Amazon’s Record Earnings Reveal Strong Growth Despite Economic Concerns

Amazon.com (AMZN) reported impressive third-quarter earnings for 2024, with profits soaring to $1.43 per share—marking a 52.1% increase compared to the same period last year. This performance outshined the Zacks Consensus Estimate by 25.44%.

Net income climbed to $15.3 billion in Q3, a substantial rise from $9.9 billion in the same quarter of 2023.

Net sales reached $158.8 billion, reflecting an 11% year-over-year growth. This exceeded the company’s guidance of $154-$158.5 billion and surpassed the Zacks Consensus Estimate by 1.15%.

When adjusting for a $0.2 billion adverse impact from foreign exchange rate fluctuations, net sales continued to grow by 11% from Q3 of the previous year.

The strong performance primarily stemmed from the Amazon Web Services (“AWS”) segment, alongside positive momentum in North America and International segments. The company’s expanding advertising business also contributed to these figures.

Future investments in generative AI by AWS are expected to sustain its growth among cloud customers in the forthcoming quarters.

With a robust global reach, increasing traction among small and medium enterprises, and growing Prime membership, Amazon is well-positioned for continued financial success. However, it faces challenges including geopolitical tensions, exchange rate fluctuations, recession fears, inflation, rising interest rates, and labor market issues.

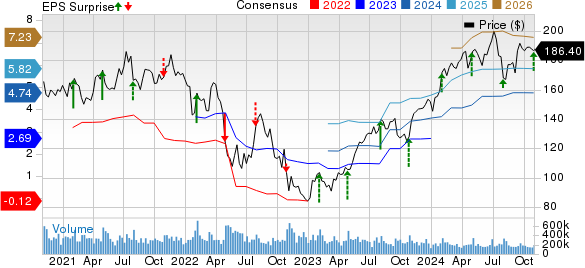

Performance Snapshot: Price, Consensus, and Earnings Surprise

Amazon.com, Inc. price-consensus-eps-surprise-chart | Amazon.com, Inc. Quote

Revenue Breakdown

Product sales, which account for 42.5% of sales, rose by 7% year over year to $67.6 billion. Service sales, making up 57.5% of sales, climbed 14.2% to $91.2 billion.

The North America segment, comprising 60.1% of sales, saw revenues increase by 8.7% to $95.5 billion, outperforming the Zacks Consensus Estimate by 0.31%.

International revenues, accounting for 22.6% of sales, were up 11.7% year over year to $35.8 billion, beating estimates by a notable 5.53%.

AWS revenues, representing 17.3% of total sales, increased by 19.1% to $27.4 billion, although this fell slightly short of expectations by 0.46%. Growth in Amazon Bedrock, due to its expanding Large Language Model offerings, helped bolster AWS adoption.

This quarter, Amazon launched new foundation models within Amazon Bedrock and Amazon SageMaker, partnering with AI21 Labs, Anthropic, Meta, Mistral, and multiple Stability AI models.

A collaboration with Databricks enables the development of custom AI models on AWS, further positioning Amazon in the competitive cloud landscape. Additionally, the company signed AWS agreements with major enterprises, including the Australia and New Zealand Banking Group, Booking.com, and Toyota.

Amazon also committed to investing £8 billion over five years in the UK, supporting job creation for approximately 14,000 annually.

Sales from third-party seller services grew 10% to $37.8 billion, just missing the Zacks Consensus Estimate by 0.56%. Advertising revenue surged by 19% to $14.33 billion, beating expectations by 1.06%.

Physical store sales grew 5% year-over-year, totaling $5.22 billion and outperforming estimates by 1.39%. Online store sales reached $61.4 billion, reflecting a 7% increase and besting the Zacks Consensus Estimate by 3.39%.

Prime Services Fuel Subscription Growth

The Prime service continues to thrive, benefiting from rapid delivery options and a diverse range of original content on Prime Video. Subscription services recorded an 11% growth year over year, generating $11.2 billion in sales, surpassing the consensus estimate by 1.32%.

This quarter also marked the success of Amazon’s annual Prime Big Deal Days shopping event, which saw record sales and participation, allowing members to save over $1 billion through exclusive deals.

For the first time, Amazon offered a fuel savings program for Prime members in the U.S., providing discounts at numerous locations.

New seasons of popular shows like The Lord of the Rings: The Rings of Power attracted significant viewership, while the Cowboys-Giants Thursday Night Football game became the most-streamed NFL regular season game to date. Additionally, Apple TV+ was added to Prime Video’s offerings in the U.S.

Operating Performance

Operating expenses totaled $141.4 billion, a 7.3% increase from the previous year. As a percentage of revenues, operating expenses shrank 310 basis points to 89%.

Expenses for sales, fulfillment, and technology rose by 7.9%, 10.5%, and 4.9% year over year, reaching $80.9 billion, $24.6 billion, and $22.2 billion, respectively.

Sales and marketing, along with general and administrative expenses, increased slightly to $10.6 billion and $2.71 billion, whereas other operating expenses grew to $262 million.

Operating income surged 55.6% compared to last year to $17.4 billion, with AWS contributing an operating income of $10.4 billion, up from $7.0 billion a year prior.

The North America segment reported an operating income of $5.7 billion, increasing from $4.3 billion, while the International segment turned around to an operating income of $1.3 billion from a loss of $0.1 billion last year.

Balance Sheet and Cash Flow Analysis

As of September 30, 2024, Amazon’s cash and cash equivalents increased to $75.09 billion, up from $71.2 billion at the end of June 2024.

Marketable securities stood at $12.9 billion, a decrease from $17.9 billion at the end of the previous quarter.

Long-term debt was reported at $58.3 billion, down from $54.9 billion as of the last quarter.

In the third quarter, AMZN generated…

Amazon Reports Strong Growth in Cash Flow and Provides Q4 Guidance

Financial Highlights

Amazon generated $25.9 billion in cash from operations for the latest quarter, an increase from $25.3 billion in the previous quarter. The operating cash flow for the last twelve months rose significantly by 57%, reaching $112.7 billion compared to $71.7 billion for the same period in 2023. Meanwhile, free cash flow surged to $47.7 billion, up from $21.4 billion year-over-year.

Fourth-Quarter 2024 Outlook

Looking ahead to the fourth quarter of 2024, Amazon anticipates net sales between $181.5 billion and $188.5 billion. This forecast indicates a growth of 7-11% from the prior year’s figures. The Zacks Consensus Estimate for net sales stands at $157.07 billion.

Management also projects a minor negative impact of 10 basis points due to foreign exchange fluctuations. Operating income is expected to be in the range of $16 billion to $20 billion.

Zacks Highlights Promising Stock Opportunities

Zacks Investment Research has identified five stocks with the potential to double in value. Among these, Director of Research Sheraz Mian emphasizes one notable stock, characterized by its rapid customer growth of over 50 million and its advanced financial solutions. While individual stock performance can vary, this pick shows promise, drawing comparisons to earlier successes like Nano-X Imaging, which saw a remarkable increase of 129.6% within nine months.

For those interested in valuable recommendations, Zacks is offering a report on the 5 Stocks Set to Double.

For free detailed analyses, consider exploring these stocks:

- Amazon.com, Inc. (AMZN)

- Apple Inc. (AAPL)

- Oracle Corporation (ORCL)

- Datadog, Inc. (DDOG)

To read more about this article, visit Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.