“`html

Amazon Reports Impressive Q3 Earnings Amid Strong Sales Growth

Amazon.com AMZN reported third-quarter 2024 earnings of $1.43 per share, reflecting a 52.1% growth from the same quarter last year, and surpassing the Zacks Consensus Estimate by 25.44%.

Net income climbed to $15.3 billion for the quarter, compared to $9.9 billion the previous year.

Net sales reached $158.8 billion, showing an 11% increase year-over-year. This figure exceeded the company’s guidance of $154-$158.5 billion and is also above the Zacks Consensus Estimate by 1.15%.

When adjusting for a negative $0.2 billion effect from foreign exchange fluctuations, net sales still increased by 11% compared to Q3 2023.

The growth in revenue was driven primarily by the Amazon Web Services (“AWS”) segment’s performance. The North America and International segments also showed strong momentum, while the expanding advertising business contributed positively to the quarter’s results.

AWS is expected to benefit from ongoing investments in generative AI, which should help it gain traction with cloud clients in the near future.

Looking forward, Amazon’s vast global reach, growing interest in its Prime offerings, and efforts to connect with small and medium-sized businesses are poised to enhance its financial performance.

Nonetheless, challenges remain due to geopolitical unrest, fluctuating foreign exchange rates, recession worries, inflation, rising interest rates, and regional labor issues.

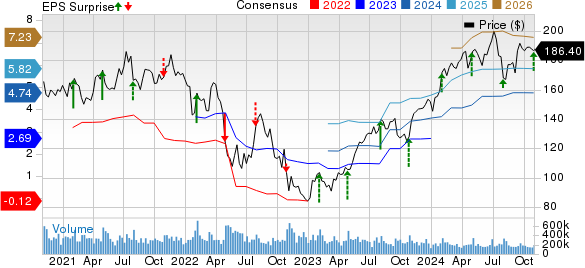

Amazon.com, Inc. Price, Consensus and EPS Surprise

Amazon.com, Inc. price-consensus-eps-surprise-chart | Amazon.com, Inc. Quote

Sales Breakdown

Product sales made up 42.5% of total sales, increasing by 7% year over year to $67.6 billion, while service sales (57.5% of sales) saw a rise of 14.2%, totaling $91.2 billion.

In terms of revenue by segment, North America (accounting for 60.1% of sales) increased by 8.7% to $95.5 billion, outperforming the Zacks Consensus Estimate by 0.31%.

International revenues, 22.6% of sales, grew 11.7% year-over-year to $35.8 billion, beating the consensus estimate by 5.53%.

AWS revenues (17.3% of sales) were $27.4 billion, up 19.1% year-over-year, but fell short of the consensus estimate by 0.46%. The positive traction of Amazon Bedrock, associated with its expanding Large Language Model offerings, played a significant role in this growth.

This quarter, Amazon introduced new foundation models in Amazon Bedrock and Amazon SageMaker, showcasing advanced technologies from AI21 Labs, Anthropic, Meta, and Stability AI.

A strategic collaboration with Databricks aims to speed up the development of custom models using Databricks Mosaic AI on AWS, leveraging AWS Trainium chips to enhance performance in generative AI applications.

Additionally, AWS signed agreements with major corporations such as The Australia and New Zealand Banking Group Limited, Booking.com, Capital One, Datadog DDOG, Epic Games, Fast Retailing, Itaú Unibanco, Luma AI, National Australia Bank, Sony, T-Mobile, Toyota, and Veeva.

Amazon also announced plans for AWS to invest £8 billion over five years in the UK, which is expected to support 14,000 jobs per year.

Sales from third-party seller services were up 10% year-over-year to $37.8 billion, although this fell short of the Zacks Consensus Estimate by 0.56%.

Advertising services brought in $14.33 billion, reflecting a 19% growth from last year and exceeding the consensus mark by 1.06%.

In its physical stores, Amazon recorded a 5% year-over-year increase in sales, amounting to $5.22 billion, surpassing the consensus estimate by 1.39%.

Online store sales totaled $61.4 billion, a 7% rise from the previous year, beating the Zacks Consensus Estimate by 3.39%.

Prime Services Fuel Subscription Growth

Amazon saw 11% year-over-year growth in its subscription services, which totaled $11.2 billion. This growth was attributed to the popularity of Prime, bolstered by fast delivery services and an expanding range of original content on Prime Video. Notably, this figure outperformed the consensus estimate by 1.32%.

During its annual Prime Big Deal Days shopping event, Amazon achieved record sales and participation, reportedly saving Prime members over $1 billion with various offers available across its platform.

The company introduced its first fuel savings offer, allowing U.S. Prime members to save 10 cents per gallon at numerous gas stations.

Following the successful launch of Season 2 of The Lord of the Rings: The Rings of Power, Prime Video experienced its highest viewership for a returning season. The Cowboys-Giants Thursday Night Football game also set records as Amazon’s most-streamed NFL regular-season game ever, attracting over 17 million viewers. Furthermore, Amazon expanded its Prime Video offerings by adding Apple TV+ to its list of subscription channels.

Operating Expenses and Financial Health

Operating expenses rose to $141.4 billion, a 7.3% increase from the same quarter last year. Relative to total revenues, operating expenses decreased by 310 basis points to 89%.

Cost increases for sales fulfillment, technology, and infrastructure were noted, rising 7.9%, 10.5%, and 4.9% to $80.9 billion, $24.6 billion, and $22.2 billion, respectively.

Other operating expenses, including sales and marketing, general and administrative, were $10.6 billion, $2.71 billion, and $262 million, showcasing increases of 0.5%, 5.9%, and 7.4% year-over-year.

Overall operating income soared to $17.4 billion, representing a 55.6% growth compared to the previous year.

The AWS segment generated an operating income of $10.4 billion, significantly up from $7.0 billion in Q3 2023.

Operating income for the North America segment was $5.7 billion, up from $4.3 billion the prior year, while the International segment turned around with an operating income of $1.3 billion, improving from an operating loss of $0.1 billion a year earlier.

Financial Position

As of September 30, 2024, cash and cash equivalents stood at $75.09 billion, an increase from $71.2 billion as of June 30, 2024.

Marketable securities were reported at $12.9 billion as of September 30, having decreased from $17.9 billion at the end of the previous quarter.

Long-term debt totaled $58.3 billion at the end of the quarter, down from $54.9 billion previously.

In the third quarter, AMZN generated strong financial results, indicating robust underlying business health.

“`

Amazon Reports Strong Cash Flow Growth and Provides Q4 Guidance

Financial Performance Overview

In the latest report, Amazon generated $25.9 billion in cash from operations for the third quarter, a slight increase from $25.3 billion in the prior quarter. Over the last 12 months, operating cash flow rose significantly, reaching $112.7 billion compared to $71.7 billion for the previous 12-month period ending September 30, 2023, marking a remarkable 57% increase.

Free cash flow also saw a substantial boost, climbing to $47.7 billion over the same trailing 12 months, in contrast to $21.4 billion for the previous period ending September 30, 2023.

Fourth-Quarter 2024 Expectations

Amazon anticipates net sales for the fourth quarter of 2024 to fall between $181.5 billion and $188.5 billion, a projected growth of 7-11% from the same quarter last year. The Zacks Consensus Estimate stands at $157.07 billion for net sales.

Management also expects a minor adverse impact from foreign currencies, projected at 10 basis points (bps). In terms of operating income, the company estimates a range between $16 billion and $20 billion.

Stock Watch

According to Zacks’ research chief, a particular stock has been identified as having the greatest potential for growth, with expectations it may double in value. This stock comes from a highly innovative financial firm that has quickly attracted a customer base exceeding 50 million, paired with advanced solutions poised for significant gains. While not all selected stocks have performed as expected, this candidate is drawing comparisons to past successful picks such as Nano-X Imaging, which increased by +129.6% in just over nine months.

For those interested in investment opportunities, you can access a list of five stocks expected to double in value. Click to download the report.

This article was sourced from Zacks Investment Research, which also offers free stock analysis reports for companies like Amazon.com, Inc. (AMZN), Apple Inc. (AAPL), Oracle Corporation (ORCL), and Datadog, Inc. (DDOG).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.