Allison Transmission Reports Strong Earnings Growth in Q3 2024

Allison Transmission Holdings (ALSN) reported earnings of $2.27 per share for the third quarter of 2024. This marks a 29% increase from the same quarter last year and exceeds the Zacks Consensus Estimate of $2.01. The company achieved record revenues of $824 million, a 12% rise compared to the previous year, and surpassing the Zacks Consensus Estimate of $791 million.

Stay up-to-date with quarterly releases: See Zacks Earnings Calendar.

Quarterly Financial Performance Overview

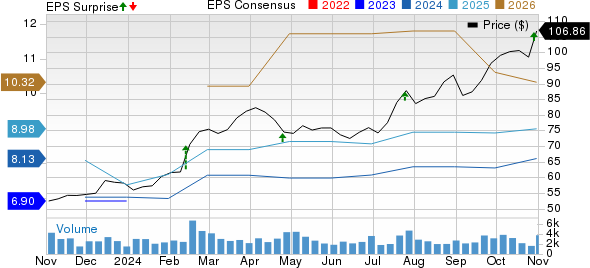

Allison Transmission’s price, consensus, and EPS performance chart.

Segment Analysis

Allison Transmission divides its revenues into different end markets:

In the latest quarter, net sales in the North America On-Highway market jumped 21.5% year over year to $457 million, surpassing the Zacks Consensus Estimate of $412 million, driven by strong demand for Class 8 vocational and medium-duty trucks along with price increases on certain products.

Conversely, net sales in the North America Off-Highway sector fell to $1 million from $9 million a year earlier, missing the Zacks Consensus Estimate of $3.32 million.

Sales in the Defense market grew by 23.2% to $53 million, supported by increased demand for tracked vehicle applications, although it fell short of the Zacks Consensus Estimate of $56 million.

Meanwhile, the Outside North America On-Highway segment registered net sales of $126 million, up from $118 million in the prior year primarily due to strong demand from Asia. This figure also exceeded the Zacks Consensus Estimate of $124 million.

Net sales in the Outside North America Off-Highway market remained unchanged from last year at $19 million, falling below expectations set at $20.90 million.

Additionally, net sales from Service Parts, Support Equipment & Other declined by 1.7% year over year to $168 million, missing the Zacks Consensus Estimate of $170 million.

Financial Health Update

Allison reported a gross profit of $396 million, an increase from $357 million a year ago, largely due to increased sales and higher prices on some products.

The adjusted EBITDA for the quarter was $305 million, up from $267 million in the same period last year, attributed to strong gross profit growth.

For operating expenses, selling, general, and administrative costs stood at $85 million, slightly down from $86 million in the previous year. Meanwhile, engineering and research expenses increased to $51 million from $49 million.

As of September 30, 2024, Allison had cash and cash equivalents of $788 million, a significant increase from $555 million at the end of 2023. The company’s long-term debt decreased to $2.39 billion from $2.49 billion.

Net cash provided by operating activities reached $246 million, while adjusted free cash flow rose to $210 million, compared to $182 million in the previous year.

Revised 2024 Projections

Allison has updated its guidance for full-year 2024. The company now expects net sales between $3.13 billion and $3.21 billion, up from the previous estimate of $3.09 billion to $3.17 billion. Net income guidance has also been raised to a range of $675 million to $725 million, compared to the earlier forecast of $650 million to $700 million. Adjusted EBITDA is now projected at $1.11 billion to $1.17 billion, a revision from the prior estimate of $1.08 billion to $1.14 billion.

Furthermore, the firm anticipates net cash from operating activities to fall between $740 million and $800 million, previously estimated at $715 million to $775 million. Capital expenditures are expected to range from $135 million to $145 million, and adjusted free cash flow now is projected between $605 million and $655 million, up from $590 million to $640 million.

Zacks Rank & Key Competitors

Currently, Allison holds a Zacks Rank #3 (Hold).

Top competitors in the auto sector include Tesla (TSLA), Toyota (TM), and REE Automotive (REE), each holding a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for TSLA’s EPS for 2024 and 2025 has increased by 18 cents and 12 cents, respectively, in recent days.

Similarly, the EPS estimates for TM for 2024 and 2025 have risen by 56 cents and 65 cents, respectively, over the past two months. REE’s earnings estimates for 2024 and 2025 indicate expected increases of 64% and 13.3%, respectively.

Find Top Stock Picks with High Growth Potential

Our team has highlighted five stocks that are likely to gain +100% or more in the upcoming months. Among these, Director of Research Sheraz Mian has identified one stock with the highest potential. This firm is innovative and has a rapidly growing customer base of over 50 million.

While not every stock will perform well, this particular pick could outperform past successful Zacks stocks like Nano-X Imaging, which surged +129.6% in just over nine months.

Want to discover more picks from Zacks Investment Research? Download your free report on 5 Stocks Set to Double today!

Toyota Motor Corporation (TM): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

REE Automotive Ltd. (REE): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.