Amazon’s AWS Drives Strong Growth: Is It a Smart Time to Invest? (NASDAQ: AMZN) shares surged after the release of third-quarter results, once again bolstered by its cloud computing division, AWS. The stock has gained over 25% this year.

Market dynamics can change quickly. AWS growth in Q3 mirrored Q2’s performance, which previously caused a decline in stock value. However, investor sentiment shifted positively following the latest report. Let’s explore Amazon’s recent results and assess if now is the right time to invest in the stock.

AWS Drives Revenue Growth

The remarkable performance of AWS stood out in Amazon’s report, with cloud revenue climbing 19% to $27.5 billion. Operating income jumped nearly 49%, rising from $7 billion to $10.4 billion. This sector benefits from high fixed costs and significant operating leverage, which helped boost operating margins to record levels.

Amazon highlighted that its AWS AI revenue experienced impressive triple-digit growth, seeing generative AI as a “once-in-a-lifetime opportunity.” The company plans to invest $75 billion in capital expenditures this year, with intentions to increase investments further in 2025.

Additionally, the company reported robust interest in its custom AI chips, Trainium for training tasks and Inferentia for inference operations. Amazon shared that it has had to increase orders with manufacturing partners due to higher-than-expected demand for these chips. Organizations are increasingly standardizing their AI models, leveraging the capabilities of Amazon’s SageMaker product.

On the consumer front, North American sales grew 9% to $955.5 billion, while international sales rose 12% to $35.9 billion. Operating income for North America jumped 33% to $5.7 billion, while the international segment turned a profit of $1.3 billion, a turnaround from a loss last year.

Advertising services led the pack with 19% revenue growth to $14.3 billion. Amazon noted that sponsored ads were performing strongly across a broad customer base. The company is also diving into its first broadcast season for Prime Video advertising. Subscription service revenue rose 11% to $11.3 billion.

Revenue from third-party seller services increased by 10% to $37.9 billion. Online store sales climbed 8% to $61.4 billion, while physical store revenues grew by 5% to $5.2 billion.

Overall, Amazon reported a quarterly revenue growth of 11%, reaching $158.9 billion—slightly above the analyst consensus estimate of $157.2 billion, as gathered by LSEG. Adjusted earnings per share (EPS) soared 52% to $1.43, surpassing analysts’ expectations of $1.14.

The company generated $112.7 billion in operating cash flow and $47.7 billion in free cash flow during the quarter.

Image source: Getty Images.

Is It Time to Invest in Amazon Stock?

Amazon’s AWS segment continues to show robust revenue growth and strong operating leverage, leading to impressive income growth. The company is heavily investing in AI, eager to meet the rising demand for its services.

Profits from AI extend beyond cloud services. The company utilizes large language model (LLM) services, like SageMaker and Bedrock, along with its custom AI chips, Trainium and Inferentia. AI also enhances its consumer operations, aiding product recommendations and improving the logistics network.

The firm’s advertising sector shows solid growth too, driven by sponsored product ads. With its Prime Video service set to intake more advertising and a partnership with the NBA for streaming games next season, this could propel growth in the ad business moving into 2026.

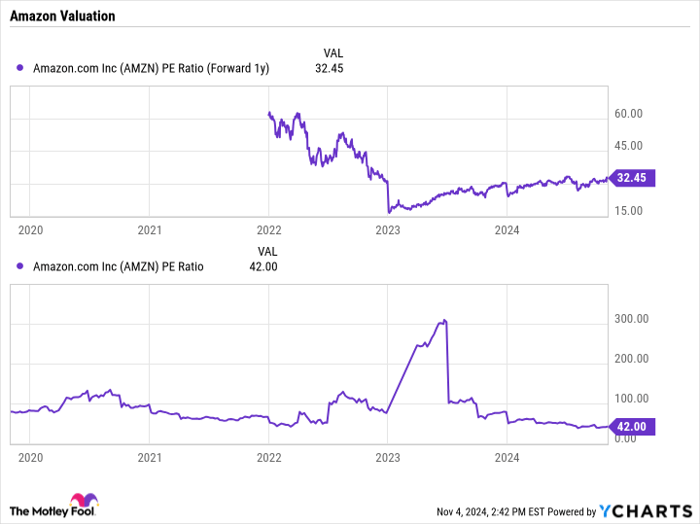

Currently, Amazon is trading at a forward price-to-earnings (P/E) ratio of about 32.5, which is below its historical averages.

AMZN PE Ratio (Forward 1y) data by YCharts

Amazon has a history of investing heavily to secure its position as the world’s leading e-commerce and cloud computing giant. With its current focus on AI and its determination to lead in this area, the stock appears to be a sound investment choice based on its strong track record.

Take Advantage of This Unique Investment Opportunity

Have you ever worried about missing the opportunity to invest in top-performing stocks? If so, here’s your chance.

Our team of expert analysts occasionally issues a “Double Down” stock recommendation for companies they believe are poised for significant growth. If you think you’ve already missed your opportunity to invest, now may be the best time to buy before prices increase. Let’s look at some impressive numbers:

- Amazon: If you invested $1,000 when we recommended it in 2010, you’d have $22,469!*

- Apple: If you invested $1,000 when recommended in 2008, you’d have $42,271!*

- Netflix: If you invested $1,000 when recommended in 2004, you’d have $411,970!*

Right now, we’re launching “Double Down” alerts for three exceptional companies, and opportunities like this don’t come around often.

Discover 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.