Executives making significant moves within big corporations often catch the eye of investors. When it’s someone at Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), the stakes seem higher. Last Monday, Ajit Jain, Berkshire’s Vice Chairman, offloaded $139 million worth of Berkshire stock, constituting more than half of his total stake in the company.

Ajit Jain’s Remarkable 38-Year Journey

A 38-year veteran, Jain has been at the helm of Berkshire’s vital insurance operations since 1986. Warren Buffett himself lauded Jain as surpassing his own importance to the conglomerate. Jain’s impact is profound as insurance fuels Berkshire’s core activities and generates investment capital. In the insurance arena, Jain’s value creation for Berkshire shareholders is estimated in the tens of billions. The 2016 annual shareholder letter by Buffett underscored Jain’s pivotal role, stating, “If there were ever to be another Ajit and you could swap me for him, don’t hesitate. Make the trade!”

Possible Retirement on the Horizon for Jain

At 73, Jain might be contemplating retirement. Managing a global insurance giant with an annual float of $169 billion is demanding. Berkshire, with its solid insurance team bolstered by strategic acquisitions, is well-positioned for a seamless transition. Recent acquisitions such as Alleghany Insurance and a significant stake in Chubb (NYSE: CB) could further fortify Berkshire’s insurance arm.

Image source: The Motley Fool.

Factors Influencing Jain’s Decision Making

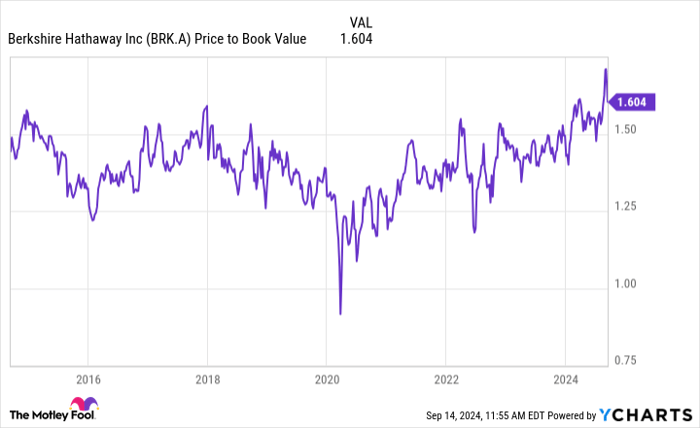

Besides retirement plans, the current evaluation boom and impending tax adjustments could have nudged Jain towards divestment. Berkshire recently entered the trillion-dollar market cap realm for the first time, buoyed by expanded margins. With a price-to-book ratio hitting a decade-long high, Berkshire’s valuation stands at 1.6 times, a significant peak for an insurance-centered company.

BRK.A Price to Book Value data by YCharts

Concerns about future tax policies resonated with Buffett, who hinted at tax implications during Berkshire’s annual meeting. The reduction of the corporate tax rate from 35% to 21% under the 2017 Tax Cuts and Jobs Act may face revisions post-2025. Proposed increases in the top capital gains rate, now at 20%, could potentially impact individuals like Jain significantly.

Forecasting the Road Ahead for Berkshire Investors

While Jain’s actions warrant attention, Berkshire investors need not panic. The confluence of personal considerations, lofty valuations, and anticipated tax revisions likely spurred Jain’s stock sale. For long-term Berkshire backers, faith in the successors, including Greg Abel, remains pivotal. Comparatively, those eyeing near-future disinvestments could take cues from Jain’s strategic move.

Contemplating Investment in Berkshire Hathaway

Before delving into Berkshire Hathaway shares, weigh this insight: The analysts at Motley Fool Stock Advisor highlighted their top ten stock picks, excluding Berkshire Hathaway. As history shows, strategic investments like Nvidia made a difference with substantial returns for early backers. The service has remarkably outpaced S&P 500 returns since 2002.

*Stock Advisor returns as of September 9, 2024