Astera Labs ALAB shares have surged 122% since their IPO, vastly outpacing the broader Zacks Computer & Technology sector’s return of 20.7% and the Zacks Electronics – Semiconductors industry’s growth of 45.8%.

The remarkable performance of Astera Labs is largely due to the rising demand for AI servers and data center resources.

ALAB’s revenue growth is fueled by the expanding demand across various product lines, particularly AI platforms that utilize both third-party GPUs and the company’s in-house AI accelerators.

Astera Labs Shines Bright in Technology Markets

Image Source: Zacks Investment Research

ALAB’s Strategic Advantages in AI and Connectivity

Astera Labs is experiencing strong demand for its AI products, leading to significant successes with offerings like Aries Retimers, Taurus Smart Cable Modules, and Scorpio Fabric Switches.

Astera Labs, Inc. Price and Consensus

Astera Labs, Inc. price-consensus-chart | Astera Labs, Inc. Quote

Recently, ALAB rolled out its Scorpio Smart Fabric Switches, designed for large-scale AI infrastructure, featuring P-Series for PCIe Gen 6 connectivity and X-Series for GPU clustering. Scorpio is anticipated to significantly expand Astera Labs’ addressable market, which is expected to surpass $12 billion by 2028.

The company’s Aries product line also highlights growth potential, especially with the rising demand for high-performance connectivity solutions that support enhanced AI system capabilities.

Astera Labs’ growing product range helps it compete effectively against formidable players like Broadcom AVGO, which has seen its shares rise 80.6% since its IPO.

Astera Labs Collaborates with Leading Chipmakers

Astera Labs has become influential in the AI landscape through partnerships with major chipmakers, including NVIDIA NVDA, Advanced Micro Devices AMD, Micron Technology, and Intel.

Astera Labs products feature in NVIDIA’s GB200 line, and their PCIe switches are expected to be key in future NVIDIA technologies, underscoring Astera’s role in driving advanced AI solutions.

Likewise, AMD utilizes Astera Labs solutions to boost the performance and scalability of its AI products, enhancing both companies’ positions in this growing market.

Positive Earnings Prospects for ALAB

As demand for AI-related products remains high, ALAB’s customer base is also expanding, which bodes well for revenue growth.

The company is optimistic about strong sales from its Aries product family across various AI platforms, along with increased shipments of Taurus SCM for 400-gig applications and Scorpio P-Series switches.

The Zacks Consensus Estimate for 2025 revenue stands at $605.57 million, suggesting a significant year-over-year increase of 57.95%.

Projected earnings for 2025 are estimated at $1.13 per share, indicating a growth of 56.15% compared to the previous year’s forecast of 72 cents per share, which has shown stability over the last month.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

What Lies Ahead for ALAB Investors?

Though ALAB boasts a robust product lineup, it must navigate increasing competition in the AI and cloud sectors, particularly from larger semiconductor firms enhancing their AI product offerings.

Non-GAAP gross margins are projected to decline due to a shift in product mix toward hardware solutions.

Currently, ALAB stock is considered expensive, reflected in its Value Score of F.

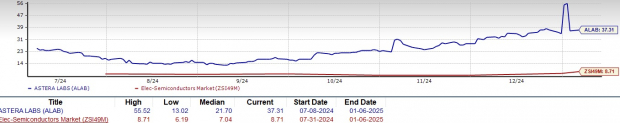

With a forward 12-month Price/Sales ratio of 37.31X, ALAB trades significantly higher than the sector average of 8.71X.

Price/Sales (F12M)

Image Source: Zacks Investment Research

Astera Labs holds a Zacks Rank #3 (Hold), indicating a potential strategy to wait for a better entry point before investing. To see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each stock is curated by a Zacks expert as the top pick to gain +100% or more in 2024. Not all selections may succeed, but past recommendations have soared impressively, with gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Many stocks highlighted in this report are currently unnoticed by Wall Street, presenting an excellent opportunity for early investors.

See These 5 Potential Home Runs >>

For the latest recommendations from Zacks Investment Research, download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

Astera Labs, Inc. (ALAB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.