Walmart vs. Amazon: The Battle for E-Commerce Supremacy

Walmart (NYSE: WMT) and Amazon (NASDAQ: AMZN) stand out as the two largest companies in the U.S. by sales. However, Amazon is quickly narrowing the gap and may soon surpass Walmart.

While Amazon’s use of artificial intelligence (AI) makes it seem like the obvious choice for investment, there are several factors that complicate this decision. Let’s take a closer look at each company.

Why Investors Are Eyeing Amazon: The AI Advantage

Amazon leads the U.S. e-commerce market and is the world’s largest cloud computing provider. These two sectors give it a strong position and significant growth potential.

However, the appeal of Amazon extends beyond just its e-commerce and cloud computing. CEO Andy Jassy notes that the AI sector is already generating billions and has immense room for future growth. He anticipates an upcoming surge in corporate demand for cloud solutions, and Amazon is heavily investing in various AI technologies to capitalize on this opportunity.

Amazon dominates e-commerce with over a third of the U.S. market, while Walmart trails with only about 6%. Amazon continues to enhance its services by adopting advanced robotics technology that reduces processing times by 25%. This focus on efficiency, along with improvements in same-day delivery, has fostered loyalty among Prime members and boosted sales.

In addition to e-commerce, Amazon has a competitive streaming service and a thriving advertising business that generates billions every quarter, as well as ventures in healthcare and smart devices, creating a diversified revenue stream.

Why Walmart Holds Its Ground: Stability and Value

Walmart operates approximately 4,600 stores in the U.S. and about 10,600 worldwide. Despite its size, the retailer consistently reports growth in both sales and profits, largely due to ongoing innovations that resonate with shoppers.

Walmart is enhancing its digital channels and leveraging its vast store network, allowing it to provide omnichannel shopping options that Amazon cannot match. This strategy is appealing to a broad customer base, including more affluent consumers seeking diverse products online. In the third quarter of fiscal year 2025 (ending October 31), Walmart’s e-commerce sales saw a substantial 27% year-over-year increase.

Moreover, Walmart’s dividend may not be the highest, yielding 0.9% currently, but it remains stable and is increasing, making it attractive for income-focused investors.

Performance Comparison: A Timeline of Dominance

When reflecting on the performance history of both companies, Walmart has surpassed Amazon at various points. Established long before Amazon—going public in 1970—Walmart boasts an impressive market gain of 677,000%. In contrast, since its IPO in 1997, Amazon has achieved a 232,000% gain.

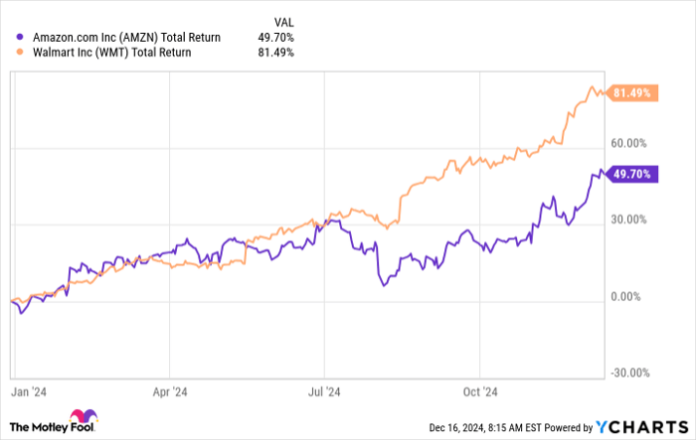

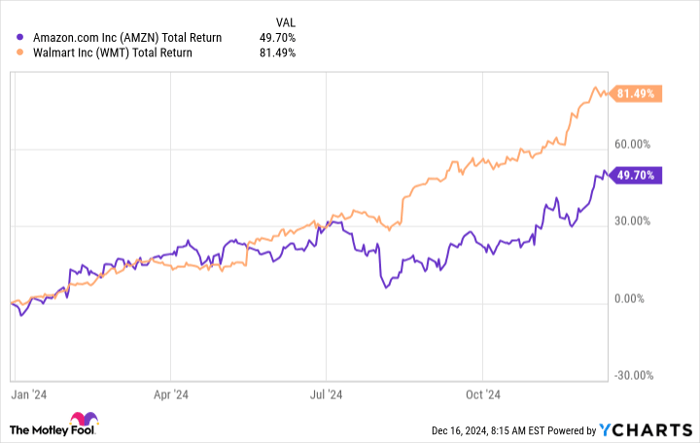

While Amazon’s growth over the past decade has outpaced Walmart, their performance aligns more closely over the last five years. Remarkably, Walmart has excelled over the past three years. The market may place a heightened value on Walmart’s stability compared to Amazon’s perceived AI edge, especially as Walmart has outperformed Amazon in the final stretch of the year:

AMZN total return level; data by YCharts.

To better understand their recent performance, here’s a comparison of key metrics:

| Metric | Q3 24 | Q2 24 | Q1 24 | Q4 23 |

|---|---|---|---|---|

| Amazon sales growth | 11% | 10% | 13% | 14% |

| Walmart sales growth | 5.5% | 4.8% | 6% | 5.7% |

| Amazon operating income growth | 55% | 91% | 218% | 389% |

| Walmart operating income growth | 8.2% | 8.5% | 9.6% | 30.4% |

Data source: Amazon and Walmart quarterly reports. Walmart’s quarters are for the fiscal year 2025.

While Amazon has shown strong performance recently, market participants seem to value Walmart’s consistent outcomes and reliability at the moment. Although AI presents a significant advantage for Amazon, Walmart’s proven stability gives it an edge in the current economic landscape.

For those drawn to growth stocks and willing to embrace risk, Amazon remains an appealing option, despite Walmart’s recent outperforming metrics. Conversely, investors focused on value and passive income may find Walmart’s steady dividends and solid stock performance more appealing.

Catch This Second Chance for a Potentially Lucrative Investment

Ever thought you missed your chance to invest in the biggest stocks? You might want to pay attention now.

Every once in a while, our experts issue a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. If you think you’ve missed your window to invest, now is the optimal time to act before it’s too late. Here are some compelling success stories:

- Nvidia: Invest $1,000 back in 2009 and it would be worth $338,855!

- Apple: A $1,000 investment in 2008 would now be $47,306!

- Netflix: If you put $1,000 in 2004, you’d have $486,462!

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this may be a rare opportunity you won’t want to miss.

Discover 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Walmart. The Motley Fool has a disclosure policy.

The views expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.