Amdocs Reports Q4 Earnings: A Mixed Bag Amid Dismal Guidance

Financial Performance at a Glance

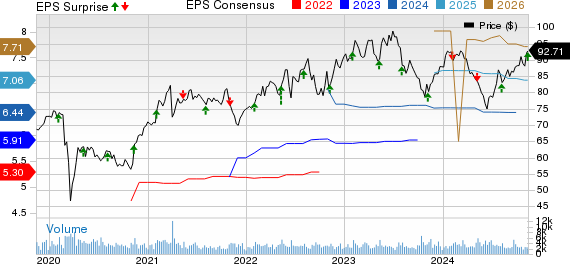

Amdocs (DOX) released its fourth-quarter fiscal 2024 results, showing non-GAAP earnings of $1.70 per share. This matched the midpoint of the provided guidance and marked a 19.7% increase compared to the same quarter last year. The earnings also aligned with the Zacks Consensus Estimate.

Over the last four quarters, Amdocs’ earnings have seen inconsistency, with two estimates missed, one matched, and one exceeded, resulting in an average negative surprise of 0.3%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

In the same quarter, Amdocs reported revenues of $1.264 billion, which was slightly below the consensus estimate by 0.17%. However, compared to last year, the revenues grew by 1.7% on a reported basis and by 2.1% in constant currency.

Furthermore, Amdocs projected weak guidance for the upcoming fiscal first quarter and fiscal 2025, which might negatively impact its stock value. Year-to-date, Amdocs’ shares have risen by 5.7%, while the Zacks Computers – IT Services industry has performed better with a return of 15.9%.

Market Trends and Amdocs’ Position

Amdocs Limited Price, Consensus, and EPS Surprise

Amdocs Limited price-consensus-eps-surprise-chart | Amdocs Limited Quote

Insights into Amdocs’ Q4 Performance

Amdocs’ growth in Q4 can be attributed to an increase in revenues from North America, Europe, and the Rest of World (RoW). In North America, revenues reached $835.8 million, making up 66.1% of total revenues, which is a slight year-over-year increase of 0.2%. Europe showed revenues of $184.1 million (14.6% of total revenues), up 4.9% year over year. RoW revenues climbed 4.9% year over year to $244 million, reflecting 19.3% of total revenues.

Managed services revenues rose by 0.5% from the previous year, hitting $721.4 million. Amdocs concluded the fourth quarter with a backed order of $4.06 billion, experiencing a sequential increase of $30 million and an annual rise of 2.5%.

Non-GAAP operating income reached $236.2 million, an increase of 6.8% year over year, while the operating margin improved by 90 basis points to 18.7%. The operating margin for fiscal 2024 showed an enhancement of 60 basis points, reaching 18.4%.

Overview of Fiscal Year 2024

For fiscal year 2024, Amdocs reported revenues totaling $5.005 billion, slightly missing the consensus estimate by 0.1%. The company saw a 2.4% year-over-year increase in revenue on a reported basis and 2.7% in constant currency.

Non-GAAP earnings for the year stood at $6.44 per share, matching expectations and reflecting a 9% year-over-year growth.

Financial Standing and Cash Flow Analysis

As of September 30, 2024, Amdocs held cash and short-term investments totaling $514.3 million, up from $502.2 million on June 30. Long-term debt remained steady at $646.3 million.

Cash flow from operations increased to $217.9 million, compared to $191.5 million recorded on June 30. Free cash flow also saw an uptick, reaching $192.1 million, compared to $175 million in the previous quarter.

Future Guidance for Fiscal 2025

Looking ahead, Amdocs anticipates revenues for the first quarter of fiscal 2025 to range between $1.095 billion and $1.135 billion (mid-point $1.115 billion). This is below the Zacks Consensus Estimate of $1.27 billion, suggesting a year-over-year rise of 2.1%.

Projected non-GAAP earnings for the first quarter are expected to fall between $1.61 and $1.67, against a Zacks Consensus estimate of $1.71 per share, indicating a potential year-over-year growth of 9.6%.

For the full fiscal year 2025, Amdocs predicts a revenue decline between 7.7% and 10.9% year-over-year. The Zacks Consensus estimate for total revenues is $5.19 billion, which suggests a year-over-year increase of 3.6%.

Operating margins are forecasted to range between 21.1% and 21.7% for fiscal 2025, while non-GAAP earnings are expected to grow between 6.5% and 10.5%. The Zacks Consensus estimate for earnings stands at $7.06 per share, which indicates a year-over-year rise of 9.7%.

Amdocs also forecasts free cash flow to be between $710 million and $730 million.

Investment Outlook and Recommendations

Currently, Amdocs holds a Zacks Rank #4 (Sell).

CyberArk Software (CYBR), NVIDIA (NVDA), and Bilibili (BILI) present better-ranked options for investors within the broader Zacks Computer & Technology sector. CYBR holds a Zacks Rank #1 (Strong Buy), while BILI and NVDA have a Zacks Rank #2 (Buy) at this time.

A notable year-to-date performance includes CYBR shares, which have surged by 37.3%. CyberArk Software is expected to announce its third-quarter results on November 13.

BILI shares have experienced a 73.3% increase year-to-date, with its third-quarter results set to be released on November 14.

NVDA shares have skyrocketed by 199.5% year-to-date, and the company plans to report its third-quarter results on November 20.

Explore Top Stock Picks for Upcoming Opportunities

Recently, experts outlined 7 exceptional stocks from the current list of Zacks Rank #1 Strong Buys, which are predicted to deliver significant price gains shortly.

Since 1988, this curated list has outperformed the market more than twofold, achieving an average annual gain of +23.7%. Pay attention to these carefully selected stocks.

Interested in the latest recommendations from Zacks Investment Research? Download the report on 5 Stocks Set to Double for free online.

Amdocs Limited (DOX): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

CyberArk Software Ltd. (CYBR): Free Stock Analysis Report

Bilibili Inc. Sponsored ADR (BILI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.