Amazon Shines Amidst Mixed Earnings Reports from Tech Giants

Earnings season is proving worrisome for some of the biggest names in tech. Companies like Microsoft (NASDAQ: MSFT), Meta Platforms (NASDAQ: META), and Apple (NASDAQ: AAPL) have seen declines following disappointing results and guidance. As these are major players in the market, their struggles have raised concerns overall.

However, it’s important not to rush to conclusions. The performance of different companies varies significantly, with some thriving despite the challenges faced by others.

Amazon’s Impressive Performance Stands Out

Initially, the claim that Amazon could be a top stock pick might seem exaggerated. Yet, upon review, this assertion is supported by solid evidence. Last quarter, Amazon’s revenue reached $158.9 billion, marking an 11% increase from the previous year. Consequently, earnings per share rose from $0.94 a year ago to $1.43, outpacing Apple’s sales growth.

While both Microsoft and Meta recorded higher revenue growth during the same period, they offered less optimistic forecasts. Meta plans to increase its investment in artificial intelligence, while Microsoft expects a revenue of $68.1 billion for the quarter ending in December, falling short of the $69.8 billion forecast. In contrast, Amazon anticipates about 9% sales growth for the current quarter, driving up its operating income by 36%, showcasing substantial strength.

Remarkably, among these four major companies, Amazon’s stock was the only one that rose following its earnings announcement.

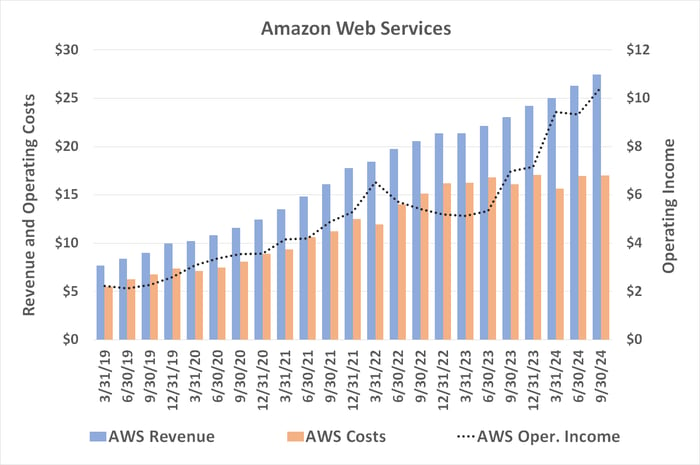

The stock’s ascent is not solely due to its impressive numbers. The way Amazon achieved this growth—largely through its cloud computing division, Amazon Web Services (AWS)—is noteworthy. AWS saw revenues climb by 19%, boosting its operating income from just under $7 billion last year to over $10.4 billion this quarter, while also improving its profit margin from 30% to 38%. This trend is expected to continue, as AWS contributes 60% of Amazon’s overall operating income.

Data source: Amazon Inc. Chart by author. Figures are in billions.

In addition to AWS, Amazon’s advertising segment thrived, reaching a record $14.3 billion in revenue, also up by 19%. This area has become a significant element of Amazon’s evolving business model, contributing about 10% of total sales.

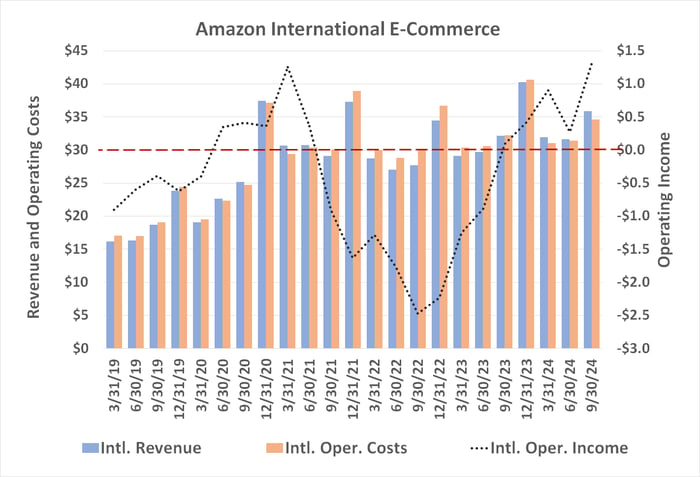

Another highlight from the third quarter was the performance of Amazon’s international e-commerce operations. Traditionally struggling, this segment is now consistently generating profits thanks to improved scale and effective cost controls.

Data source: Amazon. Chart by author. Figures are in billions.

Though still a smaller profit source, Amazon’s international business is growing rapidly and contributing more to the company’s overall profitability.

Importantly, shares of Microsoft, Apple, and Meta have soared to record highs over the past three years, making them susceptible to recent declines. In contrast, Amazon’s stock has not experienced significant overextension, sitting just slightly above its pandemic peak after the latest earnings report, suggesting potential for continued growth.

Bright Prospects Ahead for Amazon

This is not to imply that Apple or Microsoft cannot rebound, or that their stocks won’t appreciate in value again. Market dynamics are ever-changing. Eventually, their stock prices may reach attractive levels again, and their revenue and earnings growth will likely align with investor expectations. It’s simply a matter of time.

Nonetheless, for the moment, Amazon stands out as one of the market’s most promising investments among the so-called “Magnificent Seven” stocks. Last quarter’s earnings showed strong performance, and current guidance aligns well with what investors hoped to see, unlike the uncertainty surrounding Meta, Apple, Microsoft, and others.

This comparison between Amazon and its competitors may seem simplistic, yet it highlights how sometimes straightforward differences can yield significant benefits.

Should You Invest $1,000 in Amazon Right Now?

Before investing in Amazon, consider this:

The Motley Fool Stock Advisor analyst team has identified their picks for the 10 best stocks to buy now, and Amazon isn’t among them. The stocks chosen have the potential for substantial returns in the upcoming years.

For example, if you had invested $1,000 in Nvidia when it made the list on April 15, 2005, you would now hold a value of $833,729!*

Stock Advisor offers investors a clear path to success, with ongoing guidance on portfolio building, regular analyst updates, and two new stock suggestions each month, boasting returns that have more than quadrupled the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of November 4, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is affiliated with The Motley Fool’s board of directors. Randi Zuckerberg, a former Facebook director and sister of Meta CEO Mark Zuckerberg, is also part of The Motley Fool’s board. James Brumley does not hold any positions in the companies mentioned. The Motley Fool recommends and holds positions in Amazon, Apple, Meta Platforms, and Microsoft, and advises long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool adheres to a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily represent those of Nasdaq, Inc.