Allegiant Travel Company Reports Wider Loss in Q3 2024 Amid Increased Fare Challenges

Q3 2024 Earnings Overview

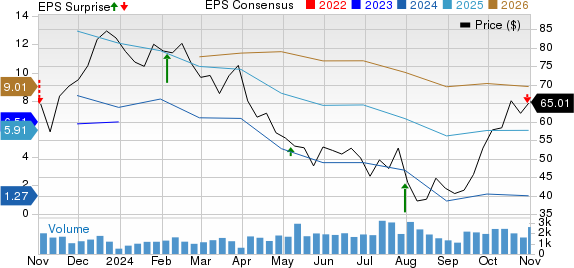

Allegiant Travel Company ALGT reported a third-quarter 2024 loss of $2.02 per share (excluding three cents from non-recurring items). This result was worse than the Zacks Consensus Estimate of a $1.85 loss and a notable decline from an earnings of 9 cents per share from the same quarter last year.

Discover the latest EPS estimates and surprises on ZacksEarnings Calendar.

Revenue Insights

Operating revenues reached $562.2 million, slightly above the Zacks Consensus Estimate of $561.2 million. However, this figure marked a decrease of 0.6% year-over-year.

The majority of passenger revenues, making up 87% of total income, fell by 5.3% compared to the previous year. In the same period, air traffic, as measured by revenue passenger miles for scheduled services, declined by 1.1%. Available seat miles (ASMs) showed a 1.1% increase year-over-year. However, the load factor, or the percentage of seats filled with passengers, dropped to 85.6% from 87.5% as traffic did not keep pace with capacity.

Operating costs per available seat mile, excluding fuel, rose by 8.1% from last year to 8.65 cents. Conversely, the average fuel cost per gallon decreased by 6.6% to $2.85. Scheduled service passenger revenue per available seat mile fell to 12.21 cents compared to 12.78 cents in the previous year.

Performance Snapshot: ALGT Price and EPS Analysis

Allegiant Travel Company price-consensus-eps-surprise-chart | Allegiant Travel Company Quote

Liquidity Position

As of September 30, 2024, Allegiant held total unrestricted cash and investments of $804.6 million, down from $870.7 million at the end of the previous quarter. Long-term debt and finance lease obligations stood at $1.77 billion, a decrease from $1.82 billion in the prior quarter.

Updated Guidance for Q4 & 2024

For the fourth quarter of 2024, the company expects a 1.5% increase in ASMs for scheduled services. Total system ASMs are similarly projected to rise by 1.5% compared to the previous year.

Operating margin is forecasted to range between 6% and 8%, with EPS for the airline anticipated between $0.50 and $1.50. For the fourth quarter, consolidated earnings per share, excluding special items, are predicted to either break even or increase up to $1 per share. The anticipated fuel cost per gallon is $2.50.

For the full year of 2024, ASMs for scheduled services are expected to increase by 0.5%. Interest expenses are now estimated to be between $150 and $160 million, up from the previous estimate of $130 to $140 million.

Under capital expenditures, costs related to aircraft, engines, and pre-delivery deposits are projected between $105 and $125 million, down from a previous range of $180 to $200 million. Heavy maintenance capital expenditures remain expected between $80 million and $90 million, with other airline capital expenditures projected at $105 to $115 million.

The company plans to grow its fleet size to 122 aircraft by the end of 2024, a revision from previous expectations of 124 aircraft.

Currently, Allegiant holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Comparative Q3 Performance of Other Airlines

Delta Air Lines DAL reported earnings of $1.50 per share for Q3 2024, excluding 47 cents from non-recurring items. This was below the Zacks Consensus Estimate of $1.56, representing a 26.11% decrease year-over-year driven by increased labor costs.

Delta’s revenues were $15.68 billion, exceeding the Zacks Consensus Estimate of $15.37 billion, and up 1.2% year-over-year, supported by solid air travel demand. Adjusted operating revenues reached $14.59 billion, remaining flat compared to the previous year, impacted by a $380 million outage due to CrowdStrike CRWD.

Norfolk Southern Corporation NSC reported Q3 2024 earnings of $3.25 per share (excluding $1.6 from non-recurring items), beating the Zacks Consensus Estimate of $3.10, a 22.6% increase year-over-year attributed to lower costs.

Railway operating revenues for Norfolk Southern were $3.05 billion, slightly below the Zacks Consensus Estimate of $3.09 billion, although up 2.7% year-over-year, with revenue improvements in the Merchandise and Intermodal segments.

J.B. Hunt Transport Services JBHT reported earnings of $1.49 per share for Q3 2024, surpassing the Zacks Consensus Estimate of $1.42 but down 17.2% from a year ago.

Total operating revenues of J.B. Hunt reached $3.07 billion, exceeding the Zacks Consensus Estimate of $3.04 billion but represented a 3% decline year-over-year. Their operating income for this quarter fell by 7% year-over-year to $224.1 million.

Stock Recommendations and Leads

Our expert research team has identified five stocks with the highest potential to gain +100% in the coming months. Among these, Director of Research Sheraz Mian highlights the top stock primed for significant growth.

This leading pick stands out in the financial sector, boasting a growing customer base of over 50 million and offering diverse, innovative solutions. While past elite picks, like Nano-X Imaging, achieved a remarkable +129.6% growth in less than nine months, not all will succeed, but this one holds promise.

Free: See Our Top Stock And 4 Runners Up

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Norfolk Southern Corporation (NSC) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Allegiant Travel Company (ALGT) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

For more details, read the full article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.