Ambarella’s Strong Growth in AI and Automotive Markets Amid Challenges

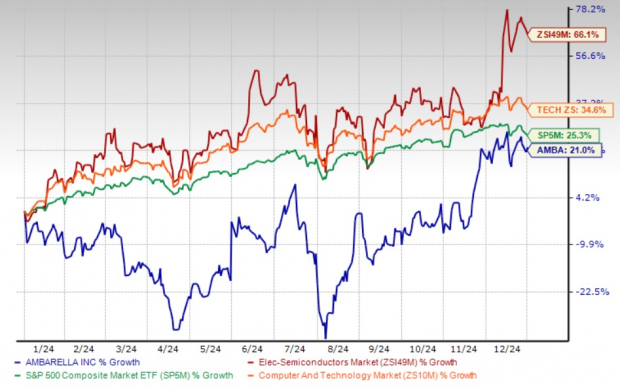

Ambarella (AMBA) is showing encouraging performance, with its stock climbing 21% in 2024. However, it has lagged behind the Zacks Electronics – Semiconductors industry, the broader Computer and Technology sector, and the S&P 500, which saw growth rates of 66.1%, 34.6%, and 25.3%, respectively, during the same timeframe.

While facing some shortfalls compared to its peers, Ambarella’s commitment to artificial intelligence (AI), automotive, and Internet of Things (IoT) markets reveals significant potential for future expansion.

Ambarella’s Focus on AI, Automotive, and IoT Growth

Positioned as a leader in the computer video solutions system-on-chip (SoC) market, Ambarella is introducing AI-based SoCs known as CVFlow. These AI inference processors, including the CV3, CV2, CV5, CV25, and CV22 models, are gaining traction and receiving positive feedback from clients. Ambarella forecasts that the CV line will significantly boost its revenue in fiscal 2025.

The company’s automotive and IoT segments are expanding rapidly, particularly with increasing demand for its AI-SoCs within the advanced driver-assistance systems (ADAS) market. Ambarella is launching new products like the CV3-AD655 AI SoC, aimed at Level 2+ autonomous driving applications, while exploring opportunities in advanced IoT applications. A notable plan includes developing a 2-nanometer chip to meet the needs of the next-generation AI platforms.

With these initiatives, Ambarella expects its fiscal 2025 revenues to grow between 22% and 24%. The Zacks Consensus Estimate predicts fiscal 2025 revenues at $279 million, marking a year-over-year increase of 23.2%.

Ambarella Price Performance Chart

Image Source: Zacks Investment Research

Challenges Ahead for Ambarella

Ambarella faces intense competition from industry giants like NVIDIA (NVDA), QUALCOMM (QCOM), and Mobileye (MBLY) in the advanced automotive sector. The rise of new Chinese competitors, including Horizon Robotics, exacerbates this competitive pressure. Furthermore, the ongoing U.S.-China trade tensions create hurdles for Ambarella due to stricter regulations and trade limits.

Specifically, AMBA’s CV2 competes against NVIDIA’s Xavier chips while its automotive chips face challenges from Qualcomm’s Snapdragon 602 Automotive Platform and Mobileye’s Shield and Connect solutions. Moreover, Ambarella has experienced a downturn in sales for its high-margin action cameras following a decline in business from GoPro and persistent issues in the drone sector, hindering the company’s overall growth potential.

In addition, the transition from older products to innovative ones is impacting gross margins. Adoption of Level 2+ autonomous technologies has been slower than anticipated among enterprise clients, with high development costs accompanying this shift. Anticipated weak results for the fiscal fourth quarter of 2024 reflect typical seasonal trends that pose additional concerns for AMBA.

Investor Guidance on Ambarella

Despite the short-term hurdles, Ambarella’s strong position in AI, automotive, and IoT, along with its innovative product launches, offers a promising path for long-term growth. While challenges persist, the company’s strategy to tap into expanding opportunities in high-growth markets suggests a confidence in recovery by 2025.

For now, maintaining a hold on Ambarella shares appears wise. The company’s determination to drive technological advancements and capture market share in transformative sectors makes it a noteworthy option for investors. Currently, AMBA holds a Zacks Rank of #3 (Hold).

Just Released: Zacks Top 10 Stocks for 2024

Hurry – early access remains available for our top 10 stock picks for 2025, selected by Zacks Director of Research Sheraz Mian. This portfolio has experienced remarkable success, with the Zacks Top 10 Stocks achieving a gain of +2,112.6% since its inception in 2012 through November 2024, significantly outperforming the S&P 500’s +475.6%. Mian has analyzed 4,400 companies covered by the Zacks Rank to highlight the best 10 for investment in 2025. Don’t miss this opportunity to learn about these promising stocks.

Want the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double for free.

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Ambarella, Inc. (AMBA): Free Stock Analysis Report

Mobileye Global Inc. (MBLY): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.