AMD Reports Strong Q3 Earnings Amid Mixed Market Reactions

Advanced Micro Devices (AMD) delivered third-quarter 2024 non-GAAP earnings of 92 cents per share, surpassing the Zacks Consensus Estimate by 1.10%. This marks a remarkable 31.4% increase compared to the same quarter last year.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Revenues for the quarter reached $6.82 billion, exceeding the Zacks Consensus Estimate by 1.59%. This represents a year-over-year growth of 17.6% and a sequential increase of 17%.

The growth was largely fueled by strong performances in the Data Center and Client segments, which helped to offset slower sales in the Gaming and Embedded divisions.

AMD’s Pricing Trends and EPS Impact

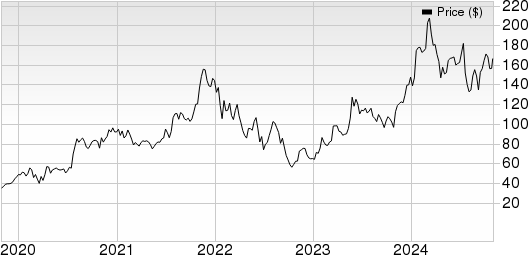

AMD shares faced an 8.45% decline in pre-market trading due to weaker-than-expected guidance for the fourth quarter. Year-to-date, AMD has underperformed compared to the broader Zacks Computer & Technology sector, gaining only 12.8% against the sector’s 26.4% increase.

Data Center Growth Drives Revenue in Q3

Data Center revenues saw a substantial rise of 122.1% year-over-year, reaching $3.55 billion and representing 52% of total revenues. Compared to the previous quarter, these revenues grew by 25%.

The success was attributed to the well-established Instinct product line and strong demand for the fourth-generation EPYC CPUs.

As of the end of Q3 2024, AMD’s public cloud instances increased by 20% year-over-year, surpassing 950, with deployments by major firms including Microsoft, AWS, Uber, and Netflix.

Notably, Meta Platforms utilized over 1.5 million EPYC CPUs for its global operations. Enterprise adoption of EPYC CPUs also expanded, gaining traction with companies such as Adobe, Boeing, and Tata.

AMD’s customer base diversified this quarter, securing deals with energy, tech, and automotive firms, including Airbus, FedEx, and HSBC. Additionally, Microsoft enhanced its use of MI300X accelerators for applications like GPT-4 and Microsoft 365 services.

In a strategic move, AMD announced plans to acquire ZT Systems, an AI infrastructure provider for large computing operations, which will aid in developing next-generation AI technologies.

Client Segment Strengthened Amid Gaming Decline

The Client segment’s revenues rose 29.5% year-over-year to $1.88 billion, constituting 27.6% of total revenues, while showing a sequential growth of 26%.

In contrast, revenues from the Gaming segment plummeted by 69.3% year-over-year to $462 million, making up 6.8% of total revenues, with a sequential dip of 29%.

Revenues from the Embedded segment totaled $927 million, down 25.4% year-over-year but up 8% sequentially, contributing 13.6% to total revenues.

Improved Margins Amid Rising Costs

Non-GAAP gross margin improved by 300 basis points (bps) year-over-year to 54%, supported by growth in the Data Center and Client segments.

Meanwhile, non-GAAP operating expenses rose by 15.3% year-over-year to $1.72 billion, leading to a non-GAAP operating margin increase of 300 bps to 25% during the third quarter.

Strong Financial Position Yet Cautious Outlook

As of September 28, 2024, AMD held $3.89 billion in cash and cash equivalents, a slight decrease from $4.11 billion on June 29, 2024. Total debt remained flat at $1.72 billion.

Operating cash flow amounted to $628 million, compared to $593 million in the second quarter of 2024, while free cash flow improved to $496 million from $439 million in the prior quarter.

Uninspiring Q4 Projections Lead to Market Concerns

AMD projects fourth-quarter 2024 revenues around $7.5 billion, with a variance of +/- $300 million. This midpoint forecast indicates approximately 22% year-over-year growth and about 10% sequential growth.

The company expects robust sequential revenue increase in Data Center, Client, and Gaming segments, though a decline is anticipated in the Embedded segment year-over-year.

For the fourth quarter, AMD estimates a non-GAAP gross margin of approximately 54% and plans for non-GAAP operating expenses close to $2.05 billion.

Market Positioning and Future Prospects

Currently, AMD holds a Zacks Rank #4 (Sell).

AudioEye (AEYE), Astera Labs (ALAB), and Angi (ANGI) are better-ranked stocks within the same sector, each holding a Zacks Rank #2 (Buy). You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AudioEye shares have surged 319.4% year-to-date and is set to present its third-quarter results on November 7. Astera Labs, with a 19.4% year-to-date gain, will report on November 4. Angi shares have declined 3.6% year-to-date, with earnings scheduled for November 11.

Invest in Top Semiconductor Stocks for Maximum Growth

As the semiconductor sector continues to grow, companies involved in AI and machine learning are positioned for significant expansion. Global semiconductor manufacturing is expected to rise from $452 billion in 2021 to an impressive $803 billion by 2028.

Find out more about promising stocks, including Advanced Micro Devices, in our free stock analysis reports:

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Angi Inc. (ANGI): Free Stock Analysis Report

AudioEye, Inc. (AEYE): Free Stock Analysis Report

Astera Labs, Inc. (ALAB): Free Stock Analysis Report

To delve deeper into this article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.