Amazon vs. Shopify: Which Stock Should You Buy for E-Commerce Growth?

E-commerce presents an attractive investment opportunity with substantial growth potential. Statista Market Insights estimates that the global e-commerce market will skyrocket from $3.6 trillion in 2023 to an impressive $6.5 trillion by 2029.

Amazon (NASDAQ: AMZN) and Shopify (NYSE: SHOP) are both vying for a larger piece of this expanding market but with differing strategies. While Amazon focuses on selling directly to consumers, Shopify supports businesses in selling their products online by providing essential technical infrastructure.

Both companies reported outstanding results for the third quarter, bolstering their stock prices throughout November. However, which one is the superior investment right now?

Why Invest in Amazon?

Amazon commands the U.S. e-commerce market with a 38% share, far ahead of its next closest competitor at 6%. However, its international success has been a bit rocky. In Q3 of 2023, Amazon reported an operating loss of $95 million in its international segment. The company rebounded in 2024, achieving $1.3 billion in international operating income during Q3, which contributed to a massive 56% year-over-year growth in overall operating income, totaling $17.4 billion.

Amazon is also focusing on increasing its free cash flow (FCF), giving the company flexibility to invest further, pay down debt, and buy back shares. This past year, Amazon’s FCF surged by 123% year-over-year to reach $47.7 billion, an impressive turnaround compared to its negative $19.7 billion trailing FCF just two years prior.

Interestingly, Amazon’s consolidated Q3 revenue increased by 11% to $158.9 billion, driven in part by innovations like an AI shopping assistant and AI-powered guides that boosted retail sales. The revenue also benefited from tools designed for its third-party sellers, who generated $37.9 billion of Amazon’s total Q3 sales.

Understanding Shopify’s Position

Shopify operates differently from Amazon as it does not sell products directly. Instead, it offers e-commerce technology to businesses. Its revenue comes from subscription fees for its software platform and additional fees for services like online payment processing and currency conversion.

Shopify’s merchant solutions sector, which encompasses these additional fees, accounted for 72% of its $2.2 billion revenue in Q3. Thus, its gross merchandise volume (GMV), representing the total sales processed by Shopify’s platform, is a vital metric. In Q3, GMV grew by 24% year-over-year to $69.7 billion due to rising sales and more businesses joining the platform. Consequently, Shopify’s revenue surged by 26% year-over-year.

A key strength for Shopify is its ability to keep existing merchants satisfied while attracting new ones. Merchants who have been with Shopify since 2020 saw their sales nearly double by 2023. This success is attributed to Shopify’s continuous improvements in user experience, including introducing AI features for customer inquiries and automatic tax filing.

Choosing Between Amazon and Shopify

Both companies offer compelling investment options. Shopify’s Q3 revenue growth of 26% outpaced Amazon’s 11%. Nevertheless, Amazon’s significantly larger and more diversified business spans retail, cloud computing, consumer tech, and satellite broadband services.

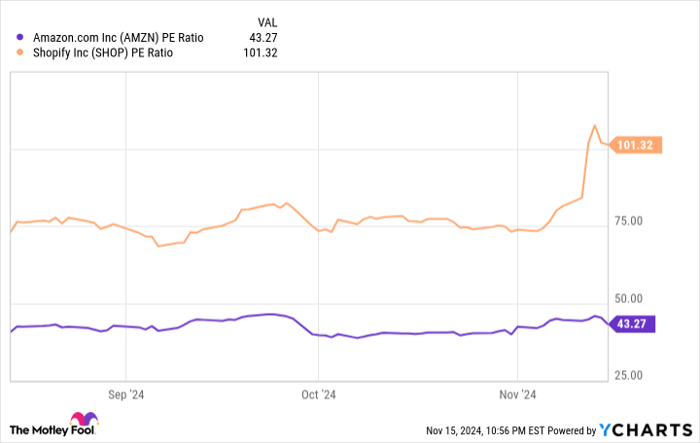

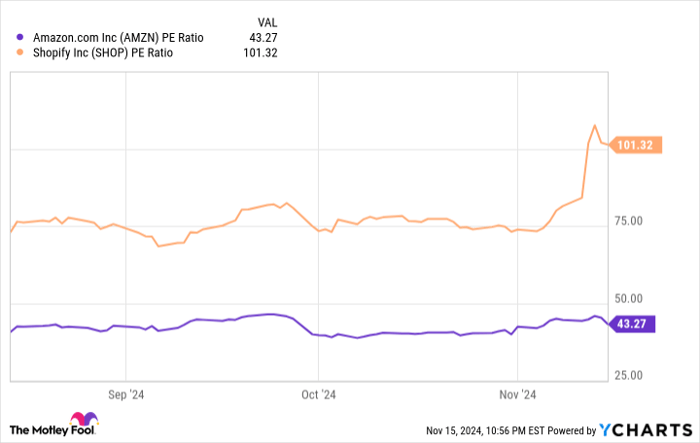

Additionally, viewing their price-to-earnings (P/E) ratios provides insight into current valuation. This metric shows how much investors are willing to pay for every dollar of earnings the companies generate.

Data by YCharts.

Shopify’s robust Q3 performance exceeded Wall Street expectations, resulting in a spike in its stock price and pushing its P/E ratio above 100. In contrast, Amazon’s considerably lower P/E suggests it may offer a better value. Given Amazon’s improving financial indicators—especially around operating income and FCF, along with its vast business reach and lower P/E multiple—it emerges as the preferable investment choice over Shopify at this time.

Your Opportunity for a Lucrative Investment

Have you ever felt like you missed out on buying top-performing stocks? If so, it’s time to pay attention.

Occasionally, our team of financial analysts issues a “Double Down” stock recommendation for companies they believe are on the verge of significant gains. If you think you missed your chance to invest, now is an excellent time to act before it’s too late. The evidence is compelling:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $381,173!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $43,232!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $469,895!*

Currently, we are issuing “Double Down” alerts for three extraordinary companies, and this opportunity may not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Robert Izquierdo has positions in Amazon and Shopify. The Motley Fool has positions in and recommends Amazon and Shopify. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.