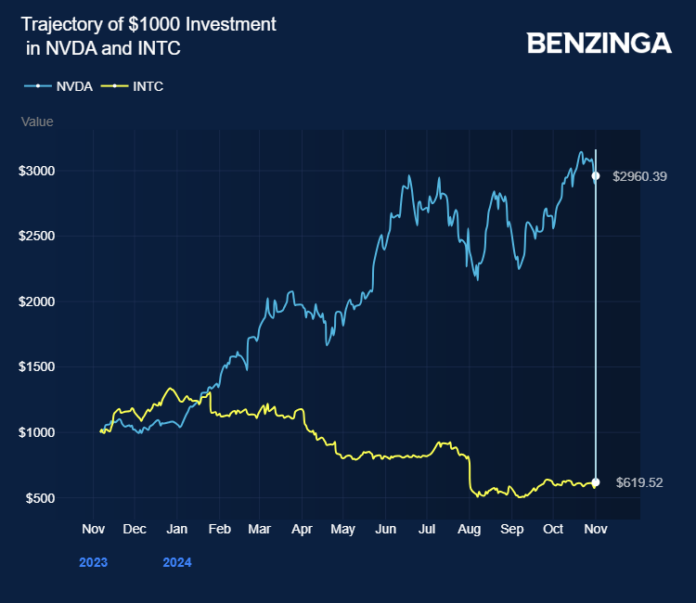

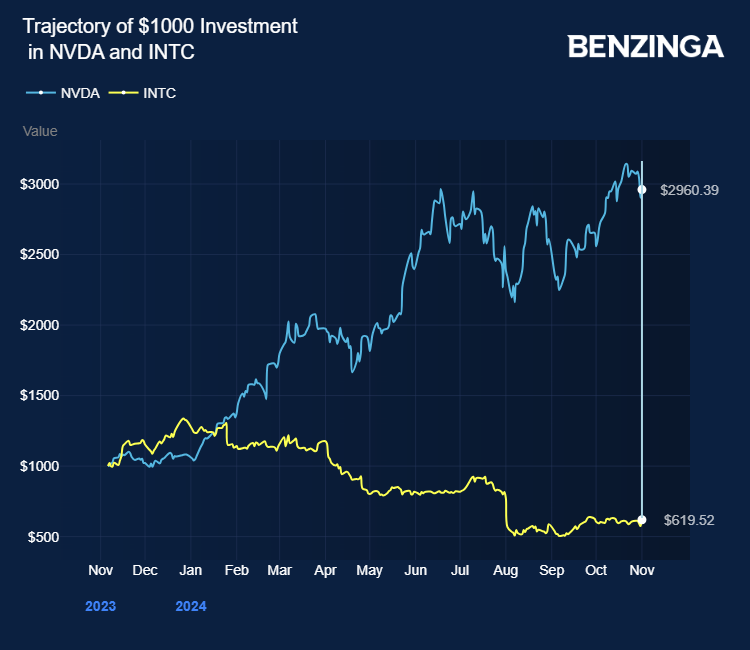

As of now, Intel’s stock has dropped 52% year-to-date, while Nvidia has seen a remarkable increase of over 181%.

Price Actions: As of Monday morning, NVDA stock rose by 1.92% to $138.01 in premarket trading, whereas INTC fell by 1.38%.

Also Read:

Image via Shutterstock

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs