Amidst an all-time high in the S&P500, the spotlight now falls on the downtrodden commodity stocks. Albemarle Corporation (NYSE:ALB), a formidable force in American lithium mining, is one such contender. The company has weathered a brutal year, grappling with plummeting lithium prices, mostly attributed to subdued electric vehicle battery demand in a harsh macro environment. This deceleration in demand has sparked concerns about an expanding chasm between supply and demand, as mining companies race to scale up production to satiate the burgeoning secular demand.

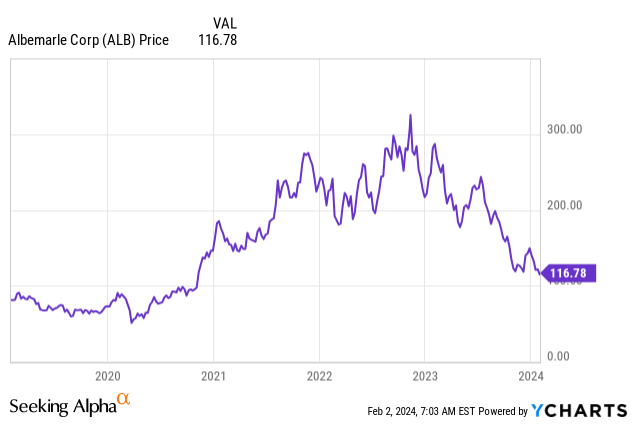

Back in August of 2022, Albemarle’s stock ascended to an all-time high, breaching the $325 mark. Fast forward, and it has plummeted to a mere $116. A word of advice: navigating the volatile seas of commodity markets demands intestinal fortitude. However, within this turbulence also lies the potential for substantial returns if navigated astutely. Given that the lion’s share of Albemarle’s business hinges on lithium, its stock price is intimately tethered to lithium prices. Thus, the entwined fate of this iconic mining company and the lithium market is the focal theme of this discourse. I hereby propound a Hold rating for this entity. Should the stock witness another nosedive of at least 30%, or should the supply and demand tapestry morph into a more promising one, prospective investors might find themselves perched on the precipice of a compelling risk/reward juncture.

As such, just as the tides ebb and flow, investors need to stay ahead of the curve, keeping an unwavering eye on Albemarle’s dynamic performance in the percolating lithium market.

Diving into Albemarle’s Realm

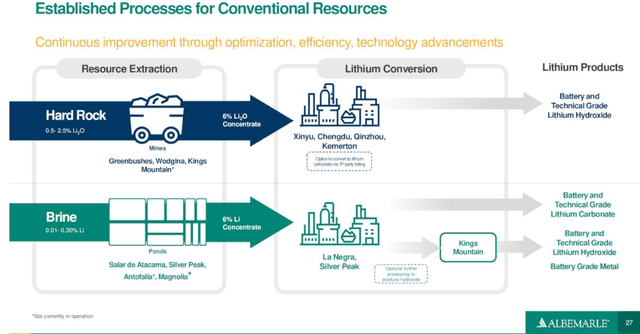

Albemarle Corporation stands as a global purveyor of specialty chemicals, dispensing an array of essential ingredients that cater to sundry industries. The company operates within three business segments: Energy Storage (Lithium), Specialties (Lithium, Bromine), and Catalysts (Ketjen).

Revenue Rhythms

Albemarle’s primary revenue tributary stems from vending its products to clients, which find utility in a myriad of applications, including:

- Lithium-ion batteries for electric vehicles and grid energy storage

- Bromine-based products for fire safety, water treatment, and refrigerants

- Catalysts for oil refining, petrochemical processing, and industrial emissions control

In addition to direct sales, Albemarle extends contract manufacturing services to firms necessitating specialized chemistry or manufacturing processes for their products.

Cost Constellations

Albemarle’s cost cosmos revolves around research and development, manufacturing, and sales and marketing expenses. The company funnels significant resources into developing new technologies and processes, and for erecting and upholding its manufacturing facilities. Equally vital are sales and marketing expenses, vital for Albemarle to reach a broad spectrum of customers across diverse industries.

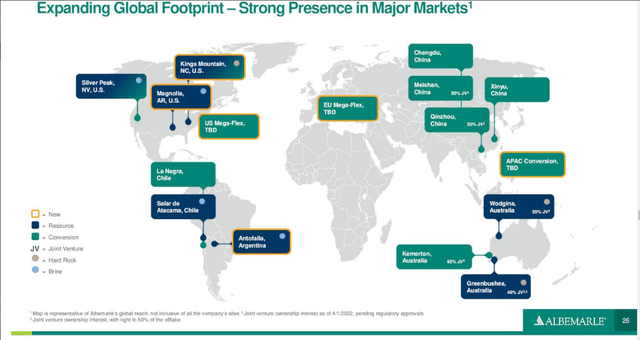

This panorama offers a glimpse of Albemarle’s global operations and yields a fundamental understanding of its lithium ventures.

Navigating Financial Horizons

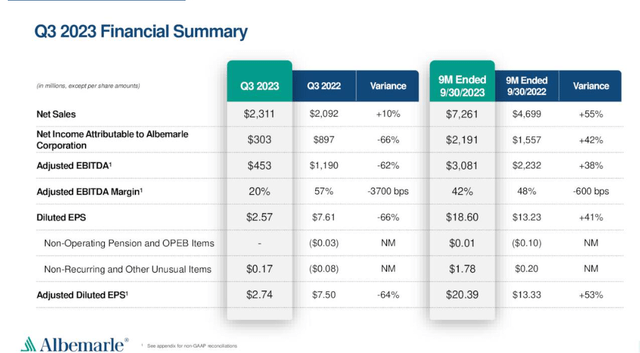

An astute glance at Q3 of 2023 compared to the same quarter of 2022 might evoke a somber narrative; however, truth lies elsewhere.

In Q3 of 2023, Albemarle’s Net Income and Diluted EPS contracted by -66%. Adjusted EBITDA also receded by -62%, dragging margins down from 57% to 20%. These bearish portents paint a desolate picture, primarily an offshoot of the nosediving lithium prices. However, as they say, this is a mere patch on the quilt. Lithium prices in the preceding years have been exceptional and do not epitomize market norms. A dip, by all means, might seem precipitous, but it is far from cataclysmic. Contrastingly, the 9M conclusion ended on 9/30/22, boasting a 41% surge in Diluted EPS and a 38% uptick in Adjusted EBITDA. Amid this, however, looms a peril—the propensity of management to don rose-tinted glasses, presuming the prompt resurgence of high lithium prices and making superfluous prognostications about their enterprise.

Underscoring the Q3 comparison, Net Sales soared by 10%, showcasing sustained demand for Albemarle’s offerings, even within a tempestuous macro milieu. Albemarle’s cost structure for lithium production stands as paragon within the industry, enabling them to sustain lithium production amid low prices. This not only allows them to poach market share from rivals forced to curtail or cease production due to higher costs but also bestows an enviable vantage point in the lithium industry. As prices spiral upward, they stand to amass an expanding clientele and sales. Yet, this doesn’t immediately greenlight the entry of investors. As low-cost producers forge ahead, supply mushrooms and depresses lithium prices until demand inflates or supply dwindles vis-à-vis demand. Only when even the most cost-conscious producers commence shelving projects do we witness a nadir in prices. In such an event, it would be an opportune moment for investors.

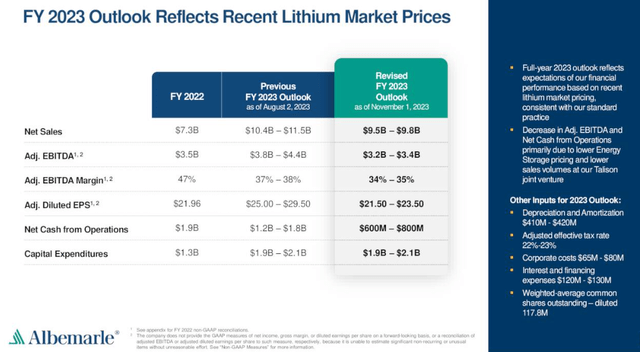

During the Q3 Earnings Call, CFO Scott Tozier charted a guidance course for the full year:

Our adjusted EBITDA outlook hovers in the range of $3.2 billion to $3.4 billion. This translates to full-year EBITDA margins of 34% to 35%. Our full-year 2023 adjusted EPS outlook has been tweaked to a corridor of $21.50 to $23.50.

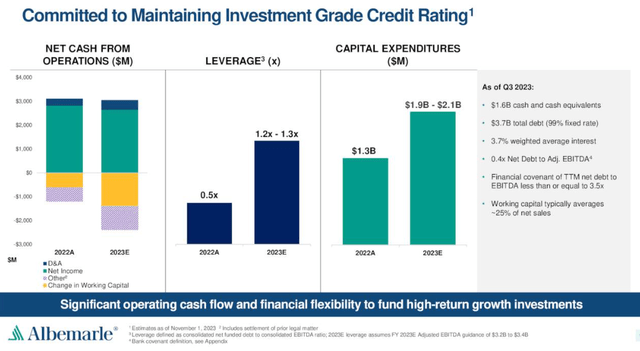

Scrutinizing Albemarle’s balance sheet, the company seems to be operating with a conservative disposition. The company operates with a leverage of 1.2x to 1.3x, nestled within acceptable thresholds. With the bulk of its debt

Lithium Investment Report: Assessing Albemarle Corporation’s Financial Landscape

Albemarle Corporation, a major player in the lithium industry, is facing both immense opportunities and significant financial challenges. The company’s current leverage poses a potential concern, with $3.7 billion in debt set against negative levered free cash flow at -1.25 billion (‘TTM’). However, amidst the shifting landscape, it is essential for investors to closely monitor this debt burden, especially in light of the upcoming quarterly reports.

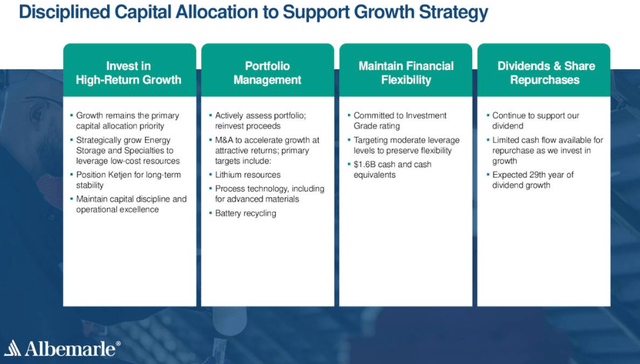

Despite these financial challenges, Albemarle Corporation aims to exhibit resilience in their capital allocation strategy to maintain their BBB credit rating and financial agility. As they navigate through the terrain of organic and inorganic growth, their capacity to balance conservative financial practices with strategic investments will be closely scrutinized by investors. Moreover, the company has sustained a 28-year streak of annually increasing dividend payments, a testament to their commitment to shareholder value. Nevertheless, with a modest yield of 1.40%, investors may seek more enticing options.

Growth Expectations and Financial Projections

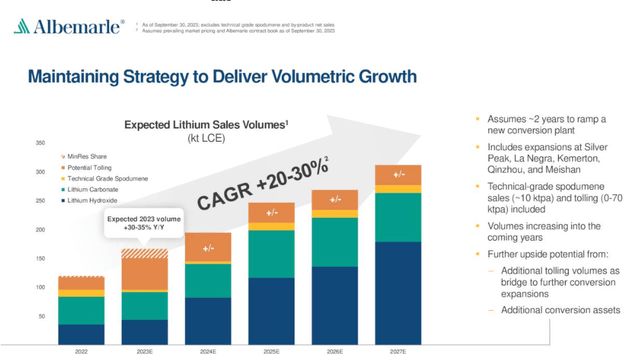

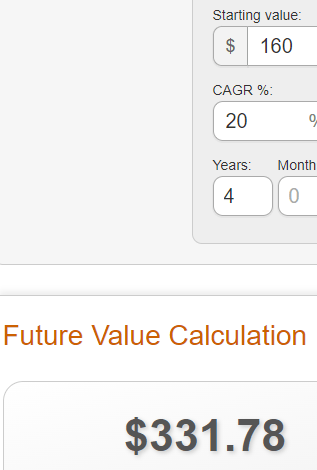

Albemarle projects a vigorous volumetric growth of 20-30% CAGR until 2027, with the full-year of 2023 anticipated to yield 30-35% growth. This growth trajectory is underpinned by a strategic expansion of projects to cater to future demand and consolidate market share in the industry.

However, the potential disparity between the CAGR estimations of 20% and 30% beckons a critical assessment. Should the company fail to meet the estimated growth targets, it might necessitate a revision of their forecasts, casting a shadow of uncertainty over their predictive accuracy. Notably, Albemarle’s revised net sales estimates for 2023, indicating a substantial deviation from the initial projections, further raise questions about the reliability of the company’s estimations.

As illustrated, the extensive disparity between sales volume projections and CAGR estimations accentuates the ambiguity surrounding the company’s forecasting precision. The evident fluctuations in net sales estimates underscore the challenging task of placing unwavering trust in the company’s predictions.

Assessing Competitive Landscape and Financial Metrics

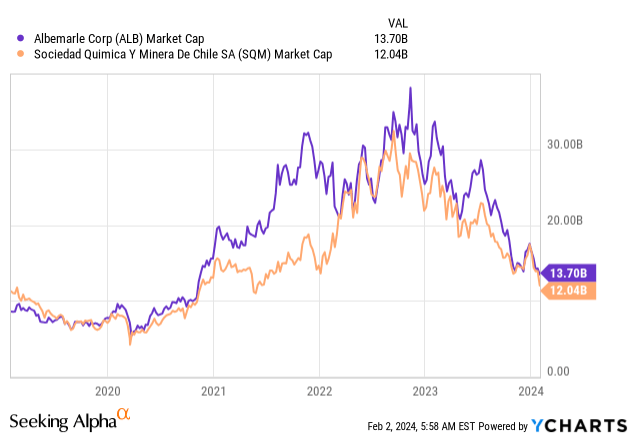

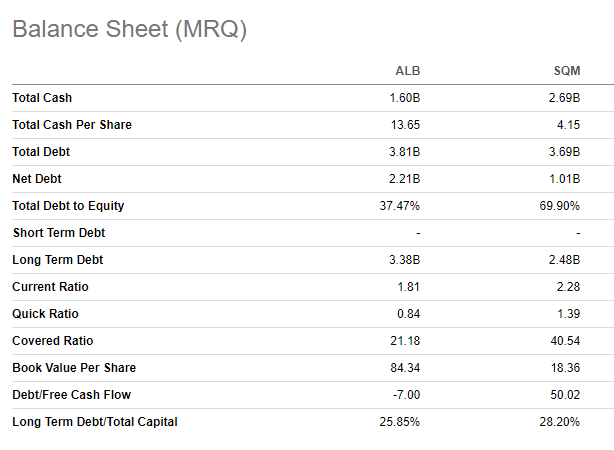

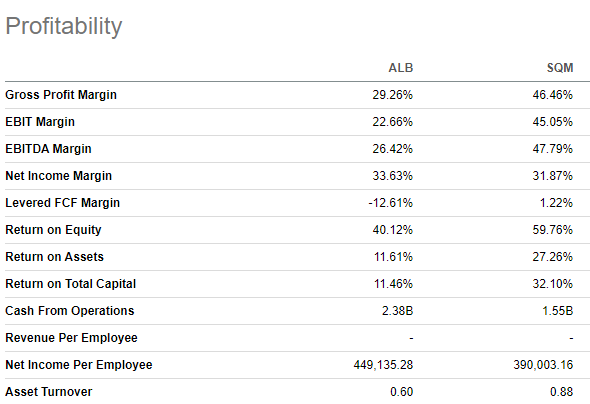

Delving into the competitive milieu of the lithium industry, an examination of Albemarle Corporation and Sociedad Química y Minera (SQM) – two prominent players in the sector – sheds light on their financial dynamics and strategic positioning amidst industry shifts.

Analyzing key financial metrics, it becomes evident that SQM holds a favorable position in terms of the current ratio, signaling a stronger capacity to settle short-term obligations. However, employing the quick ratio metric reveals a less appealing financial stance for Albemarle Corporation, underscoring the multi-dimensional evaluation required for a comprehensive financial assessment.

In terms of profitability, SQM maintains an edge over Albemarle Corporation, primarily driven by higher EBITDA margins and RoE. The implications of these metrics underscore the influence of volatile lithium prices on the financial performance of these industry juggernauts. Additionally, the consideration of potential tax implications, particularly in Chile where both companies operate, warrants careful evaluation due to its potential impact on their financial outlook.

Albemarle’s future financial trajectory and competitive positioning will undoubtedly be shaped by its ability to navigate these intricate financial terrains, and investors will keenly observe the company’s strategic decisions and operational performance as it charts its course amidst industry headwinds.

Unveiling the Lithium Giants: A Deep Dive into Albemarle and SQM

The lithium market continues to captivate investors’ attention as Albemarle Corporation and Sociedad Quimica y Minera de Chile (SQM) dominate the industry. Both companies boast remarkable growth, positioning themselves as giants in the lithium sector. Their expansion prospects are bolstered by skyrocketing demand for lithium-powered electric vehicles (EVs).

Albemarle measures up well against SQM in terms of figures, but is it truly the superior investment? Political uncertainties in Chile could cloud the future for SQM, while Albemarle presents a more stable and diversified global landscape. Valuation, a crucial aspect, adds complexity to the comparison. Seeking Alpha’s optimistic view of Albemarle’s current price relative to its prospects and sector peers offers investors hope, though potential earnings disappointments could alter this outlook. Additionally, the macroeconomic environment and its impact on the lithium and EV market are crucial factors in assessing both companies’ potential.

The Growth Race: A Soaring Trajectory

Both Albemarle and SQM ride the crest of a growth wave. At first glance, SQM appears more robust, flaunting a better set of figures. However, the Chilean company’s fortunes are flanked by political turmoil – a turnoff for many investors. The shadows of nationalization fears and higher taxes cast a pall over SQM’s otherwise sound operations.

Conversely, Albemarle stands as a steadier ship, navigating a less politically fraught course and boasting a more diversified global presence. Political stability is a rare gem in the business world, and Albemarle’s grip on it gives the company a distinct edge, making it a more comfortable investment option for many.

Unmasking the Valuation Conundrum

Valuing companies teetering on the cusp of a lithium revolution is no mean feat. The hallucinatory nature of lithium’s cyclical swings bedevils valuations, injecting unpredictability into forecasts of margins, cash flows, earnings, and dividend growth. Trying to predict lithium’s price over the next five years is akin to navigating a labyrinth blindfolded.

Seeking Alpha assumes a relatively optimistic stance on Albemarle’s current price vis-à-vis its prospects and sector peers, painting an encouraging picture for potential investors. However, this optimism could wane swiftly if earnings fail to meet expectations, turning the valuation tale into a less rosy narrative.

Navigating the Lithium and EV Market Terrain

Lithium’s meteoric rise aligns with the fervent embrace of carbon-neutral electric vehicles. This burgeoning zeal, fostered by a motley crew of car manufacturers and governments, has propelled lithium into the investment limelight. While Tesla basked in the EV spotlight for years, the surge of investments and pledges from various quarters has reinvented the industry, casting a shadow over Tesla’s once undeniable dominance.

Yet, juxtaposed against this fervor is a global macroeconomic backdrop that lacks luster. The sheen on demand growth for lithium-fueled EVs is beginning to fade, with higher interest rates dampening the allure of car purchases. The observed shift in consumer sentiment is linked to the ebb and flow of oil prices and geopolitical tensions, collectively shaping the contours of the market.

The Ongoing Lithium Conundrum: An In-Depth Analysis

Even though the global landscape continues to present several macro headwinds, the electric vehicle (EV) market remains on an upward trajectory. In China, EV sales surged by 38% in 2023, showcasing resilience amid economic challenges. Furthermore, a market research firm, Rho Motion, reported a 31% increase in global EV sales for the same period.

Challenges and Predictions

Amidst the commendable rise in sales, the industry continues to grapple with hurdles, including a real-estate crisis and the potential threat of deflation looming over the Chinese economy. Effective policies must be implemented by the central government to address these formidable issues, offering a glimmer of hope in an otherwise turbulent economic landscape.

On the flip side, maintaining the current supply curve or surpassing it while witnessing a decline in demand growth could lead to a substantial 50% reduction in lithium prices. The resultant stagnation in prices may prevail until 2030, making long-term investment in companies like Albemarle a precarious endeavor.

Supply-Demand Dynamics

Wood Mackenzie’s analysis of lithium batteries paints a picture of supply outpacing demand, with an anticipated 45% growth in supply in 2023, leading to an excess of 1,380 GWh. The projected oversupply is poised to persist despite an expected uptick in demand, underscoring the enduring imbalance in the market.

It’s crucial to consider the potential impact of even the slightest deviations in future Compound Annual Growth Rate (CAGR) projections on the supply-demand equilibrium. Statista projects a 14% CAGR growth in lithium demand from 2025 to 2030, but a mere 2% error in these forecasted figures could dramatically skew the envisioned trajectory.

Future Projections and Market Dynamics

Should the trajectory of supply continue to rise unabated, resulting in a higher CAGR compared to demand, the market is poised to confront a protracted period of supply surplus. Goldman Sachs echoes this sentiment, underscoring the prevalence of surplus-related challenges in the contemporary lithium market.

Foresight and Evaluative Lens

It’s imperative to scrutinize production and demand data not only from lithium producers but also from market analysts and end-market entities such as automotive companies. However, it’s prudent to approach the lofty projections of companies like Albemarle with a healthy dose of skepticism, given their tendency to harbor inflated expectations.

The current market prices likely encapsulate the prevailing headwinds, but any regression in the economies of the US and Europe, coupled with adverse policy changes, could exert additional pressure on prices. China’s economic performance remains a pivotal factor, wielding considerable influence over the market’s trajectory.

Unveiling Market Risks

Goldman’s illustrative graphs vividly underscore the lingering risks entwined with the contemporary lithium market, foreboding a prolonged period of market balancing with prices potentially traversing into the cost curve. This trajectory may necessitate several project halts and a downturn in supply growth, potentially resulting in even lower prices than currently anticipated.

Global Perspectives on EVs

From a Finnish vantage point, the EV revolution has yet to make significant strides in the country’s infrastructure. Outside major urban centers, the infrastructure remains woefully limited, diminishing the allure of EVs, particularly in rural areas with constrained range and cost-effectiveness. Moreover, social media platforms often amplify skepticism and criticism surrounding EVs, casting a negative shadow, especially when incidents involve well-known EV brands.

Long-Term Vision

While the EU’s mandate for zero-emission new vehicle registrations after 2035 represents a pivotal step, the global impact may remain limited, compounded by short-term headwinds such as the German government’s cessation of an EV subsidy program. This confluence of factors underscores the complexity and multifaceted nature of the EV revolution.

The Future of Lithium: Assessing Investment Potential Amid Mounting Risks

The lithium industry stands at a precipice. Its future, tantalizing and yet precarious, is tethered to the demand for cleaner energy and the proliferation of electric vehicles. With rising competition from sodium-ion batteries, regulatory hurdles, and the capricious nature of the commodity market, investors are left to grapple with a web of intricate risks and opportunities.

Navigating Regulatory and Political Uncertainties

The mining industry’s trajectory is intertwined with a labyrinth of regulatory and political quandaries, particularly in the realm of environmental, social, and governance (ESG) concerns. For instance, a recent report from Chile revealed how indigenous groups disrupted lithium salt flat operations, casting a shadow of uncertainty on the market. As political winds in Chile remain uncertain and the specter of nationalization looms, the business landscape appears increasingly fraught with peril.

Sodium-ion Batteries: The New Foe?

The ascendancy of sodium-ion batteries presents a formidable challenge to their lithium counterparts. While the former flaunts a 30% cost advantage, the latter grapples with the specter of lower energy density. As BYD(OTCPK:BYDDF) rolls out its Seagull model, featuring both sodium-ion and lithium-ion battery iterations, the battleground is set. The urban landscape seems ripe for sodium batteries with a robust charging infrastructure, while lithium batteries hold sway in rural terrain and high-performance vehicles.

Taming the Volatile Commodity Market

The capriciousness of the commodity market adds another layer of complexity. With the potential for a precipitous drop in lithium prices, compounded by a supply glut and economic slowdown, investors teeter on the edge of uncertainty. This unrelenting volatility, intertwined with the industry’s stock price, paints a bleak picture, leaving investors in a perpetual state of angst.

Yet, we are left to ponder – where lies the silver lining?

The Allure of Timing

Timing, that capricious mistress, remains the linchpin in the lithium investment narrative. In this cyclical realm, seizing the opportune moment holds primacy, yet proves to be an arduous pursuit. The allure of buying low and selling high, intertwined with the vagaries of commodity investing, underscores the poignant conundrum. Stomach and conviction conflate as indispensable virtues, while the specter of opportunity cost lurks ominously in the backdrop.

The Far Horizon

As investors grapple with the precarious landscape, a maelstrom of uncertainties and possibilities looms large. While the siren call of an ultimate buying opportunity resonates, judicious restraint seems to be the need of the hour. The vagaries of demand-supply dynamics underscore the cautionary stance, accentuating the urgency for astute scrutiny of future company guidance and performance. The echoes of prudence reverberate, urging tempered action in the face of tantalizing prospects.

The journey ahead is tethered to the hope of seismic appreciation, juxtaposed with the caution of potential stagnation. The path is fraught with ambiguity, leaving long-term investors straddling the delicate balance between patience and prudence.