“`html

Five High-Risk Stocks That Could Soar by 2025

A Note From Eric: As you may be aware, Tom Yeung joins me weekly here at Smart Money to provide insight on markets and investment trends. If you’re a paying subscriber, you might also recognize his contributions to Fry’s Investment Report, where he delivers our Tuesday updates.

What you might not realize is that Tom also writes every Sunday for InvestorPlace Digest… a daily summary from my publisher featuring our team’s insights.

In the spirit of Thanksgiving, I’d like to share one of Tom’s Digest pieces with you. He discusses five speculative investments that offer turnaround potential for 2025. Take it away, Tom…

Many of you will know that I am a relatively conservative investor.

Focusing on long-term profitability, I believe cash flow is essential. There’s nothing wrong with earning 10% dividends from a quality stock.

However, at times, the growth potential becomes too compelling to ignore. Back in February, I mentioned that Nvidia Corp. (NVDA) could be valued at a split-adjusted $160 by 2027. Since then, its stock has surged from $72 to $144.

Similarly, the hype around Dogecoin (DOGE-USD) in 2021 led me to suggest investing $500 to speculate on its rise from $0.10, which eventually peaked at $0.64.

Several investors have built careers by making high-volatility investments.

Take Jonathan Rose, our options expert at Masters in trading. He has helped followers achieve returns of 16%, 48%, 156%, 545%, and even 1,306% in under seven hours.

His approach involves trading options that expire today, rather than those scheduled for months or years ahead. These “zero-day options” are among the fastest-growing segments of the financial market.

Remarkably, he executes these high-risk trades while minimizing potential losses.

Recently, Jonathan hosted a One-Day Winners Live Summit, offering a free masterclass. Attendees learned his five-step strategy to find one-day winning trades. It’s still possible to catch the recording of this session.

To watch, just click here.

Now, allow me to share my five speculative stocks for 2025. These investments carry significant risks, and you could potentially lose your entire investment.

Yet, for those willing to chase extraordinary returns, these stocks represent some of the best risk-adjusted opportunities for the upcoming year.

The Debt-Heavy Equity Stub

Some companies are deemed risky due to their low equity relative to their substantial debt. For instance, if a firm has only $1 in equity for every $4 in debt, a mere 10% rise in enterprise value could lead to a 50% increase in stock prices.

This describes Sabre Corp. (SABR) today.

Sabre is among the top three operators of the Global Distribution System (GDS), the computerized network that connects airline and hotel reservations. It allows travel websites like Google Flights and Kayak to display real-time flight availability.

On the upside, there are no viable competitors to the GDS system. The International Air Transport Association (IATA) attempted to launch a rival product a decade ago. However, its decentralized structure proved too slow, requiring contact with every airline for bookings. As a result, GDS companies enjoy high profit margins without any substantial competition.

During the mid-2000s, private equity firms heavily leveraged companies like Sabre, expecting to generate high returns while managing low-interest repayments. Initially, this model worked well until the Covid-19 pandemic struck.

Overnight, Sabre’s share price plummeted from the $20-$30 range to single digits, currently trading at $3.60. With profits dwindling, large interest payments have further strained its financial health.

However, travel demand is rebounding. According to IATA, air traffic surpassed pre-pandemic levels earlier this year and is projected to increase by another 8% in 2025. Sabre reported booking revenues rising nearly threefold since 2020.

The company is now on track to manage its $500 million in annual interest payments. Analysts predict Sabre will generate $86 million in net income next year, a sharp contrast to a $57 million loss in 2024.

This newfound profitability could enable Sabre to pay off maturing debts and refinance others at better rates. Historically, transitioning from losses to profits tends to signal positive trends, and Sabre is positioned to achieve this.

Three Promising Turnarounds

Additionally, there are others that present turnaround potential for 2025. Here are three companies to watch closely…

1. Stratasys Ltd. (SSYS) operates as a leader in 3D printing out of Minnesota. Over the last five years, it has acquired key players like RPS for stereolithography and XAAR for powder-based printing, expanding its technological edge.

Stratasys’s F3300 printer is one of the fastest in its price category, and while 2024 is expected to be sluggish, analysts forecast a major growth comeback. The company’s net profits are projected to soar tenfold to $26 million next year.

If President Trump were to impose 20% tariffs, American manufacturers might be compelled to turn to domestic suppliers, potentially further boosting Stratasys’s profits. Compared to competitors like 3D Systems Corp. (DDD), Stratasys shows better profitability, reinforcing the case for investment during its turnaround phase.

2. Evolv Technologies Holdings Inc. (EVLV) recently took a hit, with shares falling 50% after announcing an internal investigation into its accounting practices. High-profile managers recorded $4 million to $6 million in revenue prematurely.

This situation now creates a unique chance to invest in a promising tech firm.

Evolv develops AI-powered scanning gates capable of detecting concealed weapons. Appearing in hundreds of venues like stadiums and schools, these gates allow individuals to walk through without removing metal items, drastically speeding up the process compared to traditional detectors. Their technology mirrors that used in airports today.

The possible introduction of new regulations regarding concealed weapons may further increase demand for Evolv’s products.

The unique challenges and the urgent need for security solutions suggest that opportunities in this sector are ripe for investment.

“`

Examining New Investment Opportunities Amid Market Shifts

Recent developments in the investment landscape highlight potential growth in companies like Evolv and UiPath, while also introducing risks associated with political changes affecting giants like Pfizer.

Innovation in Transportation Security

Evolv is currently testing its products with the Transportation Security Administration (TSA). If these products receive approval for use in commercial airports, it may create an unexpected revenue boost for the company.

UiPath’s AI Comeback

UiPath Inc. (PATH) has experienced an 83% decline in its stock price since its 2021 debut. Concerns over slowing growth and executive turnover have impacted investor confidence. While the firm’s success surged during the Covid-19 pandemic, the transition to a post-pandemic environment has posed challenges.

Despite this, analysts project a rebound in growth by 2025. Businesses are now under pressure to harness AI for cost savings, and UiPath is recognized by experts as a leading provider of automation solutions. According to Gartner, UiPath is a “leading visionary” in business automation.

The momentum in AI is expected to accelerate, especially as advancements in technology continue to outpace human capabilities. Recent developments from OpenAI indicate their latest model has outperformed humans on IQ tests. This trend will likely heighten demand for UiPath’s products, as companies seek to implement smarter automation solutions.

Uncertain Times for Pfizer Amid Political Changes

The upcoming presidency of Donald Trump promises further disruption, particularly in heavily regulated sectors like healthcare. This uncertainty has led to strategic moves in the market, emphasizing the need for caution.

Pfizer Inc. (PFE) is one example. Recently, an investment newsletter advised its members to sell the stock following Trump’s nomination of Robert F. Kennedy Jr. to lead the Department of Health and Human Services (HHS).

Pfizer derives about a quarter of its revenue from Covid-19 vaccines and therapies, making it highly vulnerable amid doubts about future vaccine policies. RFK Jr. is known for his skepticism towards vaccines, prompting concerns for Pfizer’s direction.

Nevertheless, some key healthcare policies proposed by Trump could benefit healthcare stocks. These include the potential repeal of certain regulations and tax reductions, which might bolster companies like Pfizer.

Ultimately, Pfizer’s stock is unlikely to remain stable within its current range of $25 indefinitely. By 2026, the share price may either soar or plummet.

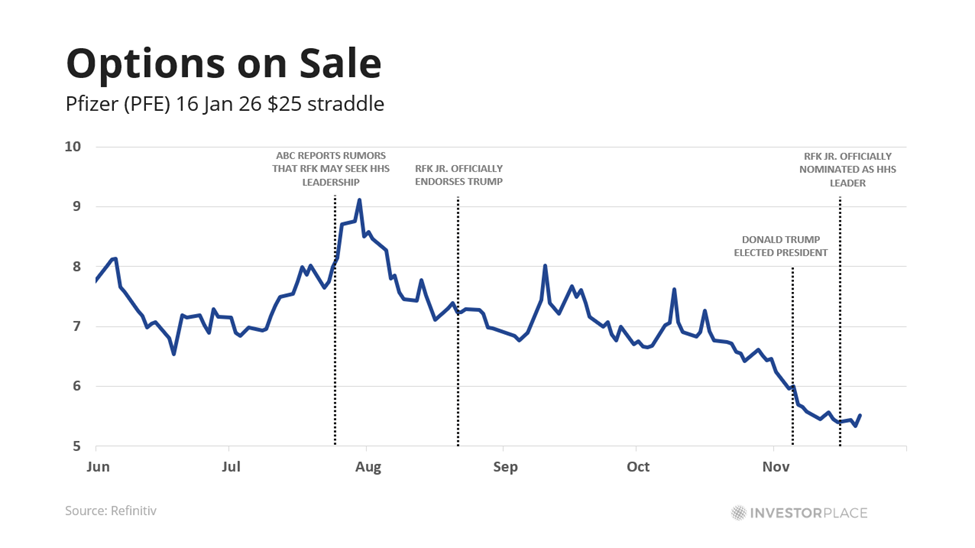

To capitalize on this uncertainty, traders are considering 2026 Pfizer straddles—an options strategy that could pay off significantly if PFE shares move beyond a $19.50-$30.50 range by January 2026. Historically, if the stock price recovers to $35, traders stand to achieve a 100% profit, similar to the stock’s performance during Trump’s first term. Conversely, a drop to $15 would also yield strong profits for traders. Additionally, straddles could also provide profits before 2026 if volatility increases.

Currently, these straddles are priced attractively due to decreased market volatility. The VIX Index has dropped by a quarter since the election, reducing the cost of 2026 straddles from $7 to $9 down to just $5.50.

Exploring Zero-Day Options for Fast Gains

While some investors may prefer to wait for Pfizer straddles or shifts in the 3D printing sector, immediate action may be warranted. Trump’s inauguration is set for January, but clarity on policy direction may take longer to materialize.

This brings attention to Jonathan Rose’s strategies in zero-day options, which have seen significant daily trading volumes. According to JPMorgan Chase, approximately $1 trillion in zero-day options is exchanged daily.

Such massive trading activity often signals opportunities for significant returns. However, these potential rewards come with noteworthy risks. Thus, a sound strategy is essential to manage downside exposure while positioning for potential gains.

To better understand these strategies, Jonathan hosted a free masterclass titled “One-Day Winners Live Summit”, showcasing how participants could leverage trades for substantial profits following major market events like Trump’s election victory.

Jonathan’s extensive trading experience, including noteworthy successes in options trading, makes his insights valuable for navigating this quickly evolving market.

To gain insights on his approach to zero-day options, you can click here to watch Jonathan’s One-Day Winners Live Summit.

Regards,

Thomas Yeung

Markets Analyst, InvestorPlace