American Axle Posts Mixed Results in Q3 2024, Adjusts Annual Forecast

American Axle & Manufacturing Holdings (AXL) reported adjusted earnings of 20 cents per share for the third-quarter 2024, exceeding the Zacks Consensus Estimate by 19 cents. This is a significant change from the loss of 11 cents per share reported in the same quarter last year.

The company’s quarterly revenue totaled $1.50 billion, falling short of the Zacks Consensus Estimate of $1.51 billion. This represents a 3% decline compared to the previous year.

Stay current with quarterly earnings: Check the Zacks Earnings Calendar.

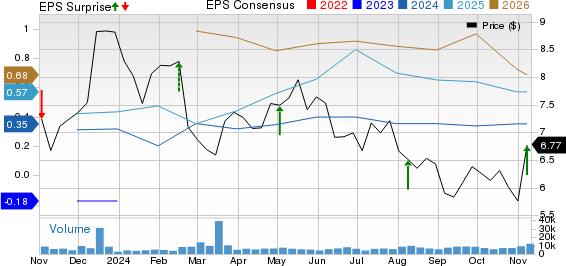

American Axle Price, Consensus, and Earnings Surprise

American Axle & Manufacturing Holdings, Inc. price-consensus-eps-surprise-chart | American Axle & Manufacturing Holdings, Inc. Quote

Examining Segment Performance

In the recent quarter, the Driveline segment achieved sales of $1.04 billion, down 1.7% year over year but exceeding our estimate of $1.03 billion. Adjusted EBITDA for the segment was $135.7 million, slightly below our estimate of $141.5 million and a decrease of 1.1% from the previous year.

The Metal Forming segment generated revenues of $596.5 million, a decline of 4.5% from the same period last year, and fell short of our estimate of $604.5 million. However, adjusted EBITDA significantly increased to $38.7 million, reflecting a remarkable 98.5% rise, well above our estimate of $21.3 million.

Financial Overview

In the third quarter, American Axle’s selling, general, and administrative (SG&A) expenses rose to $94.6 million, compared to $81.8 million in the prior year.

Operating activities generated net cash of $143.6 million, down from $178.3 million during the same period last year.

The company’s capital expenditures for the quarter were $72.9 million, up from $47.5 million in the previous year.

For the three months ending September 30, 2024, adjusted free cash flow stood at $74.6 million, a decline from $135.8 million recorded in the same period last year.

As of September 30, 2024, American Axle held cash and cash equivalents of $542.5 million, an increase from $519.9 million at the end of 2023.

The company’s net long-term debt decreased to $2.64 billion from $2.75 billion at the end of the previous year.

Updated 2024 Outlook for AXL

American Axle updated its full-year 2024 revenue forecast to between $6.10 billion and $6.15 billion, lowering it from the prior range of $6.10 billion to $6.30 billion.

Adjusted EBITDA is now estimated to fall between $715 million and $745 million, revised from the earlier projection of $705 million to $755 million.

Expected adjusted free cash flow is set in the range of $200 million to $220 million, down from the previous expectation of $200 million to $240 million.

Zacks Rank & Recommendations

Currently, AXL holds a Zacks Rank #3 (Hold).

In contrast, notable auto industry stocks include Dorman Products, Inc. (DORM), Tesla, Inc. (TSLA), and BYD Company Limited (BYDDY), all rated Zacks Rank #1 (Strong Buy) at this time.

The Zacks Consensus Estimate for DORM’s 2024 sales indicates a year-over-year growth of 3.66%, with estimated earnings rising by 51.98%. EPS estimates for 2024 and 2025 have improved by 25 and 21 cents, respectively, in the past week.

For TSLA, the 2024 sales growth forecast is 2.94%, while EPS estimates for 2024 and 2025 have increased by 20 and 13 cents, respectively, in the past 30 days.

BYDDY’s 2024 projections include year-over-year sales growth of 23.61% and earnings growth of 31.51%, along with EPS revisions of 23 and 26 cents for 2024 and 2025, respectively, in the last week.

Discover Top Clean Energy Stocks

Energy represents a crucial element of the economy and is part of a multi-trillion dollar industry that boasts some of the largest companies.

Modern technology is shifting the focus towards clean energy sources, moving away from traditional fossil fuels. Trillions of dollars are currently invested in clean energy endeavors, encompassing everything from solar power to hydrogen fuel cells.

Investing in emerging leaders in this arena could bring exciting opportunities for your portfolio. Download “Nuclear to Solar: 5 Stocks Powering the Future” to access Zacks’ top recommendations free of charge.

Want the latest insights from Zacks Investment Research? Download “5 Stocks Set to Double” for free today.

American Axle & Manufacturing Holdings, Inc. (AXL): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Dorman Products, Inc. (DORM): Free Stock Analysis Report

Byd Co., Ltd. (BYDDY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.