“`html

AMN Healthcare Reports Declining Earnings and Revenues in Q4 2024

AMN Healthcare Services, Inc. delivered adjusted earnings per share (EPS) of 75 cents in the fourth quarter of 2024, a 43.2% decrease from the previous year. Nevertheless, this figure exceeded the Zacks Consensus Estimate by 44.2%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

The company reported a GAAP loss per share of $4.90, contrasting with EPS of 33 cents during the same quarter last year.

For full-year 2024, EPS stood at $3.31, down 59.7% from 2023 but still beating the Zacks Consensus Estimate by 7.8%.

Analyzing AMN’s Revenue Performance

AMN Healthcare registered revenues of $734.7 million in the fourth quarter, reflecting a 10.2% drop year over year. However, this figure was 5.7% higher than the Zacks Consensus Estimate.

For the entire year of 2024, revenues totaled $2.98 billion, representing a 21.3% decrease compared to the previous year. This also topped the Zacks Consensus Estimate by 1.4%.

In after-hours trading, the company’s shares rose nearly 5.5% following the earnings report.

Revenue Breakdown by Segment

AMN Healthcare operates through three reportable segments: Nurse and Allied Solutions, Physician and Leadership Solutions, and Technology and Workforce Solutions.

In Q4 2024, revenues from the Nurse and Allied Solutions segment reached $454.7 million, down 15.4% from the prior year. Travel nurse staffing revenues plummeted 35%, and Allied revenues fell 9%. This contrasts with the projected revenue of $418.8 million from our analysis of the segment.

The Physician and Leadership Solutions segment reported revenues of $173.1 million, reflecting a 2.9% year-over-year increase, thanks to a 10% rise in locum tenens revenues, aided by the MSDR acquisition. Nonetheless, revenues from interim leadership fell by 11%, and physician and leadership search saw a 32% decline compared to the previous year. This matched our revenue estimate for the segment.

Revenue for the Technology and Workforce Solutions segment came in at $106.9 million, a 4.9% decrease year over year. Language interpretation services generated $76 million (up 12% year over year), while vendor management systems plummeted 26% to $23 million, compared to our projection of $102.3 million for this segment.

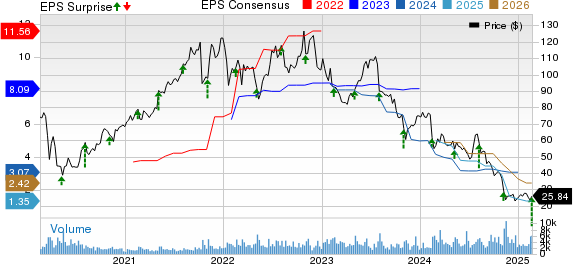

AMN Healthcare Services Inc Price, Consensus and EPS Surprise

AMN Healthcare Services Inc price-consensus-eps-surprise-chart | AMN Healthcare Services Inc Quote

Margin Analysis

During the quarter, AMN Healthcare’s gross profit decreased by 16.1% year over year to $218.9 million, with the gross margin shrinking by 208 basis points to 29.8%.

Selling, general, and administrative expenses declined by 14.3%, totaling $158.9 million.

Adjusted operating profit stood at $60.1 million, a 20.4% decrease from the prior-year quarter. The adjusted operating margin fell by 105 basis points to 8.2%.

Financial Position Overview

At the end of 2024, AMN Healthcare reported cash and cash equivalents of $10.6 million, a significant decrease from $32.9 million at 2023’s end. Total debt decreased to $1.060 billion from $1.31 billion a year prior.

Cumulative net cash from operating activities was $320.4 million, lower than the $372.2 million reported a year ago.

Future Outlook for AMN

AMN Healthcare has provided financial guidance for the first quarter of 2025. The company expects revenues to fall within the range of $660 million to $680 million, indicating a 17-20% drop from the previous year’s figure. The Zacks Consensus Estimate currently stands at $652.4 million.

The Nurse and Allied Solutions segment is anticipated to face a revenue decline of 22-25%, while the Technology and Workforce Solutions segment is projected to decrease by 8-10% in the same quarter. Additionally, revenues from the Physician and Leadership Solutions segment are expected to decline by 9-11% year over year.

Conclusion

AMN Healthcare’s disappointing financial performance in the fourth quarter of 2024 raises concerns, particularly given the revenue declines across most of its segments. The contraction in margins is troubling as well. While the company projects further declines in revenues for the first quarter of 2025, it did manage to deliver some better-than-expected results, particularly in the Physician and Leadership Solutions segment and language interpretation services.

The management noted stable bill rates for nurse and allied staffing and increasing rates for locum tenens. AMN has also introduced a new interpreter scheduling system, which could support its growth in the near future.

AMN Healthcare’s Zacks Rank and Peer Comparison

Currently, AMN holds a Zacks Rank #4 (Sell). In comparison, other better-ranked stocks in the healthcare sector include Cardinal Health, Inc. CAH, ResMed Inc. RMD, and Boston Scientific Corporation BSX.

Cardinal Health, with a Zacks Rank of 2 (Buy), reported adjusted EPS of $1.93 for its second-quarter fiscal 2025, surpassing the Zacks Consensus Estimate by 10.3%. Revenues stood at $55.26 billion.

“`

Top Earnings Performers: Cardinal Health, ResMed, and Boston Scientific Beat Estimates

Key Highlights from Latest Financial Reports

Cardinal Health outperformed the earnings consensus by 0.7%. The company has a long-term growth rate projected at 10.7%. Impressively, CAH’s earnings have exceeded estimates in each of the last four quarters, averaging a surprise of 9.6%.

In its recent report, ResMed recorded an adjusted EPS of $2.43 for the second quarter of fiscal 2025, surpassing the Zacks Consensus Estimate by 5.7%. The company’s revenues at $1.28 billion also exceeded expectations by 1.6%. ResMed holds a Zacks Rank #2 and has a long-term growth rate estimated at 16%. The company has consistently beat earnings estimates, with an average surprise of 6.9% over the past four quarters.

Boston Scientific reported an adjusted EPS of 70 cents for the fourth quarter of 2024, beating the Zacks Consensus Estimate by 7.7%. Revenues reached $4.56 billion, surpassing expectations by 3.5%. The company also carries a Zacks Rank #2 and has an estimated long-term growth rate of 13.3%. BSX has a strong track record, exceeding earnings estimates with an average surprise of 8.3% over the past four quarters.

Insightful Stock Picks for the Upcoming Month

Experts have recently identified seven standout stocks from a list of 220 Zacks Rank #1 (Strong Buy) stocks. These companies are deemed the “Most Likely for Early Price Pops” for investors looking for rapid growth.

Since 1988, the Zacks list has consistently outperformed the market, averaging gains of +24.3% annually. Investors are encouraged to focus on these seven targeted selections.

As earnings reports continue to impact stock performance, staying informed is crucial. Here are links for further analysis:

Boston Scientific Corporation (BSX): Free Stock Analysis Report

Cardinal Health, Inc. (CAH): Free Stock Analysis Report

ResMed Inc. (RMD): Free Stock Analysis Report

AMN Healthcare Services Inc (AMN): Free Stock Analysis Report

Read the full article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.