AMD Sets Sights on Mobile with New Chips

Ambitious Move into Smartphone Technology

Advanced Micro Devices Inc AMD is planning a significant push into the mobile device market with its upcoming accelerated processing unit (APU) chips, aimed specifically at smartphones.

The new chips will utilize Taiwan Semiconductor Manufacturing Co’s TSM advanced 3nm process technology, which is expected to maintain production visibility into late 2026, according to UDN.com.

These APUs are believed to target high-end smartphones, including potential applications in devices from Samsung Electronics SSNLF.

Historical Partnerships Influence Current Strategy

Previously, AMD and Samsung worked together on the Exynos 2200 processor, which implemented AMD’s RDNA 2 GPU architecture. That collaboration focused primarily on improving graphics performance, rather than building CPUs. Now, AMD’s latest MI300 series processors, recognized for their application in AI server technology, could serve as a foundation for these new mobile APUs.

Industry experts suggest that Samsung may incorporate these APU chips into its flagship devices, which already depend heavily on elements produced by Taiwan Semiconductor, including the Qualcomm Inc processors found in the Galaxy S series.

According to Taiwan Semiconductor, its 3nm technology — including variants N3, N3E, and N3P — is garnering substantial interest from significant clients such as AMD, Apple Inc, and MediaTek. The demand for these cutting-edge chips has become so high that production capacity has tripled since last year, though challenges in fulfilling all orders remain.

Inside Taiwan Semiconductor, there’s ongoing work on its 3nm family of technologies aimed at meeting growing requirements in the realms of AI, mobile devices, and automotive computing.

Strong Financial Performance and Future Outlook

AMD recently reported third-quarter revenue of $6.8 billion, exceeding analyst expectations of $6.71 billion. This figure represents an 18% increase, significantly attributed to a 122% surge in Data Center revenue, which reached $3.5 billion. The Client segment also saw a boost, rising 29% to $1.9 billion. However, the Gaming segment experienced a decline, dropping 69% to $462 million, while Embedded revenue fell 25% to $927 million.

Looking ahead, AMD forecasts fourth-quarter revenue of approximately $7.5 billion, with a possible variance of $300 million, suggesting a growth projection of 22% at the midpoint.

Analysts Speak on Market Dynamics

The growth has been attributed to escalating capital investments in AI infrastructure, as observed by Goldman Sachs analyst Toshiya Hari. Companies are engaged in what has been termed an “AI arms race.” With a robust product pipeline that includes competitive GPUs and integration with ZT Systems, AMD is well-poised for accelerated growth.

A revival in demand for server CPUs and market share gains in business-targeted products are anticipated to enhance revenue and profit margins moving forward.

Current Stock Movements

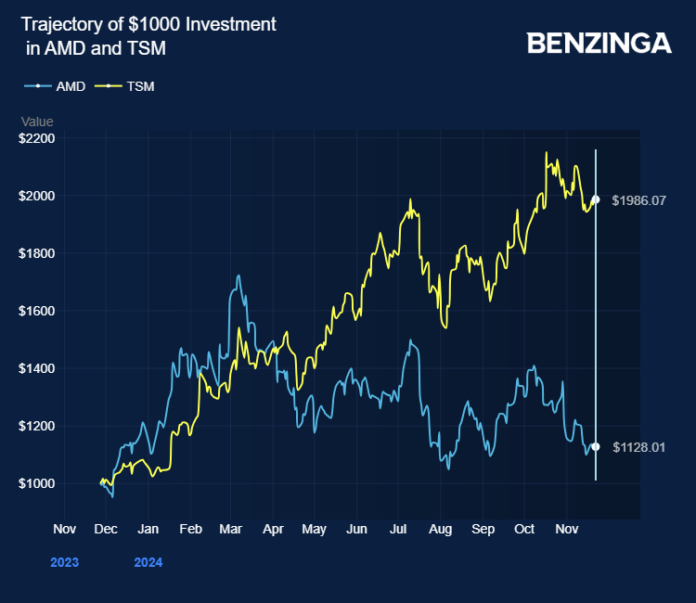

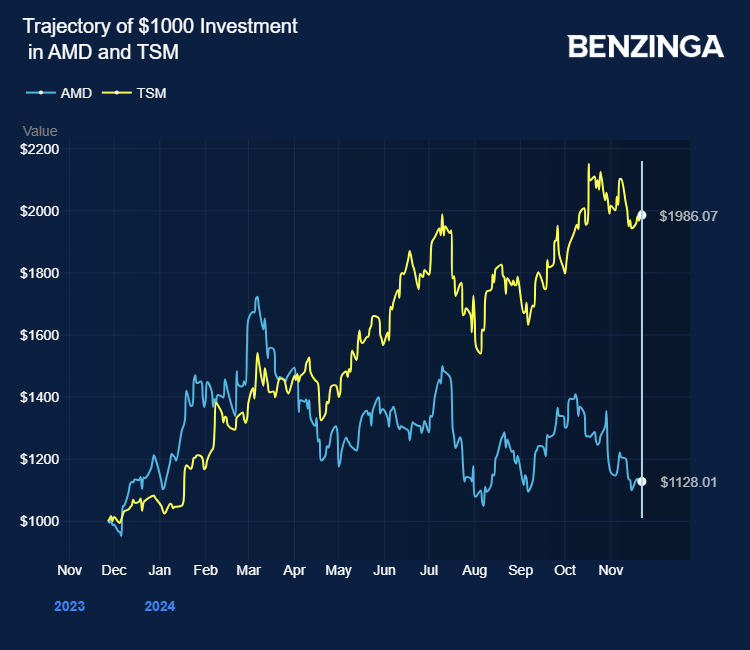

Price Actions: AMD shares have increased by 2.4%, reaching $141.75 during Monday’s trading session, while TSM’s stock has decreased by 2.6%.

Additional Insights:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs